The Foundation of UAE’s Global Stance

At the 2025 China Enterprise Globalization Summit in Shenzhen, KEZAD Group China Representative Yan Linhui (严林辉) illuminated the United Arab Emirates’ distinctive approach to international relations. Against the backdrop of global supply chain restructuring, his analysis revealed why this Gulf nation has become a magnet for foreign investment. The UAE’s core demand has always been ‘to just develop itself and be the most neutral country’ – a philosophy shaping its economic policies and diplomatic maneuvers.

This strategic positioning isn’t accidental. Historical patterns show the UAE participating in only three Middle Eastern conflicts, each with minimal involvement. Such restraint demonstrates a consistent pattern: while regional powers grapple with instability, the UAE prioritizes creating a secure commercial environment. World Bank rankings consistently place it as the Arab world’s top business destination, currently 16th globally – a testament to how neutrality fuels prosperity.

Neutrality as Economic Strategy

Historical Context of Non-Alignment

The UAE’s foreign policy reflects deliberate restraint. Unlike neighbors embroiled in regional conflicts, Emirati leaders have maintained what Yan Linhui characterizes as ‘strategic disengagement’. This isn’t passivity but calculated positioning. When diplomatic shifts occasionally spark speculation about alignment, the underlying motive remains consistent: the UAE’s core demand has always been ‘to just develop itself and be the most neutral country’. This consistency creates predictable conditions for international businesses.

- Only 3 military engagements since founding – all limited support roles

- Diplomatic balancing between global powers without permanent alliances

- World Bank security indicators: 94.3/100 for political stability

Business Environment Advantages

Neutrality translates directly into commercial benefits. The UAE’s non-aligned status correlates with exceptional business climate metrics. According to World Bank data, it leads the Arab world in:

- Contract enforcement efficiency (ranked 12th globally)

- Cross-border trade facilitation (15th worldwide)

- Investor protection mechanisms

Yan Linhui emphasized that safety perceptions significantly influence these rankings. Multinational corporations report 23% higher operational confidence in UAE-based facilities compared to regional alternatives. This stable foundation enables long-term planning absent in volatile markets.

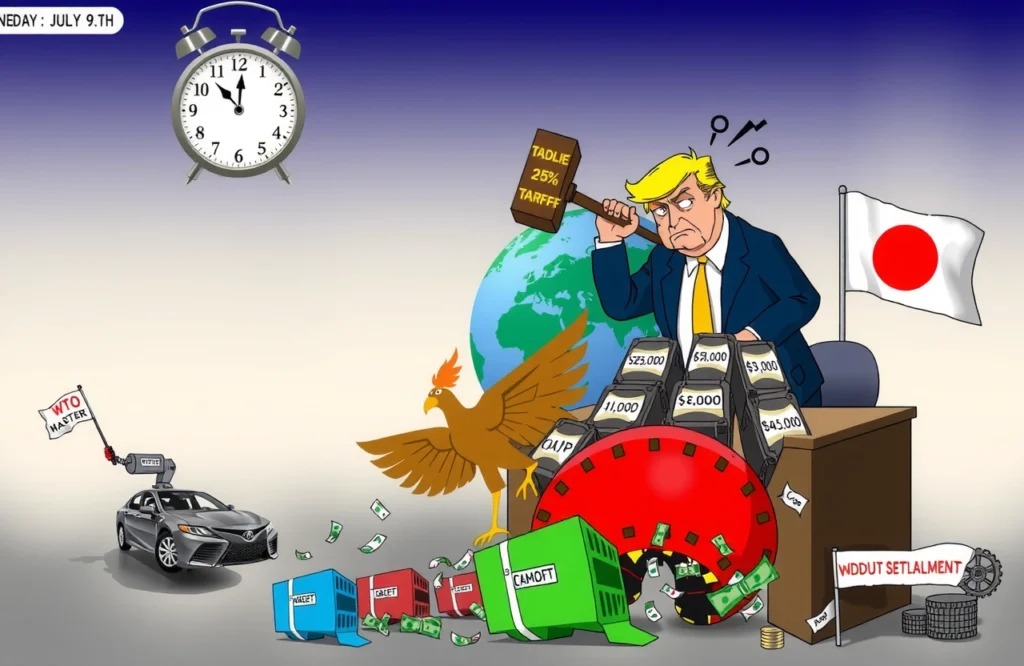

Trade War Navigation Opportunities

Amid global tariff conflicts, the UAE’s trade profile creates unexpected advantages. Yan Linhui highlighted a crucial detail: Washington imposes minimal levies on Emirati goods due to America’s $195 billion trade deficit with the UAE. This makes the Emirates among the lowest-tariff pathways to Western markets.

Tariff Advantage Mechanics

The imbalance stems from structural economic factors. While the UAE imports substantial American machinery and aircraft, its hydrocarbon exports to the US remain limited. This asymmetry creates what trade analysts call a ‘negative leverage position’ – where deficit nations hold tariff-setting advantages. For Chinese manufacturers relocating production:

- Average US import duty on UAE goods: 1.4% versus 19.3% for direct China exports

- Rules of origin flexibility in UAE free zones

- Dual avoidance of US-China tariffs and EU trade barriers

Companies utilizing UAE manufacturing hubs report 17-22% cost savings on Western market access. The UAE’s core demand has always been ‘to just develop itself and be the most neutral country’ – a stance that inadvertently created this tariff shelter.

Abu Dhabi’s Economic Transformation

Diversification Beyond Oil

Abu Dhabi’s economic evolution demonstrates how neutrality facilitates development. Non-oil sectors now contribute 54.7% to GDP – a milestone achieved through consistent three-year growth. Strategic investments target future-proof industries:

- Renewable energy infrastructure (22% national energy mix target by 2030)

- Technology and AI development zones

- Logistics and aerospace manufacturing clusters

This shift reduces vulnerability to commodity fluctuations while creating complementary industries. Khalifa Economic Zones (KEZAD) where Yan Linhui operates exemplify this – housing over 1,500 companies across 12 specialized clusters.

Sovereign Wealth Powerhouses

Abu Dhabi’s financial muscle reinforces its development model. Its sovereign funds dominate Gulf investment:

- Abu Dhabi Investment Authority (ADIA): $853 billion assets

- Mubadala Investment Company: $284 billion portfolio

- ADQ: $157 billion under management

These entities don’t just seek global returns. ADQ specifically targets local development, recently deploying $2.2 billion into domestic infrastructure. Such investments create ecosystems where foreign businesses thrive – from supplier networks to talent pools. The UAE’s core demand has always been ‘to just develop itself and be the most neutral country’, and these funds operationalize that vision.

Free Zone Competitive Edge

Abu Dhabi’s specialized economic zones offer unparalleled institutional advantages. Yan Linhui detailed how KEZAD’s framework provides:

Tax Efficiency Architecture

- 0% corporate tax for 50-year guaranteed periods

- No personal income taxation

- Customs duty exemptions on machinery and raw materials

These policies lower operational costs by approximately 30% compared to major Asian hubs. Combined with 100% foreign ownership allowances – unlike many emerging markets requiring local partners – the model attracts knowledge-intensive industries.

Regulatory Innovation

Beyond fiscal benefits, Abu Dhabi accelerates business processes through:

- Digital licensing systems (72-hour incorporation)

- Integrated customs clearance facilities

- Industry-specific regulatory sandboxes

Such frameworks explain why technology firms comprise 34% of recent free zone registrations. The UAE’s core demand has always been ‘to just develop itself and be the most neutral country’, and its business infrastructure reflects that inward-focused development priority.

Implementing Your UAE Strategy

For enterprises considering Emirati expansion, Yan Linhui recommends phased engagement:

- Leverage trade offices for market validation

- Utilize free zone ‘test-bed’ facilities before full-scale investment

- Partner with local entities for regulatory navigation

Successful market entrants highlight workforce localization as critical – not just for compliance but talent acquisition. The UAE’s visa reforms now attract global specialists, with 180,000 skilled worker permits issued annually.

The Neutrality Dividend

The UAE’s unique positioning offers more than temporary advantages. Its institutional commitment to non-alignment creates enduring commercial benefits unavailable elsewhere. For global businesses, this represents not just a tax haven but a stability haven. The UAE’s core demand has always been ‘to just develop itself and be the most neutral country’ – and in achieving this, it has built one of the world’s most resilient business ecosystems.

As supply chains reconfigure, companies prioritizing operational security find Abu Dhabi’s model increasingly compelling. KEZAD Group’s expansion pipeline shows 47% year-on-year growth in Asian manufacturing relocations, signaling where pragmatic enterprises place their bets. Evaluate your exposure to geopolitical volatility, and consider how neutrality-focused economies could transform your global footprint.