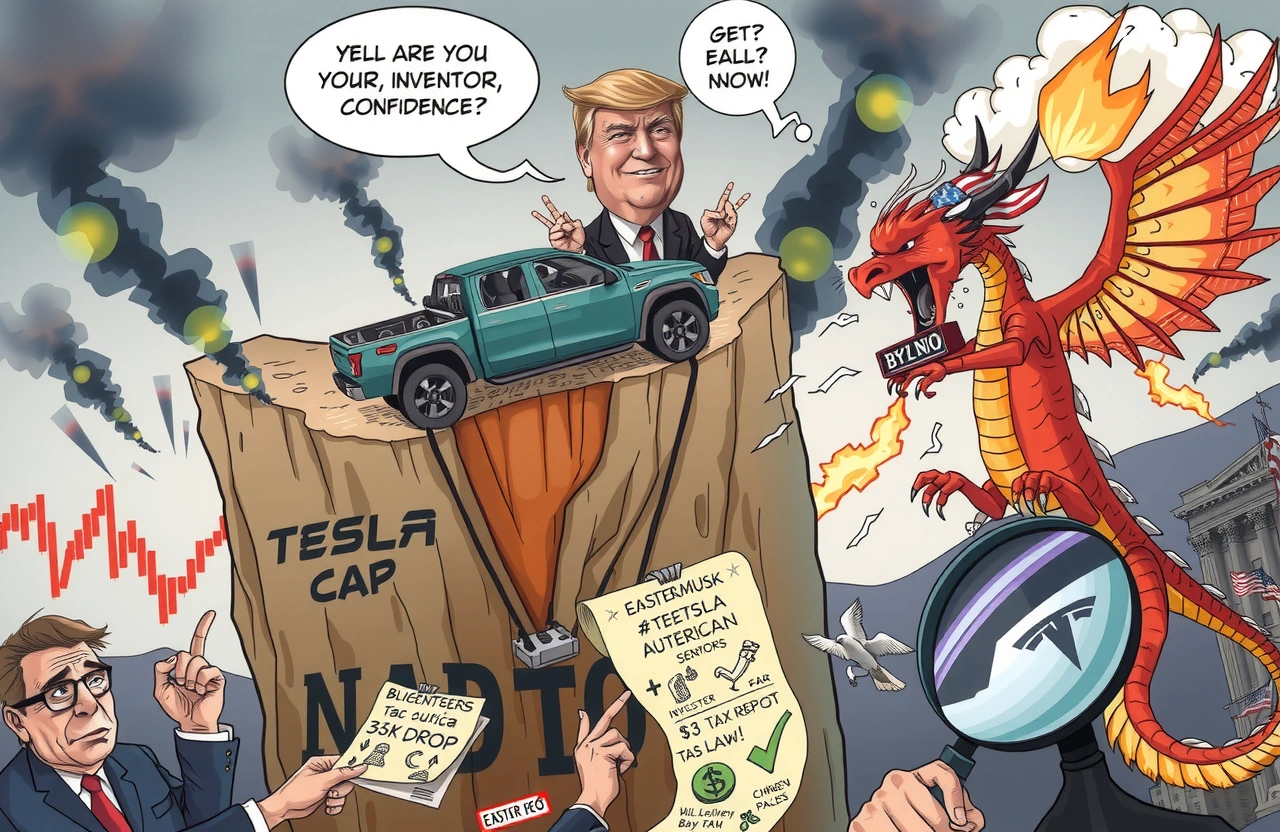

Tesla’s Market Value Plummets Following Musk Announcement

Wall Street reacted with fierce negativity as Tesla shares plunged nearly 7% on Monday, erasing $68 billion from its market capitalization. This represents the automaker’s steepest single-day decline since December 2023 and marks a 35% downturn from its peak valuation. The dramatic sell-off followed Elon Musk’s weekend announcement forming the ‘American Party,’ a new political movement claiming to represent America’s “80% of centrist voters.” Investor confidence evaporated amid fears that Musk’s renewed political focus threatens Tesla during make-or-break challenges, including declining quarterly deliveries and intensifying EV competition.

The Political Gambit

Birth of the American Party

Elon Musk revealed his third-party initiative on July 5th during escalating tensions over the recently enacted “Big and Beautiful” tax legislation championed by former President Donald Trump. The Tesla CEO framed his American Party as breaking America’s two-party deadlock, targeting moderate voters alienated by partisan extremes. Musk’s declaration represents his most direct entry into electoral politics since departing government advisory roles in May.

Trump’s Dismissal

When questioned about Musk’s venture, Donald Trump dismissed it as “ridiculous” during July 6th remarks. This public friction marks a significant deterioration from their previous rapport during Musk’s tenure advising Trump’s administration on federal efficiency. Political historians note Musk’s earlier government role drew criticism regarding potential conflicts between policy responsibilities and corporate leadership at Tesla.

The Feud’s Financial Fallout

The Tax Law Dispute

The battle centers on Trump’s “Big and Beautiful” fiscal package:

- Musk argues it burdens America with unsustainable debt

- Tesla faces cancellation of vital electric vehicle tax credits

- The reforms undermine cost-saving achievements Musk delivered at the Government Efficiency Office

Investment bank William Blair notes this conflict previously cost Tesla $150 billion in market value during June’s heated social media exchanges between Musk and Trump.

Investor Exhaustion Sets In

Tesla shareholders demonstrate dwindling patience with Musk’s political engagement:

- Wedbush analyst Dan Ives’ survey indicates 73% of institutional investors consider Musk’s political activities a ‘significant distraction’

- William Blair analyst Jed Dorsheimer downgraded Tesla to ‘hold,’ citing leadership distraction during operational pivots

- ETF provider Azoria Partners postponed Tesla-focused fund launch citing eroded shareholder confidence

Tesla’s Operational Headwinds

Delivery Disappointment

Compounding investor concerns, Tesla recently announced Q2 deliveries dropped 14% year-over-year. The automotive pioneer faces mounting pressure as competitors gain market share:

- BYD (比亚迪) expands European presence

- Chinese EV makers like NIO unveil premium models challenging Tesla’s sedan dominance

- Traditional automakers allocate $1.2 trillion toward EV development through 2030

Market Implications

Leadership Distraction Risk

Financial analysts highlight three critical Tesla priorities jeopardized by Musk’s political venture:

- Autonomous driving technology rollout

- Cybertruck production scalability

- $25,000 mass-market EV development

The Azoria Partners report underscores “governance concerns” regarding Musk’s divided attention across SpaceX, Neuralink, X platform, and now political operations.

The Investor Perspective

Sustained political involvement poses material risks for Tesla shareholders:

- Regulatory scrutiny increases as party leadership clashes with automaker oversight roles

- Consumer brand perception becomes entwined with controversial political positions

- Executive recruitment challenges emerge amid perceived leadership instability

Morgan Stanley notes Tesla trades at a 24% governance discount compared to other Magnificent Seven tech stocks.

The Path Forward

Tesla’s most valuable asset remains Musk’s visionary leadership. Yet Monday’s market reaction signals investor unwillingness to tolerate divided priorities during sector transformation. CEOs historically face shareholder revolt when politics visibly compromise corporate stewardship. Successful navigation requires separating political ambition from operational excellence while rebuilding investor trust through predictable execution. Monitor Tesla’s upcoming quarterly earnings for management clarification on governance structure as political season intensifies.

Explore Tesla’s investor relations page for upcoming earnings reports to assess leadership commitments.