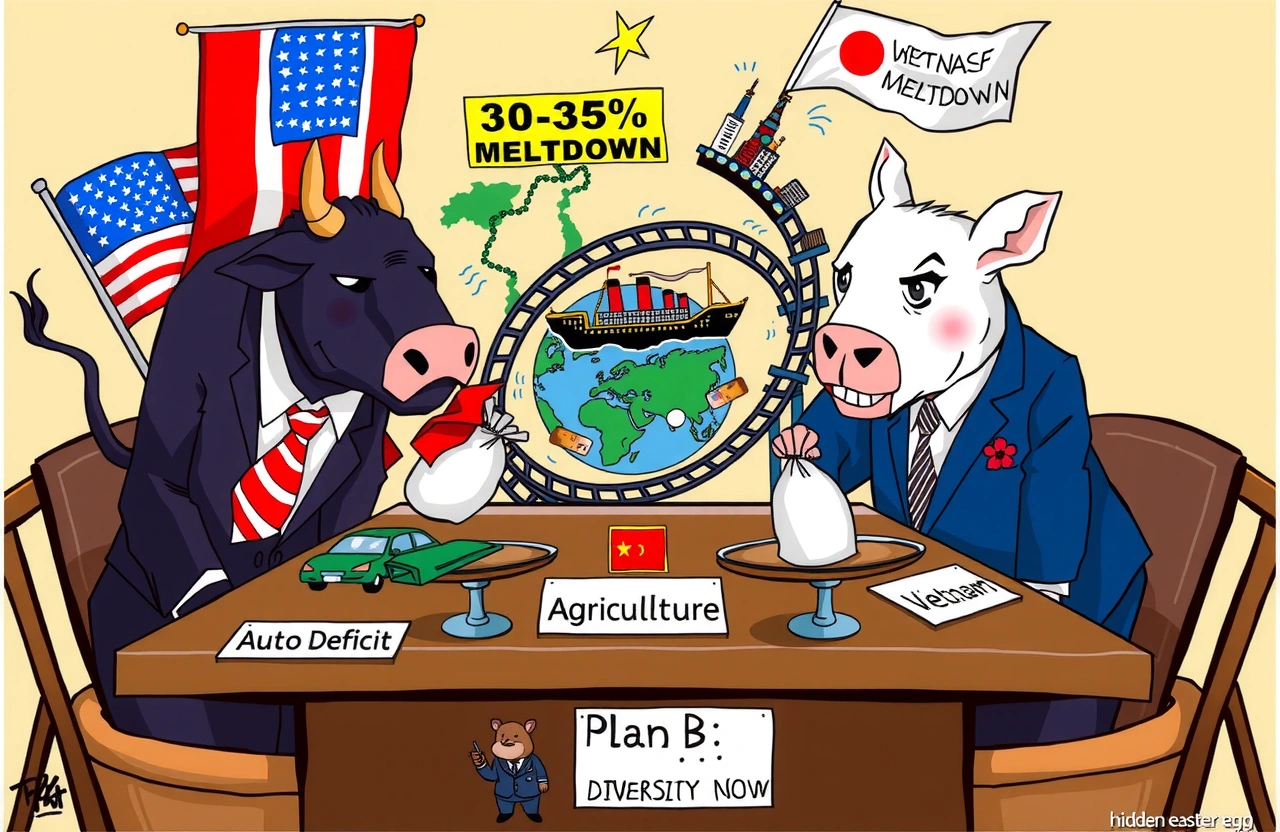

– President Trump threatens 30%-35% tariffs on Japanese exports

– Breakdown in talks stems from Japan’s ‘too tough’ stance on auto deficits and agricultural imports

– Suspension of current tariffs expires July 9, 2025 with no extension planned

– Threats exceed previous expectation of 24% combined duties

– U.S. shifts trade negotiations to India while suspending Tokyo talks

The Escalation: Trump’s 30%-35% Tariff Threat

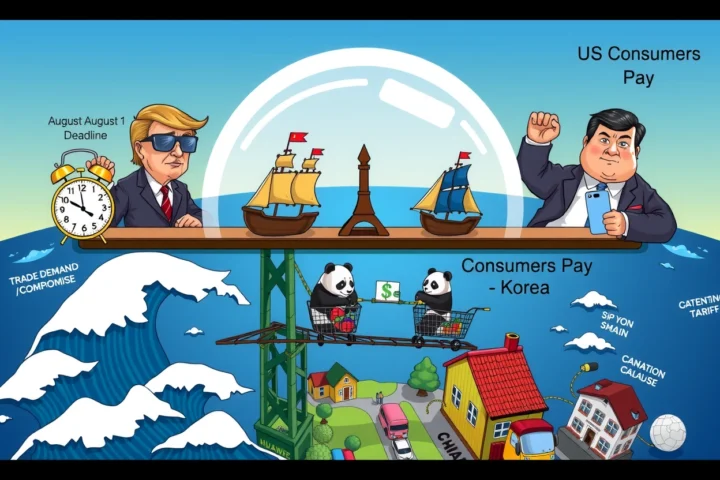

Aboard Air Force One on July 1, former U.S. President Donald Trump (唐纳德·特朗普) made a startling announcement that has shaken global markets: Japan’s “too tough” negotiating posture could trigger massive tariffs between 30% and 35% on Japanese exports. This unprecedented move marks the most significant escalation in U.S.-Japan trade tensions in decades, targeting Japan’s $143 billion in exports to the United States.

Suspension Expiration Deadline Looms

The 30%-35% tariff threat directly impacts the current tariff truce between the nations:

– Suspension expires July 9, 2025

– Affects approximately $40 billion in Japanese goods annually

– Implemented under Trump’s Reciprocal Tariff Act

Current tariff mechanisms contain:

– 10% base tariff (existing)

– 14% temporary suspension (expiring)

Trump explicitly stated he doesn’t “know whether we can make a deal” while blaming Japanese negotiators for refusing concessions on:

– $40 billion automotive trade deficit

– U.S. rice market access

– Agricultural non-tariff barriers

Roots of the Trade Conflict

The Biden administration originally established the tariffs framework, but Trump’s recent actions reveal deeper, unresolved grievances. Historical trade imbalances form the core of the dispute:

Decades of Automotive Imbalance

Japan’s automotive exports constitute 24% of Japan’s U.S. trade:

– Detroit automakers lose $16 billion annually

– Jobs impact: 350,000 U.S. auto sector positions

Trump specifically criticized Toyota and Honda models that dominate certain markets:

– Toyota Camry: 25% U.S. mid-sized sedan market share

– Honda Civic: Leading compact car imports

Agricultural Protectionism Standoff

Japanese agricultural safeguards include:

1. Rice: 778% tariff protection

2. Beef: 38.5% safeguard triggers

3. Complex phytosanitary restrictions

Trump cited California rice exporters being “locked out” by Tokyo’s policies despite quality certifications meeting international standards.

The Failed Negotiation Process

Japan’s Finance Minister Ryosei Akazawa (赤泽亮正) traveled to Washington in late June seeking resolution through:

The Seventh Round Breakdown

Critical breakdown occurred when:

– U.S. negotiator William Bessent (贝森特) canceled meetings

– Zero joint statements issued

– Working-level delegates recalled

Japanese sources indicate U.S. negotiators refused to discuss:

– Automobile tariff exemptions

– Steel/aluminum duty removals

– Agricultural access expansion

Meanwhile, U.S. officials restricted talks exclusively to:

– Reciprocal Tariff Act terms

– Bilateral deficit calculations

– Market access concessions

Economic Impact Analysis

Sector Breakdown Consequences

The proposed 30%-35% tariffs would hit:

Automotive industry:

– Estimated $2,500-$3,500 per vehicle increase

– Toyota shares dropped 4.2% after Trump comments

– Honda forecasting 15% U.S. sales decline

Electronics implications:

– Sony imaging sensors face $1 billion exposure

– Nikon cameras face 17% sales impact

– Hitachi industrial equipment tariffs hit construction

Agriculture calculation:

– Wagyu beef exports become commercially unviable

– Increased seafood tariffs sink profitability

– Sake exports face terminal decline

Global Supply Chain Disruption

Supply chain specialists warn the ripple effects extend beyond Japan:

– Toyota’s Mississippi plant relies on Japanese transmissions

– 40% U.S. semiconductor manufacturing equipment links to Japanese suppliers

– Airline industry grapples with potential Boeing-Airbus tariff wars

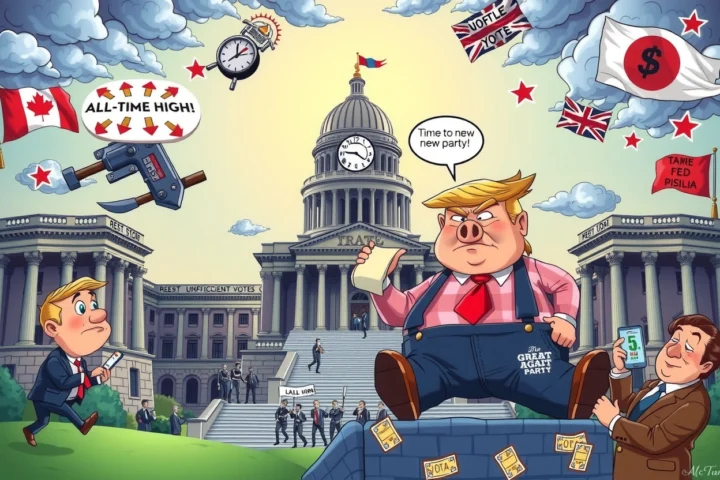

July 9 Expiration Countdown

White House Actions Confirmed

White House officials verify their deliberate strategy:

– Actively suspending Japan negotiations

– Prioritizing India trade deal completion

– Delegating Japan to secondary status

Expected July 9 outcomes include:

1. Bare-minimum 24% tariff implementation

2. Potential immediate 35% escalation

3. Graduated increase mechanism

Japanese Institutions Respond

Japan’s Ministry of Economy, Trade and Industry initiated emergency protocols:

– Corporate contingency funding

– WTO dispute filing preparation

– Export diversification workshops

Major corporations activated Plan B options:

– Nissan shifting pickup production to Mexico

– Mitsubishi Electric accelerating Thai manufacturing

– Kawasaki Heavy establishing Vietnamese rail production

Pathways Forward

Despite Trump’s warning that the situation looks “doubtful,” trade specialists suggest possible compromise scenarios:

Potential Negotiation Frameworks

Experts recommend:

1. Sectoral tariff exemptions: Auto-for-agriculture swap

2. Phased implementation: Lower initial hikes

3. Agricultural pilots: California rice demonstration

Successful precedents include:

– U.S.-Korea beef agreement adjustments

– EU-Japan EPA wine provisions

The India Factor

India’s trade team negotiated aggressively during overlapping Washington visits:

– Tariff reductions on U.S. motorcycles

– Apple manufacturing concessions

– Pharmaceutical market openings

The White House prioritizes demonstrating “new deal momentum” through India before confronting Japan, creating potential modeling opportunity for Tokyo.

The looming tariff deadline and Trump’s dramatic 30%-35% risk invitation remind businesses that economic diplomacy remains volatile. Asian trade analysts universally recommend immediate scenario planning regardless of industry position.

Businesses operating in affected sectors should:

– Audit supply chain vulnerabilities

– Demand scenario projections

– Engage customs brokers

International financial institutions prepare for potential yen volatility and Nikkei dislocation. Each percentage point in tariffs impacts CPI indexes and consumer wallets worldwide. Beware escalating trade barriers’ inflation impacts and reconsider procurement strategies accordingly – immediate diversification protects against geopolitical disruption. As Trump’s deadline nears, proactive navigation separates survivors from casualties in this high-stakes trade negotiation.