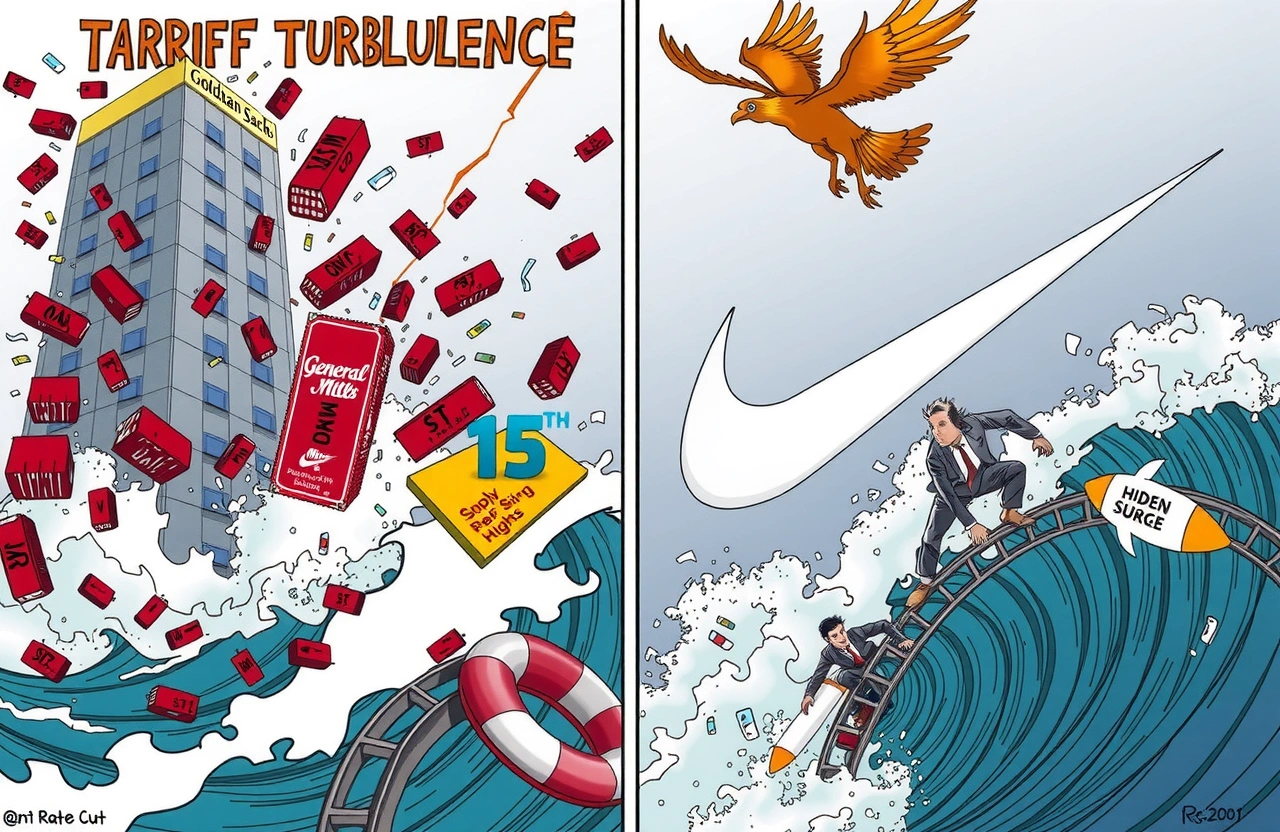

The Earnings Season Crucible: Tariffs Take Center Stage

As global markets approach the midyear mark, US corporations face their most consequential earnings season in recent memory. Beginning mid-July, quarterly reports will reveal how Trump administration tariffs implemented since April directly impact corporate America’s bottom line. Goldman Sachs analyst David Kostin (大卫·科斯汀) delivers a stark warning: mounting tariff pressures threaten profit margins despite record market highs.

Goldman Sachs’ Dire Tariff Forecast

Kostin’s research team anticipates second-quarter results will showcase tariffs’ initial shockwaves, calling this the first tangible “big test” for corporate resilience.

The Cost-Passing Dilemma

Most firms aim to offload tariff expenses to consumers, but Kostin cautions:

- Absorbing unexpected tariff costs squeezes margins

- Sectors with rigid contracts endure disproportionate pain

- Early indicators show scattered impacts across industries

Corporate Case Studies: Mixed Results Emerge

Preliminary earnings paint a fragmented picture of tariffs’ first big test:

Negative Impacts: General Mills Warning

Cereal giant General Mills flagged rising costs from tariffs through Columbia University’s supply chain research.

Positive Adaptation: Nike’s Mitigation Strategy

Footwear leader Nike cited effective contingency plans for tariff avoidance, triggering a 15% stock surge on operational resilience.

Market Turbulence: From Plunge to Recovery

The S&P 500’s volatility exemplifies tariffs’ economic ripple effects:

- April peak-to-trough: 19% drop on inflationary fears

- Current rebound: Record highs amid Fed rate-cut optimism

- Yardeni Research data: Only 6/11 sectors projected for profit growth

Statistical Forecast: Earnings Slowdown Ahead

Analytics reveal troubling Q2 projections:

- EPS growth: 2.6% (lowest since Q2 2023)

- Sector growth: Fewest expanding industries since Q1 2023

Tariff-Exposed Companies Face Downgrades

Kostin notes disproportionate analyst downgrades for firms reliant on Chinese imports shown in Federal Reserve trade data.

Goldman’s Contrarian Market Optimism

Despite tariff headwinds, Kostin forecasts upside potential:

- S&P 500 positioned to “break Q2 lows” per Goldman models

- Raised index targets reflect stronger fundamentals

- Trade de-escalation catalysts could ignite rallies

Investor Preparation Strategies

Navigating this tariffs’ first big test requires tactical adjustments:

- Scrutinize management commentary on supply chains

- Overweight companies with tariff-mitigation plans

- Monitor industries with high import exposure shown in Census Bureau data

- Prepare volatility hedges around earnings dates

Beyond the Headlines: Long-Term Implications

While tariffs’ first big test dominates immediate earnings analysis, structural shifts endure:

- Accelerated supply chain diversification

- Reshoring initiatives gaining momentum

- Strategic stockpiling becoming standard practice

The current earnings turbulence serves as critical rehearsal for enduring globalization’s recalibration.

The Path Forward for Investors

Corporate resilience facing tariffs’ first big test reveals competitive strengths and weaknesses with rare clarity. While Kostin remains cautiously upbeat on equities long-term, immediate earnings provide vital intelligence on tariff adaptations. Consult fiduciary advisors to vet holdings against supply chain maps published by Freightos, watch treasury yields for inflation clues during releases, and strategically deploy cash amid inevitable volatility spikes.