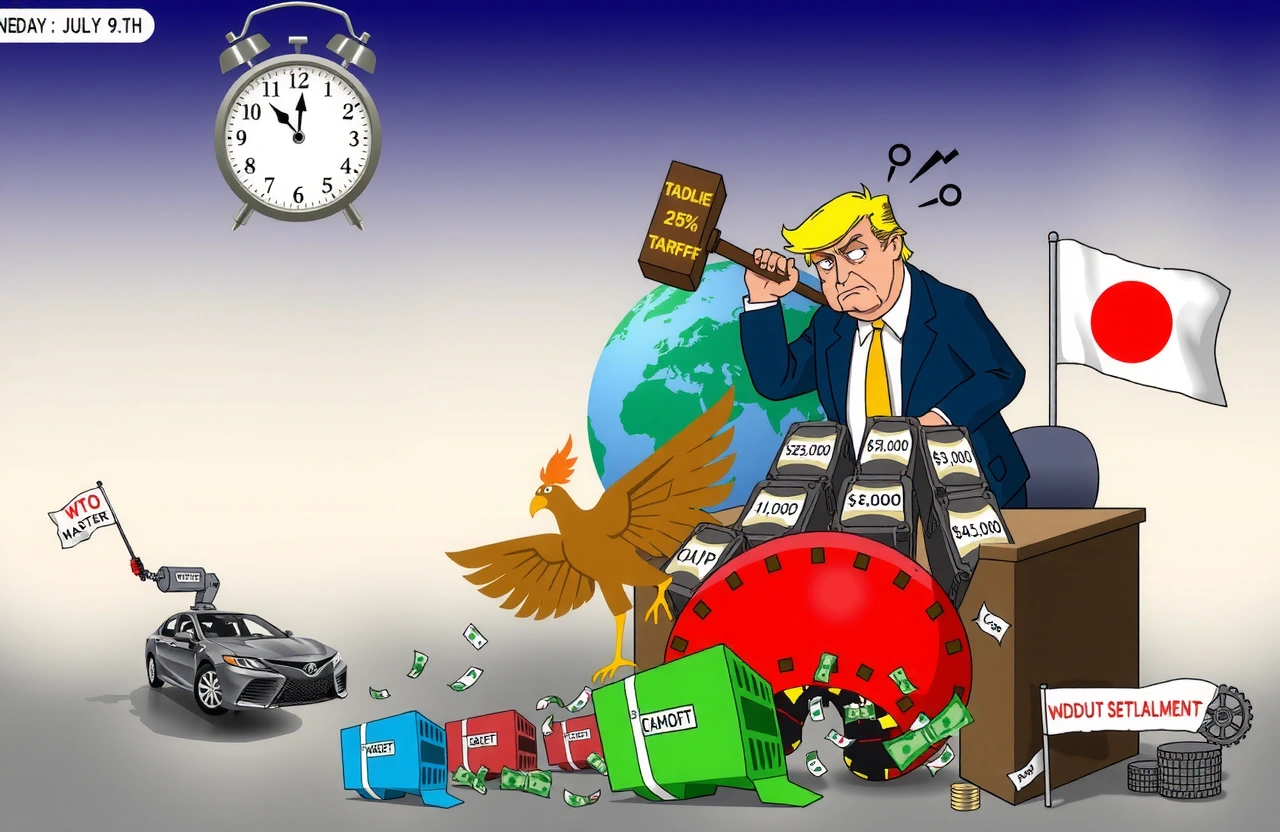

The Impending Tariff Deadline

With just days remaining until the July 9 deadline, former President Donald Trump has issued a stark warning to Japan: accept “fair” trade terms or face devastating 25% auto tariffs. In a Fox News interview on June 29, Trump framed this as rectifying what he called “one of the most lopsided trade relationships America has ever seen.” The clock is ticking for Japanese automakers who export nearly 1.7 million vehicles annually to the U.S., representing over $40 billion in trade. This 25% auto tariff threat could trigger the most significant trade disruption between the allies since the 1980s.

The Ultimatum Letter

Trump revealed his administration’s blunt approach: “I can send Japan a letter tomorrow saying, ‘Dear Japan, your cars now have a 25% tariff.'” This direct threat underscores his belief that unilateral action is justified given America’s $67.6 billion trade deficit with Japan. The former president emphasized that Tokyo “understands” his position, particularly regarding automotive market access where U.S. manufacturers face steep barriers while Japanese brands capture 38% of the American market.

Japan’s Narrow Window

Chief negotiator Akira Amari (甘利明) raced to Washington last week for emergency talks with U.S. Trade Representative Robert Lighthizer (罗伯特·莱特希泽). Though both sides described discussions as “productive,” Trump’s recent comments suggest Japan hasn’t yet secured concessions. The absence of any deadline extension signals critical days ahead for trade diplomats.

Decades of Automotive Imbalance

The roots of this confrontation stretch back to the 1970s when Japanese automakers first made significant inroads into the U.S. market. Today, the structural trade gap remains staggering: for every American car sold in Japan, approximately 100 Japanese vehicles find buyers in the United States. This imbalance forms the core justification for Trump’s 25% auto tariff proposal.

America’s Export Barriers

U.S. automakers face formidable obstacles in Japan, including:

– Unique safety and emissions standards requiring costly redesigns

– A dealership network historically favoring domestic manufacturers

– Tax structures that disadvantage larger foreign vehicles

These barriers contribute to American brands holding less than 1% market share in Japan despite decades of effort.

The Trade Deficit Dilemma

Trump repeatedly cited the $67.6 billion U.S. trade deficit with Japan as unacceptable. “We have a tremendous deficit with Japan,” he emphasized, “and they know it.” Automotive products constitute nearly 75% of this imbalance, making them the primary target for tariff adjustments. The proposed 25% auto tariff would mirror existing U.S. levies on light trucks established during the 1960s.

Negotiation Chess Match

Behind closed doors, Japanese negotiators are scrambling to avoid the 25% auto tariff through concessions. Akira Amari (甘利明) brings decades of trade experience to the table, having previously negotiated the Trans-Pacific Partnership. His current challenge involves offering meaningful market access without devastating Japan’s auto industry.

Oil as Bargaining Chip

Trump suggested an alternative solution: “We have oil. They can buy lots of oil.” This references America’s emergence as the world’s top oil producer, positioning energy exports as a potential trade balancer. Japan currently imports over 90% of its oil, much from Middle Eastern suppliers. Redirecting even 10% of these purchases to U.S. producers could reduce the trade deficit by $4-5 billion annually.

Agricultural Access Talks

Parallel discussions focus on American agricultural demands:

– Lower Japanese tariffs on U.S. beef (currently 38.5%)

– Increased wheat and corn import quotas

– Reduced protections for Japan’s dairy sector

These concessions might provide political cover for Japan to maintain favorable auto terms.

Global Economic Implications

A 25% auto tariff would ripple through global supply chains, potentially triggering:

– Price increases of $5,000+ on popular Japanese models

– Production shifts from Japan to U.S. manufacturing hubs

– Retaliatory tariffs on American agricultural exports

Automakers like Toyota and Honda, who employ over 100,000 U.S. workers, face impossible choices between absorbing costs or passing them to consumers.

Precedent for Other Nations

Trump’s approach signals potential future actions against trade partners like Germany and South Korea. The 25% auto tariff threat establishes a template for demanding concessions through brinkmanship. European automakers are already contingency planning should similar demands emerge.

Supply Chain Disruptions

Modern vehicles contain components crossing borders dozens of times. A Toyota Camry built in Kentucky uses:

– 30% Japanese-sourced parts

– 15% components from other Asian nations

– 55% North American content

The proposed 25% auto tariff could disrupt this intricate network, potentially adding months to delivery timelines.

Industry Response Strategies

Japanese automakers have activated emergency plans developed during previous trade tensions. Toyota has accelerated its Alabama-Mississippi engine production, while Nissan is fast-tracking battery plant investments in Tennessee. These moves aim to increase North American content percentages to potentially qualify for tariff exemptions.

Stock Market Reactions

Investors reacted swiftly to Trump’s comments:

– Toyota shares fell 2.3% on the Tokyo exchange

– Ford and GM gained 1.8% on tariff protection hopes

– Auto parts suppliers dropped 3-5% on uncertainty

This volatility reflects market anxiety about the 25% auto tariff becoming reality.

Consumer Impact Projections

Industry analysts predict immediate consequences if tariffs hit:

– Best-selling models like the RAV4 and Civic rising $4,000-$6,000

– Used Japanese car values increasing 15-20%

– Potential loss of 120,000 U.S. dealership jobs

Middle-income families would bear the brunt through reduced affordability and choice.

Historical Context and Outcomes

This confrontation echoes Reagan-era auto tariffs when the U.S. imposed “voluntary” export restraints on Japan in 1981. Those measures:

– Temporarily protected Detroit automakers

– Accelerated Japanese manufacturing investment in America

– Ultimately failed to reverse trade imbalances

The current 25% auto tariff threat represents a more aggressive approach, targeting specific countries rather than global imports.

Legal Authority Questions

Trump would likely invoke Section 232 of the Trade Expansion Act, claiming auto imports threaten national security. This controversial approach previously applied to steel tariffs faced multiple legal challenges. Japan would likely contest the 25% auto tariff at the WTO while implementing countermeasures.

Pathways Forward

With days remaining, three scenarios dominate discussions:

1. Breakthrough Agreement: Japan offers substantial agricultural concessions in exchange for auto tariff exemption

2. Temporary Extension: Deadline pushed to November elections for further negotiation

3. Tariff Implementation: 25% auto tariff imposed July 10 triggering Japanese retaliation

Most analysts consider scenario two most likely given both sides’ incentives to avoid immediate disruption.

Automaker Contingencies

Industry leaders are preparing for all outcomes:

– Accelerating production to build inventory before July 9

– Developing component sourcing alternatives to Japan

– Lobbying state governors to pressure the administration

These measures aim to mitigate the potential 25% auto tariff impact.

Broader Economic Consequences

Beyond autos, this confrontation threatens the U.S.-Japan alliance at a delicate geopolitical moment. Joint defense projects and technology sharing could suffer collateral damage. Meanwhile, China watches closely as America pressures another Asian trading partner, potentially accelerating regional economic realignment.

Inflationary Pressures

Economists warn the 25% auto tariff could add 0.3-0.5% to U.S. inflation at a time when the Federal Reserve struggles to control prices. With vehicles representing 7.5% of the consumer price index, this single action could undermine broader economic stability.

Critical Next Steps

As the July 9 deadline approaches, businesses must prepare for multiple outcomes. Companies relying on Japanese automotive imports should:

– Consult customs brokers about potential tariff classifications

– Evaluate force majeure contract clauses

– Develop alternative sourcing strategies immediately

Consumers considering Japanese vehicle purchases might accelerate decisions before potential price hikes. The coming days will test whether economic pragmatism or protectionism prevails in this high-stakes trade standoff. Monitor official announcements closely as this situation develops rapidly, and consult trade experts to navigate potential disruptions.