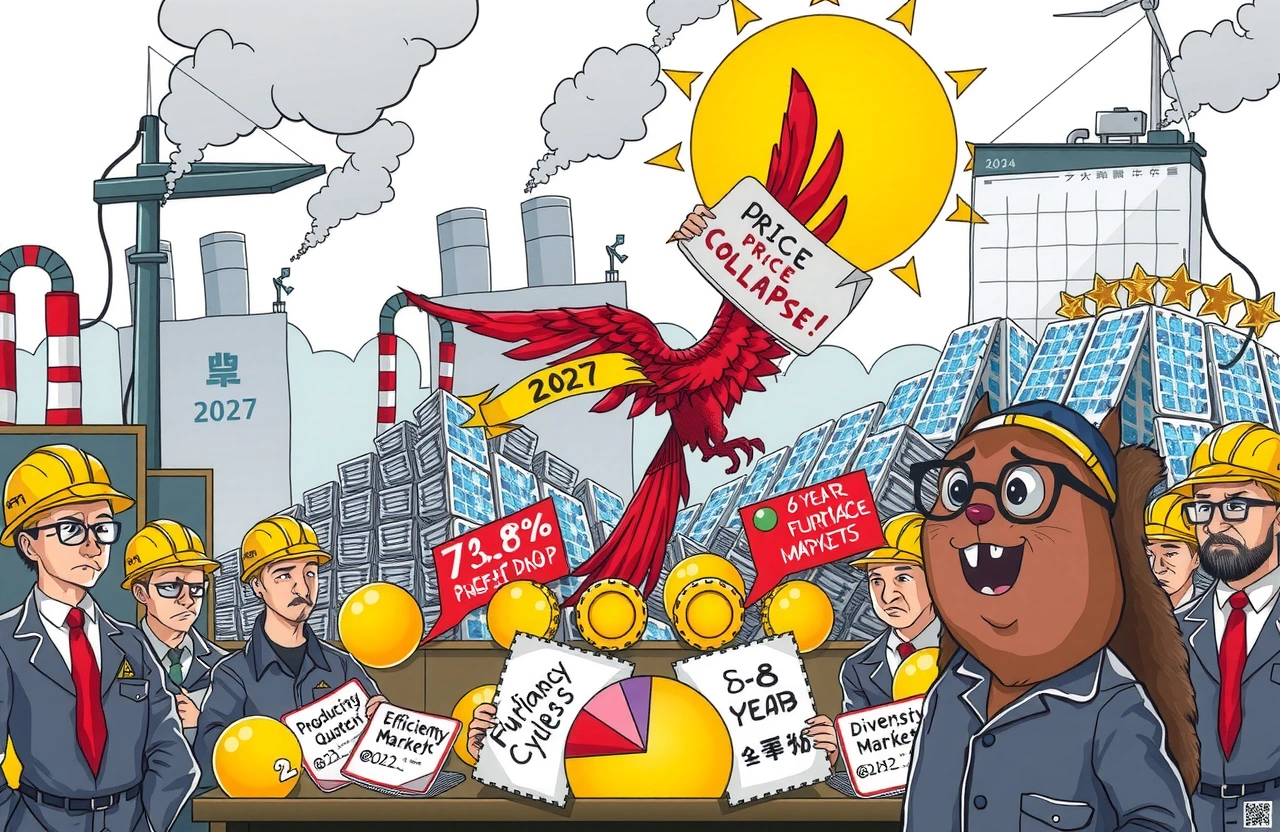

Turbulent Markets Trigger Industry Action

The photovoltaic glass sector faces renewed pressure as prices tumble below production costs, forcing major manufacturers to consider coordinated production cuts. Following a temporary price surge during March-May’s installation rush, June witnessed a dramatic reversal—glass prices crashed to 10.5 yuan/square meter according to Longzhong Information data, down sharply from spring highs of 14.5 yuan and well under the break-even point for most producers. With inventories ballooning to 32 days—double the healthy fortnightly cycle—market stabilization demands immediate intervention.

Cash Flow Crisis Deepens

Industry sources confirm cumulative losses have reached unsustainable levels, particularly among second-tier manufacturers. Flat Glass Group (福莱特) acknowledged persistent challenges despite current operations: “Each company’s production situation differs,” stated their securities department representative. “Since late 2023, we’ve maintained furnace maintenance cycles and adjusted capacity outputs.” Kibing Group (旗滨集团) echoed the pricing volatility: “Post-June demand contraction outpaced voluntary reductions, causing accelerated price erosion.” These pressures highlight why photovoltaic glass production cuts are becoming inevitable.

Planned Capacity Reduction Strategies

Multiple enterprises have privately confirmed July-initiated output curbs ranging from 15% to 30%, though execution uncertainties persist. Evidence suggests preliminarily actions already emerged:

June Precursor Adjustments

Shanghai Metals Market tracked 6,000+ tons/day of capacity reductions through:

– Operational suspension (3,850 tons/day)– Furnace sealing (3,020 tons/day)– Additional kiln shutdowns (650 tons/day)

Gao Ling (高玲), Longzhong Information analyst, quantified the dilemma: “Current effective PV glass capacity sits at 93,000 tons daily. A 30% cut would decrease this to 70,000 tons—below projected demand of 85,000 tons and risking shortages.” She elaborated that today’s industry entropy creates conflicting corporate incentives:– First-tier firms protect market share while incurring losses– Smaller players face shutdowns versus bankruptcy proceedings– Furnace maintenance costs incentivize partial operation even below capacity

Historical Precedent Offers Lessons

The September 2023 industry-wide intervention—where top-ten manufacturers collectively slashed output by 26-30%—demonstrated photovoltaic glass production cuts” effectiveness:

2023 Outcomes Analyzed

The five-month effort reportedly achieved:

– Elimination of 30,000 tons/day obsolete capacity– Price recovery to profitable thresholds– Parallels to today’s conditions yet distinct.

Flat Glass Group”s annual report contextualized last year’s challenges: “Irrational expansion across solar industry segments generated oversupply while demand growth slowed. Structural imbalances led to brutal price wars compressing profits.” Data confirms deepened pain—2024 disclosures showed:– Xinyi Solar (信义光能): Net profits down 73.8% yearly– Flat Glass Group: Net profits down 63.5% annually

Structural Imbalances Demand Systemic Solutions

While photovoltaic glass production cuts provide temporary relief, supply-demand fundamentals remain fragile till broader policy changes:

Regulatory Self-Rescue Initiatives

Industry-led reforms include:

– Production quotas allocation– Price stabilization compacts– Accelerated capacity phaseouts

Flat Glass Group emphasized phaseouts as cornerstone: “Policy coordination became prerequisite to limit new capacity additions while accelerating redundancies.” Despite progress consolidating smaller operators:– Systemic oversupply persists at 70-80% utilization industry-wide– Slowing solar installations dampen absorption potential– Current projections place rebound beyond end-2026.

The 2027 Furnace Reset Catalyst

Analysts identified 2027 as a pivotal inflexion point:– Primary furnaces commissioned during 2021-22 expansion peak– Require mandatory 6-8 year cold-repair maintenance– Will temporarily remove ~5 months operating capacity for rebuilds

Longzhong”s Gao predicts: “This creates unprecedented supply gaps benefiting surviving leaders. Margin expansion becomes feasible once inefficient kilns permanently exit.” For strategic players retaining liquidity now, market consolidation yields long-term dividends.

Navigating Transition Toward Resiliency

Market stabilization requires photovoltaic glass production cuts bridging today”s imbalance with tomorrow”s undertakings:

– Price support mechanisms sustaining capital-intensive operations– Technology improvements reducing manufacturing costs– Global tandem-cell adoption driving demand growth

Company executives emphasize disciplined production planning alongside policy advocacy. The sector”s next twelve months remains constrained—with sustained pricing volatility predicted by BloombergNEF forecasts—yet structural corrections position survivors for profitability by early 2028.

Path Forward for Solar”s Critical Component

The photovoltaic glass industry confronts painful adjustments through coordinated supply management. Production curtailments serve as pivotal tools during this cycle with emerging advantages:

– Margin preservation during volatility– Accelerating obsolescent capacity elimination– Structuring recovery for 2027 furnace maintenance phase

Industry stakeholders must urgently prioritize:– Transparent production commitments– Technical collaboration improving yield rates– Diversifying markets internationally

The solar revolution cannot advance without reliable photovoltaic glass supply chains supporting low-cost solutions.