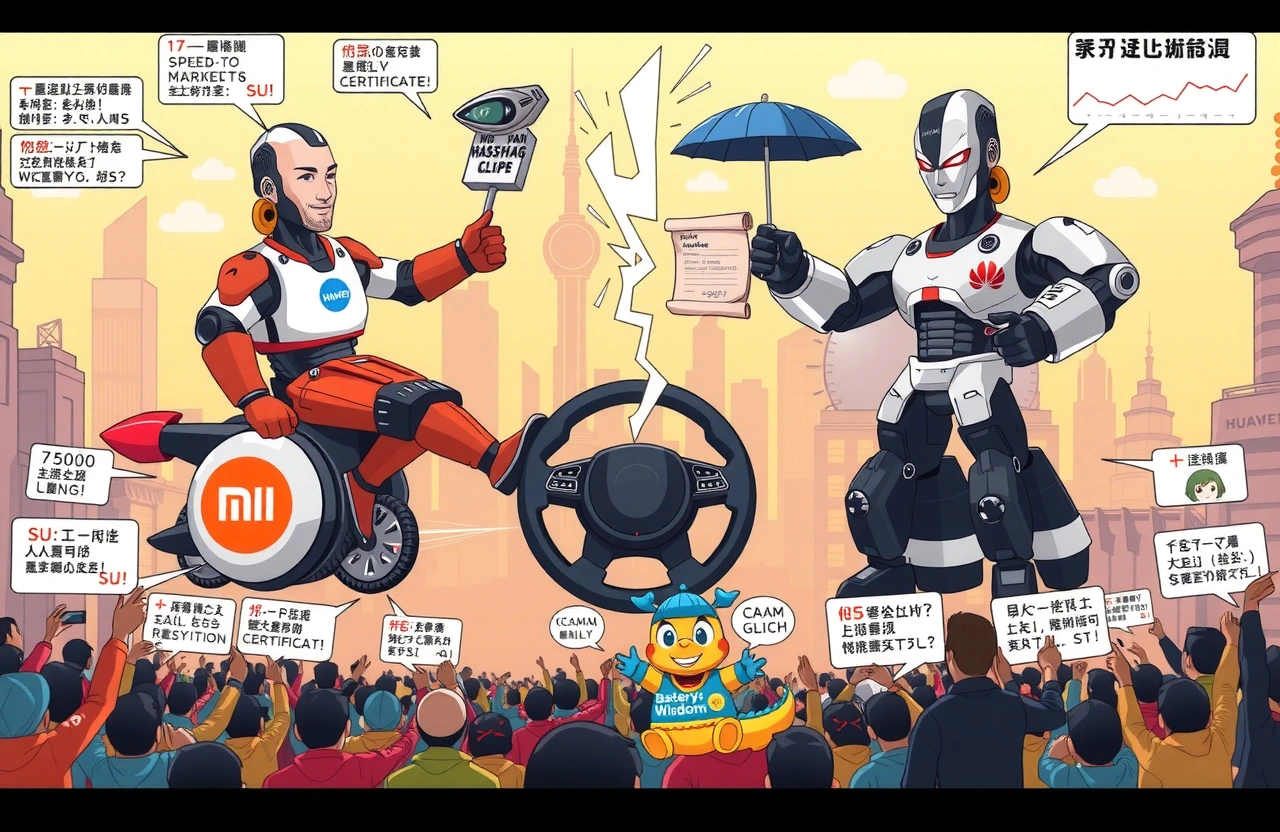

The unexpected entertainment of China’s 2025 Children’s Day came not from toys or games, but from an escalating war of words between auto industry titans. Xiaomi founder Lei Jun (雷军) and Huawei executive Yu Chengdong (余承东) traded jabs over vehicle quality claims, exemplifying how cutthroat promotional tactics overshadow deeper industry challenges. Their decade-long feud illuminates pressures facing Chinese EV makers balancing rapid growth with safety concerns amidst looming market consolidation. This public clash signals critical crossroads for an industry racing toward domination while navigating capacity gluts and regulatory scrutiny.

The Recent Flashpoint: ‘Mo Yan Style’ Rhetoric Sparks Viral Feud

Yu Chengdong’s Provocative Comments

At the May 31st Greater Bay Area Auto Forum, Huawei Consumer Business Group CEO Yu Chengdong (余承东) ignited controversy: ‘Some companies achieve explosive sales with mediocre products… Poor quality and subpar smart driving capabilities.’ Though unnamed, references matched Xiaomi SU7’s unprecedented sales figures. Yu contended superior products shouldn’t be outsold ‘even by competitors’ sales fragments’ – visibly amplifying tensions in China’s fiercely competitive auto industry landscape.

Xiaomi’s Coordinated Counterattack

Xiaomi staged swift retaliation:

– President Lu Weibing (卢伟冰) cited ’10x investment’ in engineering

– Auto VP Li Xiaoshuang echoed literary quotes

– PR head Wang Hua invoked classical poetry

Lei Jun escalated on June 1st quoting purported ‘Mo Yan wisdom’ – ‘Defamation is just backward admiration.’ This strategic literary framing (‘Mo Yan Style’) transformed a corporate spat into trending topic with millions of engagements.

A Decade-Long Rivalry: Tech Giants Collide Across Industries

The roots extend far beyond current EV battles. Their interactions form textbook case studies of corporate friction accelerated by market pressures.

Formative Smartphone Conflicts

The ‘Dot Glue Gate’ dispute of 2014 marked their first open clash after tech bloggers alleged Xiaomi mobile hardware flaws compared to Huawei’s Honor phones. Lei Jun publicly demanded Huawei contain ‘negative marketing’ – dragging Yu Chengdong directly into the fray. This established core pattern: rivalry driving rapid innovation and attention-grabbing accusations.

Escalation Into Auto Territory

In 2024 debates shifted:

– Phone mount necessity: Lei highlighted convenience; Yu dismissed as workaround for weak navigation

– Signal-blocking claims: Yu criticizing glass coating; Lei defending technical validity

Each exchange reinforced opposing philosophies: user-focused pragmatism versus technical perfectionism. Such recurring auto industry competition spats underscore China’s production capabilities where debate substitutes prolonged litigation common elsewhere.

Beneath the Bluster: Industry-Wide Growing Pains

2024 China Association of Automobile Manufacturers (CAAM) data shows systemic strains:

| Vehicle Production | 31.28 million | (+3.7% YoY) |

| EV Production | 12.89 million | (+34.4% YoY) |

Yet cavity-rushing expansion creates imbalances:

– Projected industry capacity utilization below 60% by 2026

– Quality control inconsistencies across manufacturers

Great Wall Motor chairman Wei Jianjun (魏建军) warned automotive ‘Evergrandes’ await discovery – implying debt-fueled developments mirroring the property crash.

Manufacturing Philosophies Battle: Marketing Versus Integrity

Lei Jun’s Speed-to-Market Gambit

Xiaomi deliberately accelerates traditional automotive timelines via hyperresponsive public trialing common in smartphone launches. Example: SU7 orders exceeded 75,000 units within 24 hours through Weibo-managed prelaunch hype – embodying Lei’s axiom ‘solve users’ pain points faster.’ Such velocity grabs market share but fuels rivals’ quality concerns.

Yu Chengdong’s Safety-Centric Doctrine

Yu’s critiques reflect Huawei’s engineering rigor framework prioritizing:

– Reliability thresholds exceeding consumer electronics

– Zero-defect tolerance benefiting heavy vehicle applications

‘Lives depend on automotive error margins’ he noted – contrasting industries where reboots solve glitches. His pointed remarks echo frustrations that marketing fog compromises industry safety escalation.

Regulatory Response Coming: Cooling Overheated Battlegrounds

With recent CAAM proposals addressing ‘unhealthy competition’, authorities signal intention imposing oversight frameworks against tactics heating auto industry competition angsts. Beijing explores:

– Uniform testing/validation protocols

– Advertisement transparency requirements

– Bank lending restrictions to unproven EV startups

‘Market optimization through regulatory intervention becomes necessary when promotions obscure practical standards’ states Tsinghua auto researcher Zhang Ming.

The Road Ahead: Steering Beyond Social Media Spectacles

Brand managers coveting viral moments should note: Media-hyped spats yield short-term engagements while creating lasting skepticism. When subsequent Xiaomi SU7 incidents sparked battery fire investigations and Huawei faced Harmony OS navigational glitches, consumer forums recalled hyperbolic exchanges preceding them. Sustainable industry leadership requires:

– Prioritizing verifiable performance data

– Collaborative quality standard elevation

– Transparency about production limitations

The auto industry competition should celebrate legitimate advances honing China’s EV leadership – not cloud road risks for theatrical value. As Children’s Day ended, China’s car shoppers resumed evaluating what truly matters: reliability certificates over trending hashtags. Search dealership inventories rather than social feeds when choosing tomorrow’s commute companion.