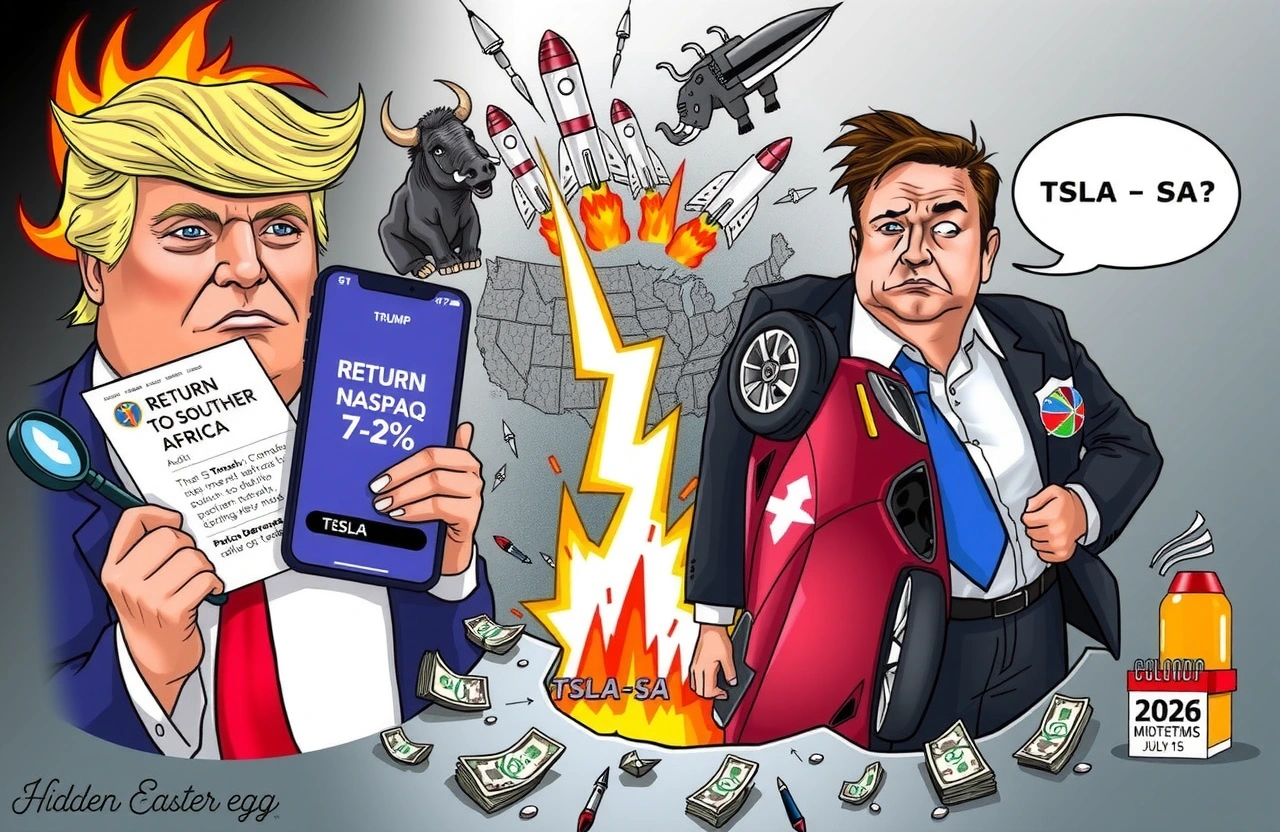

When former US President Donald Trump (唐纳德·特朗普) fired off a midnight social media attack targeting Elon Musk (伊隆·马斯克) on July 1, the impact reverberated beyond political circles straight to Wall Street. Tesla shares plunged over 7% overnight as Trump provocatively suggested the tech mogul would ‘shut down and go back to South Africa’ without government subsidies. This explosive exchange marks the latest chapter in the escalating Trump Musk subsidy dispute—a conflict exposing deep rifts in Republican energy policy while threatening wider market instability. As two of America’s most influential figures feud over billions in taxpayer-funded incentives, investors, policymakers, and voters must navigate the economic aftershocks.

Origins of the Trump Musk Feud

The conflict ignited weeks earlier when Elon Musk (伊隆·马斯克) publicly apologized to Trump after sharing sensitive information about him on June 6. This tense rapprochement dissolved on June 29 when Musk launched an extraordinary public attack against Republican-led tax reforms.

The Critical Tax Bill Flashpoint

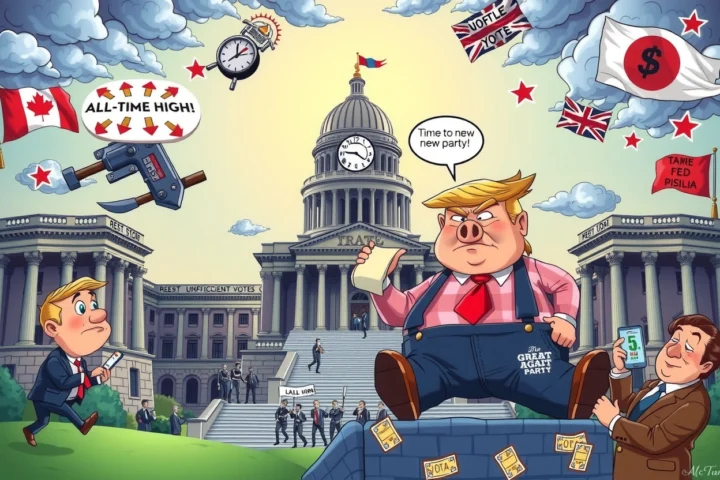

Musk specifically targeted provisions that would eliminate EV and clean energy subsidies within what Republicans call the ‘Big Beautiful’ fiscal plan. Musk declared these cuts would:– Destroy America’s clean energy competitiveness– Eliminate millions of future jobs– Represent ‘political suicide’ for RepublicansHe followed with a bold threat: ‘If this is the last thing I do on Earth, those voting for this bill will lose primaries’. Financial Times experts suggest Musk’s intervention could fracture GOP unity ahead of the 2026 midterms. Musk underscored his disillusionment by proposing a new party representing ‘the people’—a jarring stance considering he donated $25 million to Trump’s 2024 campaign.

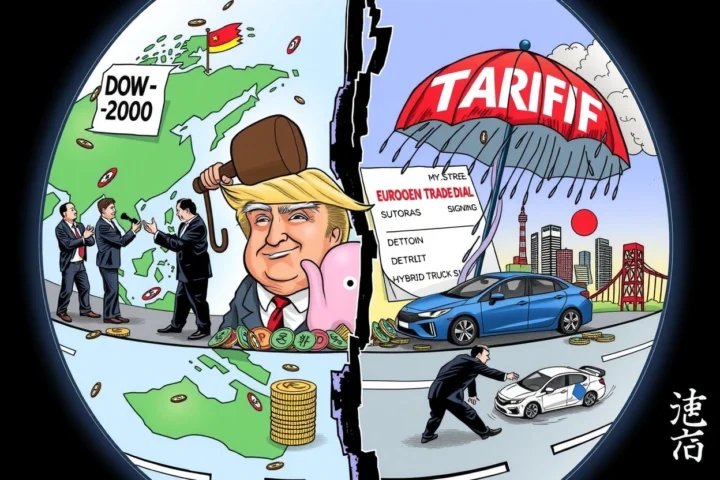

Trump’s Explosive Subsidy Accusations

After 48 hours of silence, Trump retaliated at 12:44 AM EST on July 1 with his signature incendiary rhetoric.

The ‘Return to South Africa’ Quip

Stating he’d ‘always opposed EV mandates’, Trump claimed: ‘Elon Musk knew my position long before supporting me’. The core argument landed like a missile: ‘Musk’s gotten more subsidies than anyone in history […] Without subsidies, he’d shut down and return to South Africa’. This ignited the central Trump Musk subsidy dispute now captivating global markets. His closing suggestion that government auditors ‘carefully examine’ Musk’s companies compounded the volatility.

Musk’s Swift Counterpunch

Within minutes, Musk fired back with a three-word rebuke: ‘Cut everything. Now’. Bloomberg analysis notes this sets unprecedented stakes—Musk daring lawmakers to eliminate subsidies despite Tesla historically benefiting from:$2.8 billion in federal tax incentives# Over $1.5 billion in state-level credits# Exclusive regulatory credits for zero-emission vehicles

Immediate Market Fallout

Nasdaq trading screens flashed red minutes after Trump’s tweet, with Tesla stock dropping:– 7.2% in after-hours trading– Wiping $56 billion off market capitalization– Triggering broader EV sector declinesThe Trump Musk subsidy dispute revealed market vulnerabilities analysts had underestimated. Sector-wide analysts like Wedbush Securities’ Dan Ives warned: ‘This feud exposes Tesla’s underappreciated policy dependence’. Treasury Department data highlights Tesla’s unique exposure:Environmental Protection Agency credits generated 5.2% of Tesla’s 2023 revenueFederal EV tax rebates accounted for 18% of US Model 3/Y sales

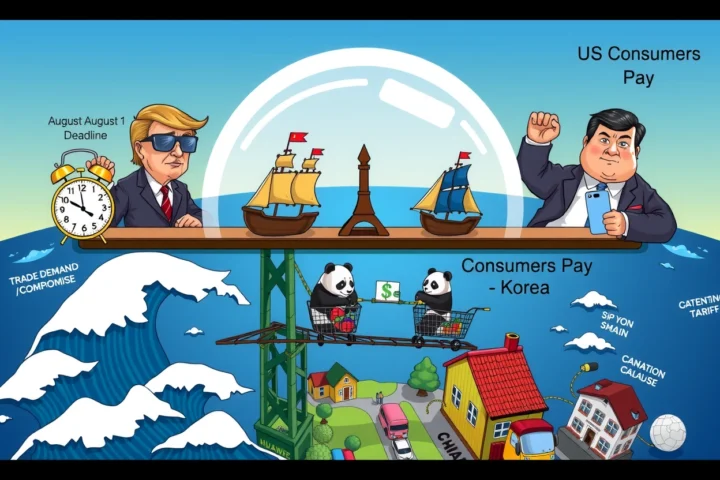

Long-Term Investor Implications

The volatility underscores hazardous blind spots:– EV valuations assume uninterrupted subsidy pathways– Regulatory credits remain Tesla’s only consistent profit center– Battery supply chains depend on bipartisan supportMorningstar research suggests investors must reassess:– Political risk weighting in clean energy portfolios– Concentration limits for policy-exposed stocks– Hedging strategies for subsidy volatility

The Deeper Political Divide

The Trump Musk subsidy dispute crystallizes Republican factions diverging on industrial strategy.

The Conservative Case Against Subsidies

Proponents argue:– Market forces should determine industry winners/losers– Federal incentives distort competition– Debt expansion endangers economic stabilityHeritage Foundation economists characterize subsidies as ‘pick-the-winner cronyism’ prolonging obsolescent industries.

The Pro-Business Green Transition View

Counterarguments cite:– China’s $150 billion annual green tech subsidies– First-mover advantages in emerging industries– Job creation multipliers exceeding traditional sectorsPrinceton’s NET Zero America study documents clean energy investments yielding:7.7 million net new jobs by 2050# $1.7 trillion in manufacturing growth# Competitive US export positioning

What Comes Next

The escalating Trump Musk subsidy dispute leaves critical questions unresolved:For Investors:– How exposed are clean tech valuations to DC politics?– Which firms innovate beyond subsidy dependence?For Policymakers:– Can long-term decarbonization survive short-term confrontations?– What guardrails prevent political attacks from cratering strategic industries?For Corporations:– How transparent should businesses be about government reliance?– When should CEOs engage political figures publicly?

The Decision Point Ahead

Congressional debate on the tax bill commences July 15. The Energy Department confirms Musk’s SpaceX retains $2.9 billion NASA contracts—exempt from current cuts. This protects Musk’s space endeavors while his terrestrial transport business faces Trump’s crosshairs. Financial regulators confirm investigation initiation requires congressional mandate.

Strategic Recommendations

Market participants should immediately implement:

For Portfolio Managers

– Diversify away from subsidy-sensitive pure plays– Allocate to vertically diversified EV manufacturers– Increase positions in smart grid infrastructure

For Corporate Leadership

– Hedge political risk with bipartisan advocacy teams– Quantify subsidy contingency scenarios– Innovation prioritization beyond policy protections

For Policymakers

– Depoliticize foundational industrial strategy– Sunset subsidy programs with predictable phase-outs– Reduce dependence on personalized policy debatesAs this historic confrontation unfolds between tech disruption and political tradition, stakeholders must remember America leads only when industrial strategy transcends partisan division. Monitor Treasury announcements, track Tesla executive policy commentary, and consult independent analyses like Congressional Budget Office briefings. Prepare plans adaptable to subsidy contraction scenarios—because policy winds shift overnight, but durable competitiveness require deeper foundations.