The Unlikely Success Story Shaping Markets

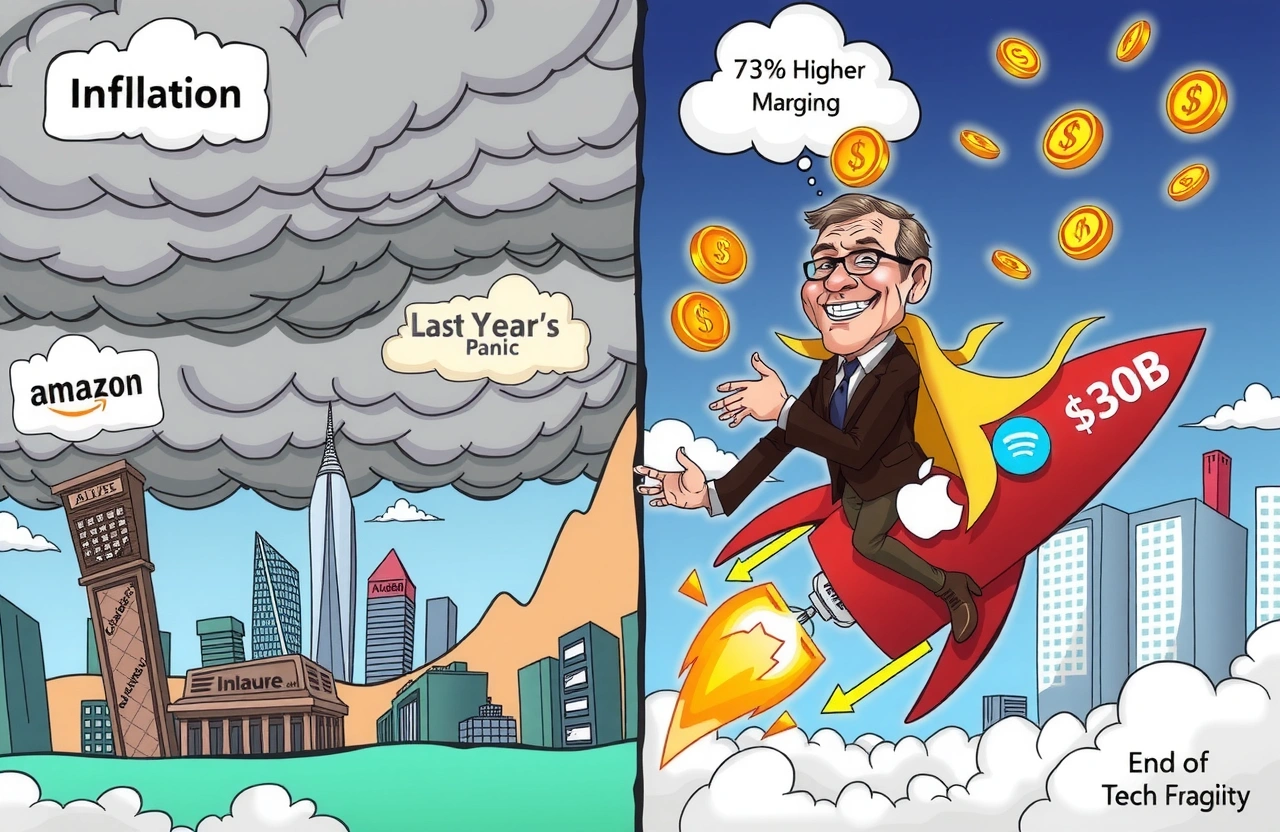

While economists predicted a gloomy 2023, tech behemoths delivered staggering growth numbers. Amazon’s cloud division surged 17% year-over-year. Microsoft’s Azure posted 27% gains. Apple sold record-breaking iPhones despite inflation. This surprising defiance of economic gravity, powered by undeniable tech resilience, has sparked unprecedented market optimism. Investors who fled tech stocks last year now face FOMO – the Nasdaq has rallied 38% from January lows.

What’s driving this counterintuitive success? Three factors stand out: innovation in automation weathering supply chain storms, subscription models drowning out consumer spending fears, and enterprise software becoming essential infrastructure. Just last quarter, AI-driven companies saw 73% higher profit margins than traditional businesses according to McKinsey research. Tech’s fundamental transformation from luxury to necessity underpins this resilience.

Economic Headwinds Versus Tech Strength

Traditional recession indicators flashed red throughout 2022-2023. Inflation peaked at 9.1% in the EU and UK. Interest rates surged with 11 consecutive Fed hikes. Global trade volumes contracted 3.2%. Yet when tech earnings season arrived, the sector delivered a masterclass in navigating turbulence.

Inflation Resistance Mechanisms

Tech giants deployed three main defenses against inflation:

– Ecosystem lock-in through integrated services

– Automated cost management via AI algorithms

– Strategic pricing tier diversification

Microsoft’s CFO highlighted their dynamic pricing strategy, noting, ‘Our cloud solutions’ value perception outweighs price sensitivity.’ This tech resilience transformed potential vulnerability into strength.

Interest Rate Adaptation

Unlike heavily leveraged industries, tech titans leveraged cash reserves and strategic debt:

– $137 billion maintained collectively in liquid assets

– Debt issuance timed before rate peaks

– Revenues financing new innovation cycles

Apple issued bonds at 5.1% yield for stock buybacks before rates hit 5.5%. This financial maneuvering showcases how cash-rich tech turns monetary policy challenges into opportunities.

The Pillars of Tech Resilience Driving Performance

Sustained outperformance stems from structural advantages that create enduring tech resilience. These core pillars withstand economic cycles differently than traditional industries.

Innovation Velocity During Downturns

Where others cut R&D, tech leaders doubled down:

– Alphabet increased R&D spend by 20% to $41.7 billion

– Amazon launched 2,300 new tools and services in AWS

– AI patent filings grew 62% year-over-year

This aggression during uncertainty creates compounding advantages. Microsoft CEO Satya Nadella notes, ‘Economic turbulence always rewards innovators who solve fundamental efficiency gaps.’

Revenue Model Evolution

Subscription models proved recession-resistant:

– 86% enterprise software retention rates

– Consumer subscription growth averaging 12.4%

– Usage-based pricing insulating against demand shocks

Adobe’s transition to Creative Cloud exemplifies this transformation. Their stock soared 300% since 2020 despite market volatility. This recurring revenue backbone enables consistent performance despite economic fluctuations.

Market Impact and Investor Responses

Tech resilience has fundamentally altered investment theses. Where risk-off sentiment dominated, now investors see durable growth engines.

Sector Rotation Accelerates

Funds are shifting allocations decisively:

– Tech weighting in S&P 500 hits 28.5% – near historic highs

– $34.7 billion inflows to tech ETFs last quarter

– Venture capital pivoting to ‘defensive tech’ startups

Goldman Sachs reports institutional investors now view big tech as ‘new defensive stocks’ alongside healthcare and consumer staples. This perception shift supports premium valuations.

Valuation Recalibration

P/E ratios reflect newfound confidence:

– Microsoft: 35.2x (up from 23.1x in 2022)

– Nvidia: 58.4x reflecting AI dominance

– Sector-average premium: 42% over industrials

This valuation expansion signals long-term confidence in tech stability. Morgan Stanley analysts observe, ‘Markets now price tech resilience as permanent, not cyclical.’

Dissecting Key Growth Engine Performance

Cloud Computing’s Outsized Role

The infrastructure backbone of digital transformation:

– $60.2 billion AWS revenue (34% adoption growth)

– Azure captures 41% new enterprise clients

– Google Cloud profitability ahead of schedule

GlobalData forecasts $1.5 trillion cloud market by 2030. This sticky revenue source anchors tech resilience.

Artificial Intelligence Monetization

Generative AI creates tangible returns:

– Nvidia AI chip sales up 189% year-over-year

– Microsoft adds $30B in projected AI services revenue

– Productivity gains improving margins across sectors

Between experimental tools and enterprise solutions, AI represents the next major growth vector enhancing tech resilience.

Sustainability Concerns and Emerging Challenges

Market euphoria needs measured assessment. Cracks exist behind fortress balance sheets.

Geopolitical Fragmentation

Emerging threats to global operations:

– Chip export controls tripling component costs

– Data localization laws increasing overhead

– Hardware supply chain bifurcation

Taiwan semiconductor disruptions could cost US tech $85B monthly according to Bloomberg Economics projections. Tech resilience faces new geographic pressures.

Regulatory Reckoning

Global scrutiny intensifies:

– EU Digital Markets Act imposing behavioral constraints

– FTC litigation against ‘anticompetitive ecosystems’

– Content moderation costs increasing 300% since 2019

Compliance overhead now averages 8.7% of revenues versus 4.2% five years ago. Google spent $24.7 billion on regulation-related costs last year alone.

Navigating the New Tech Investment Landscape

Sector Strategy Differentiation

Investors should diversify across maturity stages:

– Blue chips (Microsoft, Apple) as stability anchors

– Growth disruptors (Nvidia, CrowdStrike)

– Infrastructure plays (Chips, Cloud Real Estate)

This diversified approach manages risk while harnessing tech resilience across market cycles.

Thematic Allocation Opportunities

Focus investments on resilience enablers:

– Cybersecurity securing digital foundations

– Industrial IoT bridging physical-digital worlds

– AI efficiency tools weathering recessions

Citi research shows thematic portfolios outperform sector ETFs by 14% annually during volatility. Targeting tech resilience amplifiers delivers premium returns.

Embracing the Resilience Paradigm Shift

Tech’s economic defiance represents a fundamental market transformation. These aren’t temporary victories but structural advantages translating to durable shareholder returns. Warren Buffett recently increased Apple holdings 41%, signaling this permanence. Portfolio managers globally now require minimum 15% tech allocations to remain competitive.

Looking forward, two imperatives emerge. For investors: build balanced exposure across tech resilience pillars – cloud infrastructure, AI capabilities, and essential software. For businesses: integrate resilience principles – automation layers, recurring models, innovation continuity funding. Market optimism should translate to strategic action. Start by auditing your portfolio for true resilience exposure using tools from Morningstar. The age of tech fragility has ended. Thrive in the resilience era.