The Unstoppable March Toward Conscious Capital

Wall Street sharks and everyday investors increasingly share one conviction: Traditional investing ignores critical risks. Climate disasters cost the global economy $313 billion in 2022, while fragmented supply chains expose companies to ethical landmines. Sustainable investing addresses these vulnerabilities by integrating environmental, social, and governance (ESG) metrics into financial decisions. As we approach 2025, this approach has evolved from progressive ideology to market imperative. Pension funds managing $28 trillion now actively screen for ESG compliance, and corporations face binding green regulations across 25 jurisdictions. The stewardship of capital is undergoing its greatest transformation since the advent of index funds.

The Regulatory Revolution Reshaping Markets

Governments now recognize climate risk as financial risk. Consider these game-changing policies effective before 2025:

Mandatory Climate Disclosures

European Union’s Corporate Sustainability Reporting Directive requires 50,000 companies to publish verified environmental impact data starting 2024. Comparable regulations take effect in Malaysia, Japan, and California. Non-compliant firms face delisting from major exchanges.

Subsidy Shifts Toward Green Tech

The Inflation Reduction Act allocates $369 billion to renewable energy infrastructure in the U.S., creating valuation advantages for companies embracing sustainability. Simultaneously, carbon taxes cover 23% of global emissions as pricing mechanisms accelerate transitions.

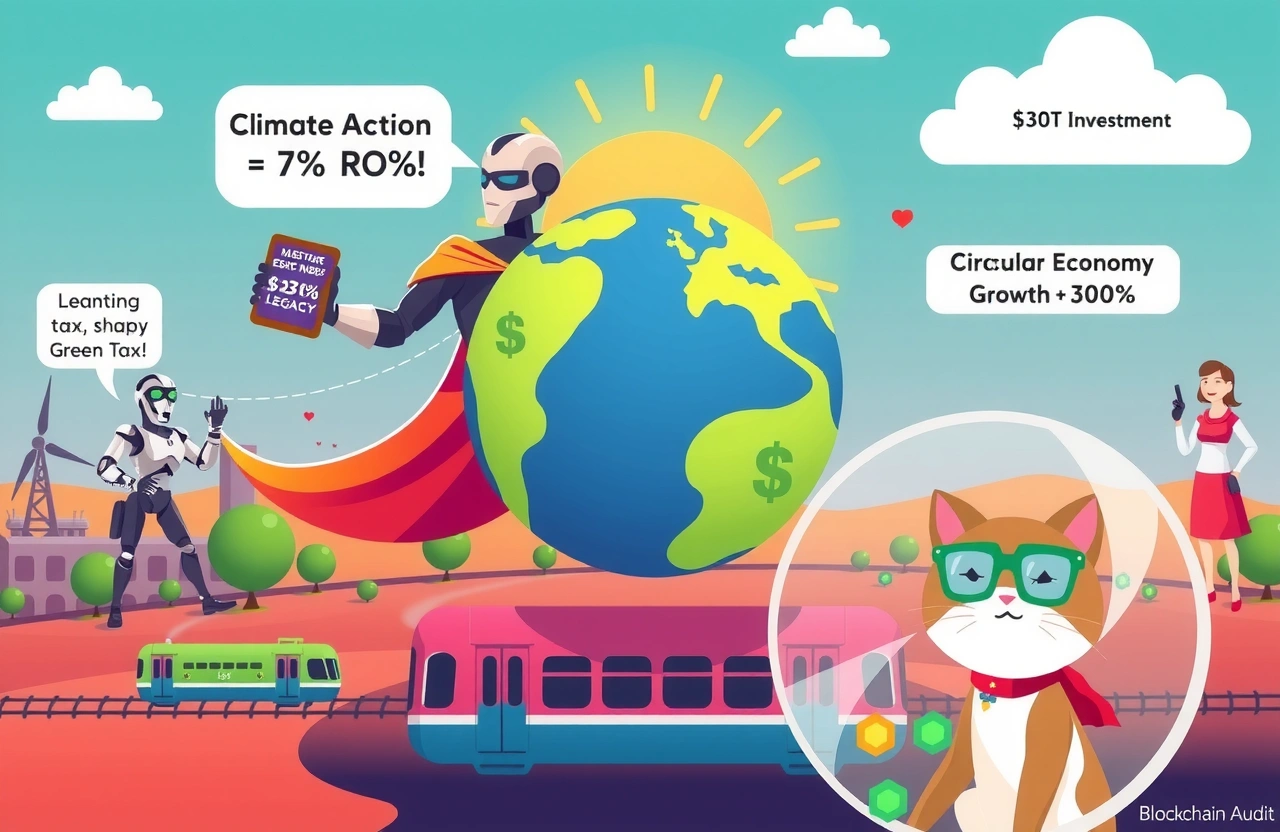

Performance Metrics Erasing Doubts

The notion that sustainable strategies sacrifice returns evaporated when MSCI’s global ESG indexes outperformed traditional benchmarks by 5.1% annually during 2020-2023 market turbulence. Why the resilience?

Cost Reduction Through Efficiency

Renewable energy now outcompetes fossil fuels economically. Key drivers include:

– Solar panel costs plunging 89% since 2010

– Energy storage solutions cutting operational expenditures

– Waste-reduction innovations boosting net margins

Institutional Adoption Surge

BlackRock, Vanguard, and State Street now tie executive compensation to ESG targets across $6.8 trillion in managed assets. Their voting power forces boardroom accountability.

The Generational Wealth Transfer Accelerating Change

Baby boomers will transfer $84 trillion to younger generations by 2045 – the largest wealth shift in history. Heirs show radically different priorities.

Next-Gen Investment Preferences

A Morgan Stanley study reveals:

– 95% of millennials seek sustainable options

– Fidelity found 78% attribute portfolio growth to ESG positions

– 40% exclusively use impact-aligned brokerages

Social Media’s Multiplier Effect

Platforms like Ante allow users to share impact metrics, creating peer pressure that shifts capital decisions. Credible “green claims” become brand imperatives overnight.

Innovations Democratizing Access

Previously exclusive to institutional players, sustainable investing tools now empower individual investors through:

AI-Powered Analysis

Platforms like Clarity AI automate ESG scoring for 30,000+ companies, identifying leaders in areas like:

– Carbon footprint reduction

– Board diversity

– Supply chain ethics

Fractional Green Bonds

Retail investors can now buy $10 slices of renewable energy projects through services like OpenInvest. This funds tangible infrastructure while generating 5-7% yields.

Combatting Greenwashing Through Standards

As sustainable investing grows, so do misleading claims. Regulators respond with strict verification protocols.

The Transparency Mandates

International Sustainability Standards Board guidelines require third-party auditing of ESG reports. Violations trigger SEC penalties and consumer lawsuits.

Blockchain Verification

Projects like World Bank’s bond registry use immutable ledgers to track fund allocation, ensuring investments actually reach sustainable initiatives.

Strategic Implementation Tactics

Integrating sustainability requires more than swapping stocks. Consider this framework:

Portfolio Evaluation Blueprint

– Assess current exposure using ESG rating tools from companies like Arabesque

– Allocate progressively: Start with 20% ESG funds before increasing exposure

– Combine thematic ETFs across renewables, water, and circular economy models

Conscious Shareholder Actions

Simply owning sustainable stocks isn’t enough. Engage through:

– Proxy voting for climate resolutions

– Direct dialogue with investor relations teams

– Platforms like Tulipshare pooling shareholder influence

Financial logic has aligned with planetary responsibility. Institutional mandates, outperformance data, and regulatory frameworks anchor sustainability as the most credible wealth-protection strategy. By 2025, all major indices will incorporate ESG metrics by default – this transition period represents your last mover advantage. Begin today: Audit one investment holding against Paris Agreement targets using the free MSCI ESG Manager tool.