Financial Rollercoaster: Revenue Growth vs. Profitability Concerns

Zhihuishu’s financial performance reveals alarming volatility despite impressive revenue growth. The education technology provider reported total revenues of RMB400 million in 2022, RMB650 million in 2023, and RMB850 million in 2024. However, net profits tell a different story: a RMB59.11 million loss in 2022, followed by an RMB81.42 million profit in 2023, and a purported RMB100 million profit in 2024. This dramatic swing becomes particularly concerning when examining interim results showing an RMB88.855 million loss in the first half of 2024.

Profitability Whiplash Pattern

The company’s erratic profit trajectory suggests fundamental operational issues. Consider these fluctuations:

– First-half 2024: RMB88.855 million loss

– Full-year 2024: RMB100 million profit

– Gross margin volatility: 51.1% (2021), 44.1% (2022), 60.7% (2023), 46.1% (H1 2024), 61.9% (FY2024)

This pattern raises questions about earnings management and the sustainability of their business model. The abrupt reversal from substantial mid-year losses to annual profits warrants scrutiny regarding revenue recognition practices.

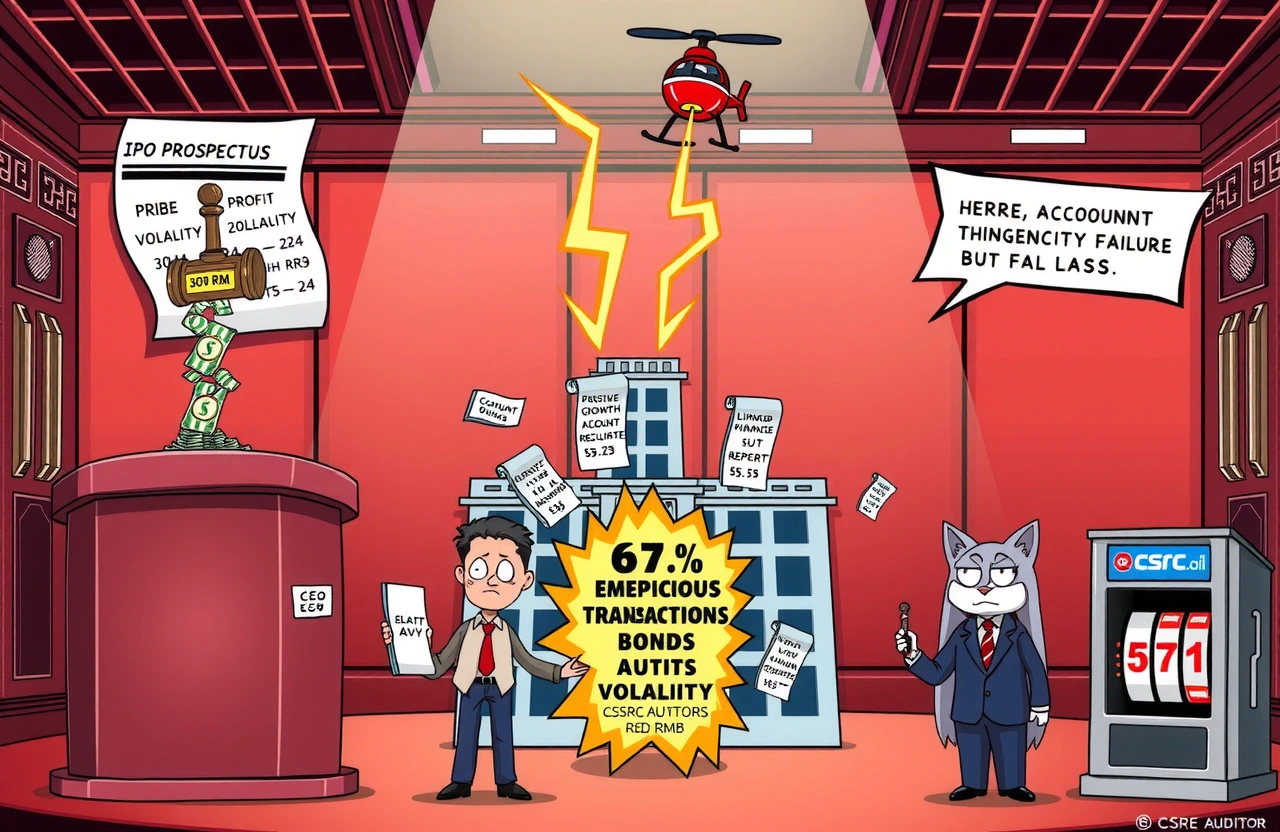

Accounts Receivable Time Bomb

Zhihuishu’s trade receivables and retention receivables exploded by 154% over two years – from RMB134 million in 2022 to RMB340 million in 2024. This represents 40% of 2024’s total revenue. By April 2025, receivables consumed 67.6% of current assets, severely limiting liquidity. Compounding the risk:

– Impairment provisions surged 177% to RMB34.1 million (2022-2024)

– Net financial asset impairment losses increased 126% to RMB14 million (2024)

Such trends indicate potential revenue inflation through extended credit terms to customers, creating a fragile financial foundation for their IPO.

Cash Flow Crisis and Mounting Debt

Operating cash flow patterns reveal deeper troubles. Zhihuishu recorded negative operating cash flows in two of the past three years: -RMB48.14 million (2022), RMB10.9 million (2023), and -RMB9.53 million (2024). The first half of 2024 was particularly dire at -RMB206 million. This cash burn accelerated as the company approached its IPO, with cash reserves plummeting 70% to RMB68.9 million by April 2025 from RMB230 million at 2024 year-end.

Emergency Financing Measures

Facing liquidity pressure, Zhihuishu secured RMB56.2 million in new borrowings during 2024. This emergency financing occurred alongside their third Hong Kong IPO attempt within twelve months, suggesting urgent capital needs. The combination of:

1. Dwindling cash reserves

2. Mounting receivables

3. New debt obligations

creates a high-risk financial profile that potential investors must carefully evaluate before considering this IPO.

Compliance Nightmares: Bribery and Regulatory Violations

Zhihuishu’s path to IPO is littered with serious compliance failures. Public records reveal multiple legal and regulatory violations that directly impact their governance credibility. According to China Judgments Online, the company’s sales personnel bribed Liu (刘), then-head of the bidding office at Gansu Industrial Vocational Technical College, through an intermediary in June 2021. The RMB30,000 bribe secured their winning bid for the “Teaching Quality and Teaching Management Enhancement Project.”

Systemic Bid-Rigging Practices

Further evidence of unethical practices emerged from Shanxi Medical University, where provincial finance authorities penalized Zhihuishu for colluding with competitors during 2021-2022 bidding processes for online course development contracts. The Shanxi Provincial Department of Finance imposed a RMB2,250 fine for this violation. Additionally, Shanghai’s Xuhui District Market Supervision Administration fined the company RMB50,000 in 2021 for false advertising in education marketing materials.

Regulatory Scrutiny Intensifies

China Securities Regulatory Commission (CSRC) explicitly questioned these violations in their June 28-July 4, 2024 supplement request, demanding:

– Detailed explanations of bribery incidents

– Evidence of corrective measures

– Assessment of IPO impact

These compliance failures represent significant IPO obstacles that could derail the listing or trigger post-IPO liabilities. The pattern suggests cultural issues that go beyond isolated incidents.

Leadership and Governance Challenges

Founders Wang Hui (王晖) and Ge Xin (葛新), a husband-wife team with decades in education technology, now face their greatest leadership test. Their company’s rushed listing attempts – abandoning a 2021 A-share application before three Hong Kong IPO filings within thirteen months (May 2024, December 2024, June 2025) – indicate desperation. This urgency appears driven by:

– Mounting financial pressures

– Expiring investor commitments

– Regulatory compliance deadlines

The repeated filings despite unresolved compliance issues raise questions about governance priorities and risk management culture at the highest levels.

Overcoming IPO Obstacles: The Path Forward

Zhihuishu’s IPO obstacles appear formidable but not insurmountable. To regain investor confidence, the company must first address compliance failures through:

1. Comprehensive anti-bribery training with third-party audits

2. Transparent bidding process reforms

3. Independent review of sales practices

Financially, reducing accounts receivable concentration through diversified revenue streams and stricter credit policies is essential. The company should also consider:

– Extending IPO timeline to demonstrate sustainable profitability

– Securing strategic investors to strengthen governance

– Divesting non-core assets to improve liquidity

These steps could gradually rebuild trust, though the process may require 12-18 months of demonstrated reform before markets welcome their listing.

Investor Considerations and Market Implications

Prospective investors should approach this IPO with heightened due diligence. Critical areas for scrutiny include:

– Receivable aging reports and collection history

– Post-bribery compliance certification

– Customer concentration risks

– Cash flow sustainability projections

Hong Kong’s exchange faces its own test in balancing market development with investor protection. Approving an IPO with Zhihuishu’s compliance record could damage Hong Kong’s reputation as a quality listing venue. Conversely, excessive rigidity might push Chinese edtech firms toward less regulated markets.

The ultimate decision will signal how Hong Kong navigates its dual role as China’s international financial gateway and a globally respected exchange. For Zhihuishu, overcoming their IPO obstacles requires more than financial engineering – it demands fundamental operational and ethical transformation. Investors should monitor CSRC disclosures and third-party audits before considering participation. Review the company’s regulatory filings at Hong Kong Exchanges and Clearing Limited for the latest developments.