Critical Juncture for Troubled Chinese Stock

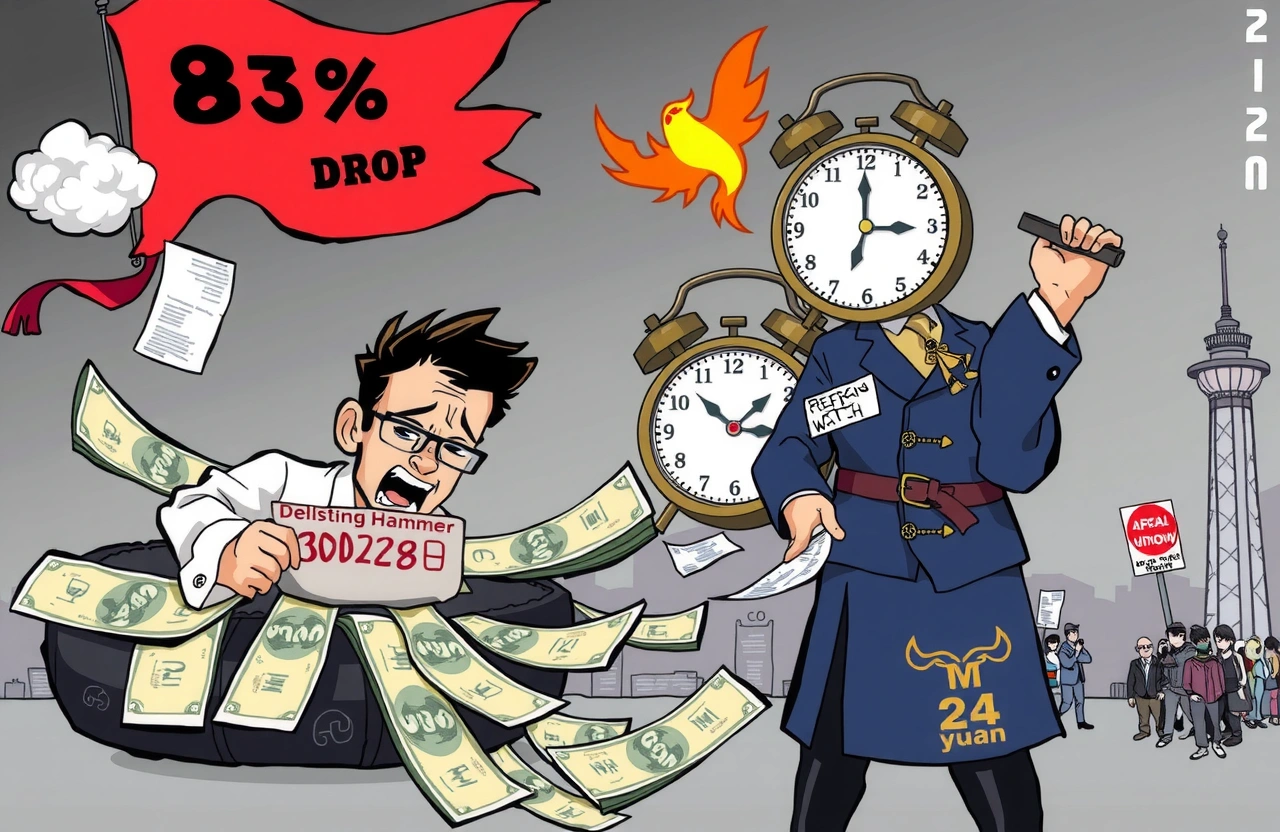

Shenzhen-listed *ST Zitian Media Technology (300280) faces market expulsion following regulatory failures, sounding China’s latest delisting alarm. Trading suspension took effect July 21, 2025, marking a critical juncture since February’s fraudulent accounting revelations left unresolved. Investors flee as shares plunge 87% this year, paralleling China’s intensified financial accountability campaign. This delisting crisis exposes systemic obstacles hindering corporate corrections amid tightening oversight.

Key Developments

- Regulators mandated corrections for false 2022-2023 financial reports – ignored deadline

- Trading halted twice in 2025 after suspension deadlines lapsed

- 87% year-to-date stock plunge before final suspension

- 24.99 billion yuan ($3.4B) inflated revenue uncovered

- Parallel case: China Ceramics (300208) delisted July 21

Regulatory Breakdown Triggers Suspension

The China Securities Regulatory Commission’s Fujian bureau delivered a corrective order on February 14, 2025, requiring audited financial restatements within thirty days. The delisting countdown began when management missed the mid-March deadline, violating Shenzhen Stock Exchange regulations prohibiting extended trading suspensions.

Accounting Compliance Failures

*ST Zitian’s inability to secure qualified audit services proved decisive. Without third-party validation, investigators confirmed inflated revenues totaling 24.99 billion yuan across 2022-2023 filings, representing 63.53% of reported income. This constitutes explicit regulatory infringement meeting termination criteria.

Termination Proceedings Accelerate

Shenzhen Exchange regulation 10.4.18 now governs proceedings, classifying violations as posing existential risk. Fujian regulators’ June 27 penalty notice formally referenced intentional misrepresentation, meeting precise thresholds for compulsory delisting under Chapter 10.4.1 violations – emphasizing China’s hardened stance toward fabrication.

Delisting Sequence Analysis

- Feb 14: Corrective mandate issued

- Mar 17: First trading suspension begins

- May 20: Official delisting warning activated

- July 20: Final suspension confirmation

Market Turbulence Precedes Halts

Severe volatility preceded suspension, with shares dropping continuously between July 11-18. Prices plummeted 13% on the final July trading day, settling at 2.74 yuan ($0.38) – slicing market capitalization to 444 million yuan ($61 million). Panicked retail investors dominated recent volumes, purchasing 800 million yuan ($110M) against 761 million yuan ($105M) sales.

Trading Data Trends

Shenzhen Exchange disclosure showed 96% of July buyers were retail accounts, typically holding smaller positions. Their disproportionate participation signals flawed risk awareness surrounding financially distressed enterprises near delisting triggers – suggesting Chinese markets require stronger investor safeguards.

Parallel Case: China Ceramics Exit

China Ceramics (300208) completed its delisting journey concurrently, exiting July 21 after June’s 70% single-day collapse. Its collapse illustrates China’s escalated enforcement against compliance failures. Ceramics ended at 0.28 yuan ($0.04) – a staggering 98% below peak valuation – demonstrating permanent value destruction possible during termination proceedings.

Synchronized Enforcement Pattern

Regulators administered identical procedures to both firms:

- 15-day trading window during exit period

- Termination after multiple suspension deadlines

- Penalty notices preceding final determinations

Investor Impact Analysis

Small investors face disproportionate harm, holding approximately 67% of *ST Zitian’s shares based on May disclosures. China’s inadequate delisting compensation mechanisms exacerbate retail vulnerability. Without settlement guarantees like Hong Kong’s system, shareholder recovery rates after termination typically approach zero.

Safeguarding Suggestions

- Scrutinize auditor engagement status quarterly

- Monitor regulatory penalty databases monthly

- Avoid stocks persistently trading under 1 yuan

- Verify correction plan submissions post-warnings

Systemic Implications Beyond 300280

*ST Zitian’s collapse exposes China’s continued accounting governance weaknesses despite stricter 2024 exchange reforms. Their inability to hire qualified auditors for corrections reveals structural flaws – many firms attempt reorganization shortcuts amid expertise shortages.

Deepening oversight highlights China’s evolving securities approach: Shenzhen Exchange terminated thirteen listings between January-June 2025 alone, contrasting markedly with just seven exits during 2020-2023 combined. This accelerating enforcement demonstrates determination to remove problematic entities.

Sustainable Investing Considerations

*ST Zitian’s delisting saga underscores why international standards increasingly integrate governance assessments. Beyond financial metrics:

- Assess auditor qualifications and history

- Review regulatory compliance track record

- Evaluate corrective action implementation speed

- Monitor related-party transaction disclosures

Pathways Forward

*ST Zitian retains rights to appeal within fifteen days per Chinese securities law Chapter XIV provisions. Successful rehabilitation remains improbable absent compliance breakthroughs given auditor vacancies. For investors navigating China’s risk landscape, prioritizing enterprises demonstrating:

- Proactive regulatory cooperation

- Transparent auditor transitions

- Report self-correction initiatives

- Strong independent director oversight

Maintain vigilance regarding debts exceeding operating capital – frequently preceding accounting violations. As market mechanisms mature, evaluation frameworks must prioritize fundamental compliance alongside earnings forecasts.