– Global markets react instantly to Trump’s tariff announcement with equity declines and currency shifts

– Major automakers face substantial losses as investors flee Japanese/Korean stocks

– EU accelerates trade negotiations amid postponed U.S. tariff deadlines

– Strategic pivots underway for automakers like Honda and Nissan amid EV setbacks

– Investor confidence shaken by geopolitical developments and political uncertainties

Former President Trump’s latest trade policy announcement sent immediate shockwaves across global financial markets on Monday. By imposing tariffs on fourteen countries including Japan and South Korea effective August 1st, the move revived fears of renewed trade conflicts during an especially sensitive economic period. Within hours, the S&P 500 recorded its worst single-day drop in three weeks while Asian currencies slumped against a strengthening dollar. Against fears of escalating trade tensions, investors rapidly repositioned portfolios while corporations raced to adapt strategies. This abrupt policy shift demonstrates how quickly global market repercussions manifest when major economies change trade policies.

Trump’s Tariff Expansion: Policy Details and Impact Scope

The announced tariffs specifically target what the Trump administration termed ‘unfair trading partners’ with Japan, South Korea, India, and eleven other nations now facing heightened import duties. Market analysts immediately noted the strategic timing – coming weeks before the Republican National Convention and coinciding with accelerated negotiations between trading blocs.

Compared Trade War Patterns

Historical context reveals notable patterns in tariff-driven volatility:

– The 2018-2019 U.S.-China tensions caused 19% average quarterly swings in industrial sector stocks

– Previous Trump-era metals tariffs preceded 9.3% declines in automotive stocks over three months

– Agricultural commodities historically suffered 20% price drops when retaliatory tariffs emerged

Immediate Market Repercussions Worldwide

Within minutes of the announcement, trader terminals lit up with rapid repositioning orders:

– The Dow plunged 380 points (-1.1%) within 90 minutes

– USD/JPY surged 1.2% to ¥159.22, triggering Bank of Japan intervention rumors

– Korean won recorded its sharpest decline since January (-1.3%)

Sector-Specific Devastation

Automakers endured disproportionate losses crossing continents:

– Toyota shares tumbled 4% on NYSE ($168.21 → $161.48)

– Honda sank 3.9% while Mazda hemorrhaged 5.3%

– Hyundai subsidiaries shed $9 billion in market capitalization collectively

Institutional investors like BlackRock reported accelerated East-to-West portfolio shifts within energy and semiconductor exposures.

European Counterstrategies Against Escalation

Citing ‘pragmatism over political posturing’, European Commission negotiators intensified U.S. talks seeking temporary exemptions for aircraft components, luxury spirits, and strategic minerals. The progress became visible when Washington postponed implementation deadlines until August.

Tariff Relief Calculus

EU diplomats focus on preserving critical sectors:

– Aviation: €28 billion in annual exports (Airbus components comprising 60%)

– Distilled spirits: €6.2 billion market protected mainly French cognac/Scotch producers

– Medical isotopes: Preserving cancer treatment supply chains

Sources inside Brussels suggest potential agreements leaving agricultural sectors most vulnerable to tariffs under preliminary frameworks. With WTO challenges likely whichever pathway emerges, Europe’s trade representatives continue negotiating furiously according to experts at the Peterson Institute.

Automakers Scramble to Mitigate Fallout

Beyond immediate stock impacts, executives convened urgent strategy sessions:

– Nissan unveiled €37 billion convertible debt funding package prioritizing EV resilience

– Mercedes-Benz confirmed Q2 premium-car shipments dropped 9%, disproportionately affecting EVs (-18%)

– Honda paused all next-gen electric SUV development, reprioritizing hybrid transitions

American Auto Finance News analytics show immediate capital expenditure shifts toward political-risk-resistant hybrid systems rather than pure-electric platforms. Notably, Ford abandoned its flagship Lightning F-150 last month citing similar tariff exposure risks.

Embracing Strategic Retreat

According to Honda CEO Tsuyoshi Higashihara, certain realities demand pragmatic responses: ‘Electrification mandates made sense when policy supported growth, but when trading costs suddenly spike 30%, we must protect our shareholders. Hybridization bridges against abrupt regulatory shifts while satisfying emission targets – it’s prudent transition engineering.’

Politics Infusing Market Instability

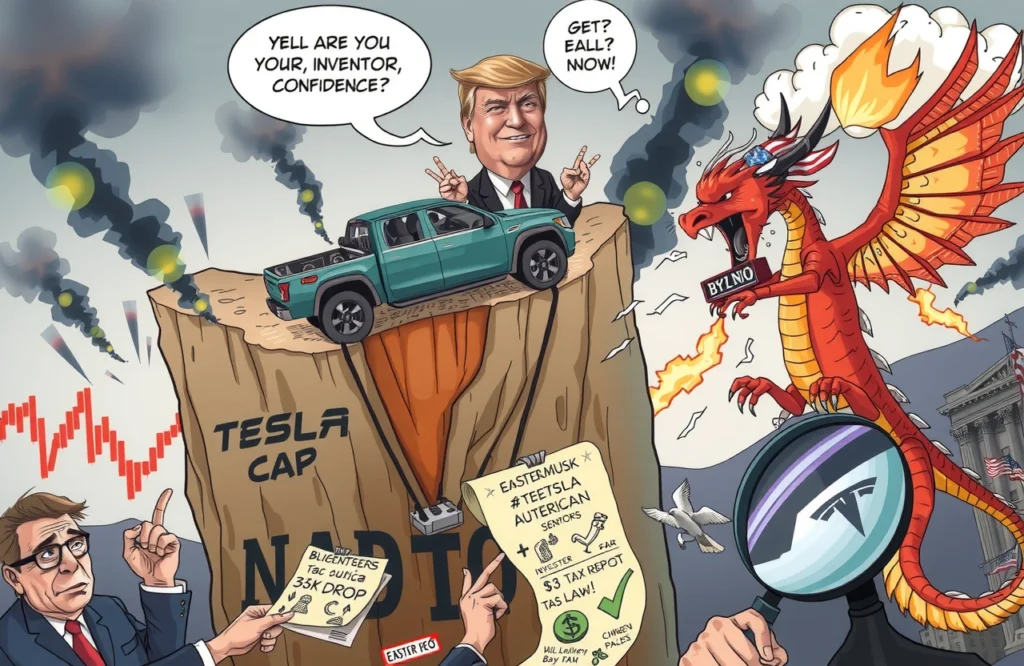

Market collateral damage surfaced beyond tariffs when Elon Musk’s political ambitions compounded Tesla’s woes:

– Tesla shares plummeted 6.9% Monday as investors reacted to Musk’s new party announcement

– The EV pioneer shed $185 billion in valuation since record highs just six months prior

Twitter feeds simultaneously buzzed with polarized debates about strategic corporate-political entanglement risks and speculation about Musk-Trump dynamics at [CNBC Politics](https://www.cnbc.com/politics/)

Meanwhile, political analysts warned about cascading effects: ‘When policy uncertainty combines with activist corporate politics, volatility inevitably magnifies. Investors now navigate two simultaneous risky games – geopolitical chess against economic dominoes,’ reported former IMF Asia director Takatoshi Ito.

Navigating Turbulence Ahead

Market participants should monitor three critical indicators in forthcoming weeks:

– Currency market interventions (especially Japanese yen/Korean won stability thresholds)

– Federal Reserve posture regarding inflation risks amidst trade disruption bottlenecks

– August tariff implementation completeness revealing long-term policy trajectories

Historical analysis demonstrates that markets gradually stabilize after initial tariff anxiety, averaging 11% recovery within five months since 1998. Nevertheless, targeted corporations inevitably scramble supply chains: Toyota recently announced accelerated North American production expansion bypassing Japanese exports.

Corporate leaders remain paralyzed without predictable frameworks. As Kiran Analytics warned CEOs yesterday: ‘Build inventories cautiously, diversify export hubs toward non-targeted partners where possible, anticipate protracted WTO disputes slowing customs flows.’ Companies should proactively prepare workforce retraining budgets while delaying discretionary capital expenditures until late-year clarity emerges.

Finance professionals must navigate abrupt volatility by hedging currency exposures while diversified investors should consider elevating positions in commodities/resources companies strategically boosted by reshoring trends. Meanwhile, individual investors should resist panic-selling equities fundamentally insulated from tariff impacts while reinforcing portfolios against stagflation risks.

Monitor tariff implementation patterns closely over August – the scale, exceptions and retaliations unfolding will establish the next twelve months’ economic trajectory. Subscribe for weekly geopolitical trade-risk analyses protecting enterprise supply chains amid shifting policies. With informed positioning supported by timely intelligence, organizations can transform disruption into competitive adaptation opportunities.