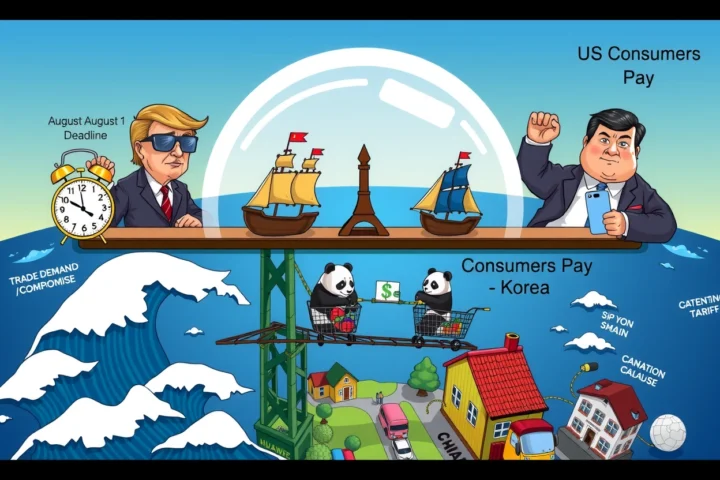

Federal Reserve Chair Jerome Powell (杰罗姆·鲍威尔) has revealed that former President Donald Trump’s (唐纳德·特朗普) tariff policies directly influenced monetary policy decisions, stating the Fed would have pursued earlier interest rate cuts without trade restrictions. This unprecedented admission during a Tuesday panel discussion highlights the complex interplay between trade wars and inflation control.

The Tariff Impact on Monetary Policy

During a CNBC-moderated session, Powell explicitly connected Trump’s trade policies to the Fed’s cautious approach. When asked whether the Fed would have implemented looser monetary policy without tariffs, Powell confirmed: “I believe so.” This marks the clearest acknowledgment to date of how political decisions constrain central bank options.

Inflation Forecasts Disrupted

The Fed chairman elaborated that impending tariffs forced abrupt recalibrations: “Once we assessed the tariff scale, we halted planned actions. Essentially, all U.S. inflation projections rose substantially because of these tariffs.” This admission underscores how $300 billion+ in proposed levies clouded economic visibility.

Three tariff-driven complications emerged:

– Supply chain disruptions raising production costs

– Import price inflation squeezing consumer budgets

– Policy uncertainty freezing business investment

The Patient Fed Approach

With tariffs expected to elevate summer inflation, Powell emphasized data-dependent patience despite robust economic indicators. The Fed left rates unchanged at 4.25%-4.5% at its June meeting – maintaining the highest level in 23 years since December 2023.

July Rate Cut Probability

Powell refused to declare July premature for policy shifts but noted: “We won’t preemptively exclude action at any meeting.” Traders anticipate continuity though – CME FedWatch shows 76% probability rates hold steady through July. Despite this, Powell revealed most FOMC members project interest rate cuts later in 2025.

Presidential Pressure Campaign

Trump has relentlessly criticized Powell’s stewardship, demanding immediate rate reductions to stimulate growth. At a June 27 rally, the former president escalated attacks, calling the Fed chair “a stubborn mule” and “stupid person” while threatening replacement.

Trump declared: “I’d never appoint someone who keeps rates high. I’d choose people who want to slash rates. Many exist.” He even welcomed Powell’s resignation. This marks the eighth public condemnation of Powell since January.

Historical Precedent

Modern Fed chairs rarely directly confront presidential criticism. Ben Bernanke faced Congressional pressure post-2008 crisis, while Alan Greenspan navigated political currents through subtle signaling. Powell’s tariff response establishes a defensive stance.

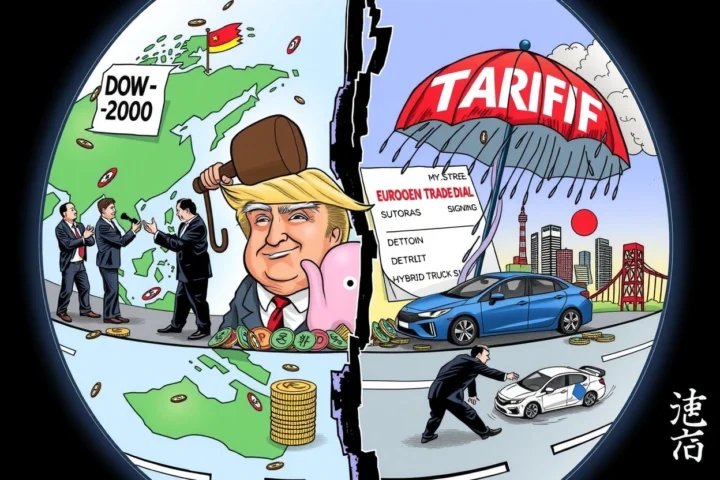

Market Reactions and Divergence

Stocks showed limited volatility following Powell’s remarks. Intraday data revealed:

– Dow Jones gained 0.4% despite early dips

– Nasdaq declined 0.35% amid tech volatility

– S&P 500 slipped 0.14% before stabilizing

Treasury yields seesawed as investors digested implications:

– 2-year yields dipped to 4.20% before settling

– 10-year notes saw muted change at 3.45%

– Dollar index marginally strengthened

Navigating Inflation Crosscurrents

The tariff-inflation nexus presents complex challenges. Consumer prices have shown:

– Core CPI holding at 3.8% year-over-year

– Import price index rising 1.2% since April

– Producer inputs increasing 0.9% monthly

Policy Tradeoff Analysis

Powell’s team balances contradictory risks:

– Premature cuts might accelerate tariff-driven inflation

– Delayed easing could over-tighten credit markets

– Global counterparts (ECB, BoE) diverging on policy paths

Forward Guidance and Investor Strategy

Asset allocation hinges on parsing Powell’s cues:

– Focus on August/September FOMC meetings

– Monitor employment data for cooling signs

– Track tariff implementation timelines

Sector recommendations emerged:

– Utilities and REITs for rate sensitivity

– Selective exporters with tariff exemptions

– Floating-rate bond allocations

The Fed maintains its dual mandate focus: maximum employment alongside price stability. Recent data continues to favor restraint:

Dot Plot Projections

September FOMC economic projections suggest:

– Core inflation easing to 3.2% by year-end

– Unemployment stabilizing at 3.8%

– GDP growth moderating to 2.7%

Strategic Approaches for Businesses and Consumers

Corporations should reassess:

– Supply Chain Vulnerabilities

Build alternative sourcing strategies

– Hedging Protocols

Lock favorable rates through 2026

– Cash Deployment

Prioritize liquidity amid uncertainty

Consumers gain advantage through:

– Refinancing variable-rate debts

– Seeking fixed-rate mortgages

– Capitalizing on inflationary wage growth

Powell’s tariff acknowledgement creates new frameworks for interpreting Fed actions. With trade policy constraining monetary tools, investors must navigate political and economic crosscurrents. Watch July meeting minutes for confirmation bias regarding potential interest rate cuts. Prepare portfolios for delayed-but-inevitable easing: analyze sector exposures and revisit fixed-income duration. Businesses should stress-test scenarios ranging from full tariff implementation to negotiated rollbacks.