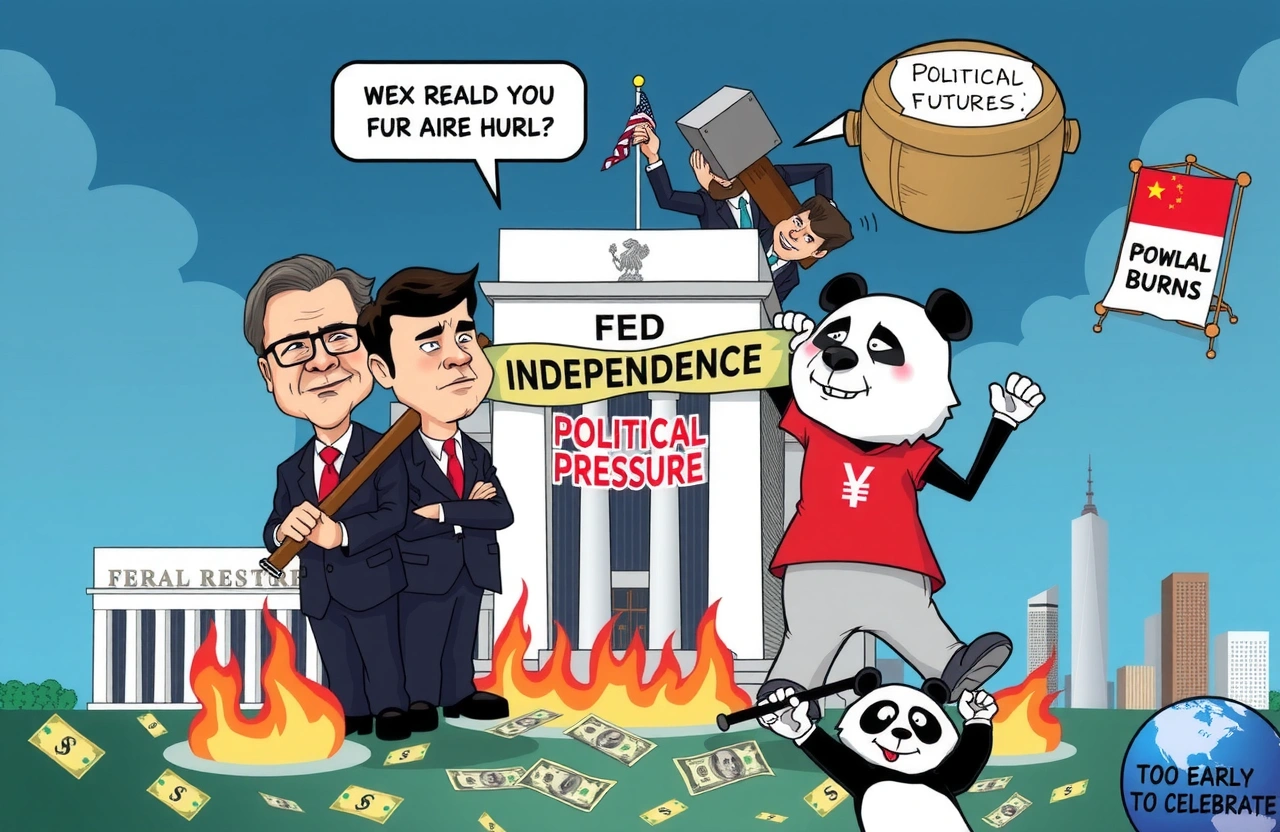

The Escalating Federal Reserve Independence Standoff

Mounting pressure from the Trump administration on Federal Reserve Chair Jerome Powell has triggered unprecedented public pushback from Wall Street titans. Treasury Secretary Steven Mnuchin confirmed this week that formal proceedings to select Powell’s potential successor have commenced, fueling market anxieties about political interference in monetary policy. Simultaneously, bond yields continue creeping upward while the dollar weakens – tangible indicators that investors recognize how threats to Federal Reserve independence could destabilize global financial foundations.

Wall Street’s Unprecedented Defense

For the first time since Trump’s public attacks began, four major bank CEOs—collectively overseeing $12+ trillion in assets—spoke out jointly:

- JPMorgan Chase’s Jamie Dimon (戴蒙) warned: “Singling out the Federal Reserve risks counterproductive consequences. Maintaining Federal Reserve independence is crucial”

- Goldman Sachs CEO David Solomon (苏德巍) stressed: “Central bank independence globally delivers immense benefits. Preserving Federal Reserve independence must remain a priority”

- Citigroup’s Jane Fraser (范洁恩) stated: “Fed independence drives institutional credibility vital for market efficiency”

- Bank of America CEO Brian Moynihan (莫伊尼汉) emphasized America’s debt burden makes Fed stability “critical to the entire world”

Their coordinated response underscores Wall Street’s fears about dollar supremacy and Treasury markets. The CEOs recognize that politically coerced rate cuts could trigger runaway inflation, weakening the dollar’s reserve currency status according to Federal Reserve research.

Presidential Power vs Fed Structural Safeguards

Trump’s dilemma lies in the Federal Reserve’s institutional architecture. While the President appoints chairs to four-year terms, governors serve 14-year staggered mandates. Powell’s board membership extends until 2028 regardless of his chair status. This design specifically insulates monetary decisions from transient political pressures—a safeguard traceable to the 1951 Treasury-Fed Accord.

Historical Lessons on Political Interference

The disastrous Nixon-Burns episode serves as cautionary precedent. When President Nixon pressured Fed Chair Arthur Burns into pre-election 1972 rate cuts, inflation rocketed to 11% within three years. Similar political interference today could:

- Erode market confidence in Treasury bonds’ risk-free status

- Jeopardize dollar-denominated trade settlement systems

- Trigger capital flight toward alternative reserve currencies

The Realistic Prospects For Forced Rate Cuts

Could replacing Powell enable Trump to slash rates? Current Federal Open Market Committee (FOMC) alignment suggests otherwise. Among voting members, only Governors Christopher Waller and Michelle Bowman openly advocate immediate cuts. Most dissenters retain seats beyond January 2025, creating mathematical obstacles.

Consensus Dynamics Defy Political Pressure

FHN Financial Chief Economist Chris Low explains: “The chair’s influence requires building consensus. Without votes, unilateral policy change is impossible.” Powell’s skillful consensus-building contrasts with potential successors like Kevin Warsh, whose self-described “blunt leadership style” might fracture FOMC cooperation. The committee’s tradition requiring broad agreement serves as an embedded institutional firewall protecting Federal Reserve independence.

Global Implications of Threatened Central Bank Independence

With U.S. Treasuries anchoring $24 trillion in global debt markets, Fed politicization risks cascade effects:

- Emerging markets reliant on dollar funding face heightened volatility

- Currency pegs from Saudi Arabia to Hong Kong come under stress

- Alternatives like China’s yuan gain strategic openings

The People’s Bank of China Governor Pan Gongsheng (潘功胜) recently emphasized stability priorities coinciding with Wall Street’s institutional warnings. Asian financial hubs like Singapore unnerved by Fed uncertainty may accelerate reserve diversification.

Sovereign Institutions Vs Political Expediency

The core conflict pits democratic accountability against institutional independence. While presidents legitimately influence fiscal policy, the Federal Reserve’s dual mandate requires insulation from electoral cycles. Seventy years of bipartisan precedent recognizes that interest-rate decisions affecting global capital allocation require technocratic detachment. Treasury Secretary Mnuchin’s procedural announcement signals institutional tensions but simultaneously affirms continuity protocols.

Market Signals to Watch

- Dollar index breaks below 100 support

- 10-year Treasury yields above psychological 4% threshold

- CBOE Volatility Index (VIX) sustained elevations

The Institutional Resilience Imperative

The Wall Street CEOs’ extraordinary intervention validates Federal Reserve independence as capitalism’s safety mechanism against damaging short-termism. While election cycles fuel politically-driven rate demands, institutional continuity defends sovereign credit. Protecting this delicate balance remains Wall Street and Main Street’s shared priority—for America’s economic leadership and global financial stability.

Engage policymakers emphasizing institutional safeguards during this critical transition period. Subscribe for analysis tracking FOMC appointments and defend rule-based frameworks. America’s monetary credibility demands vigilant stewardship.