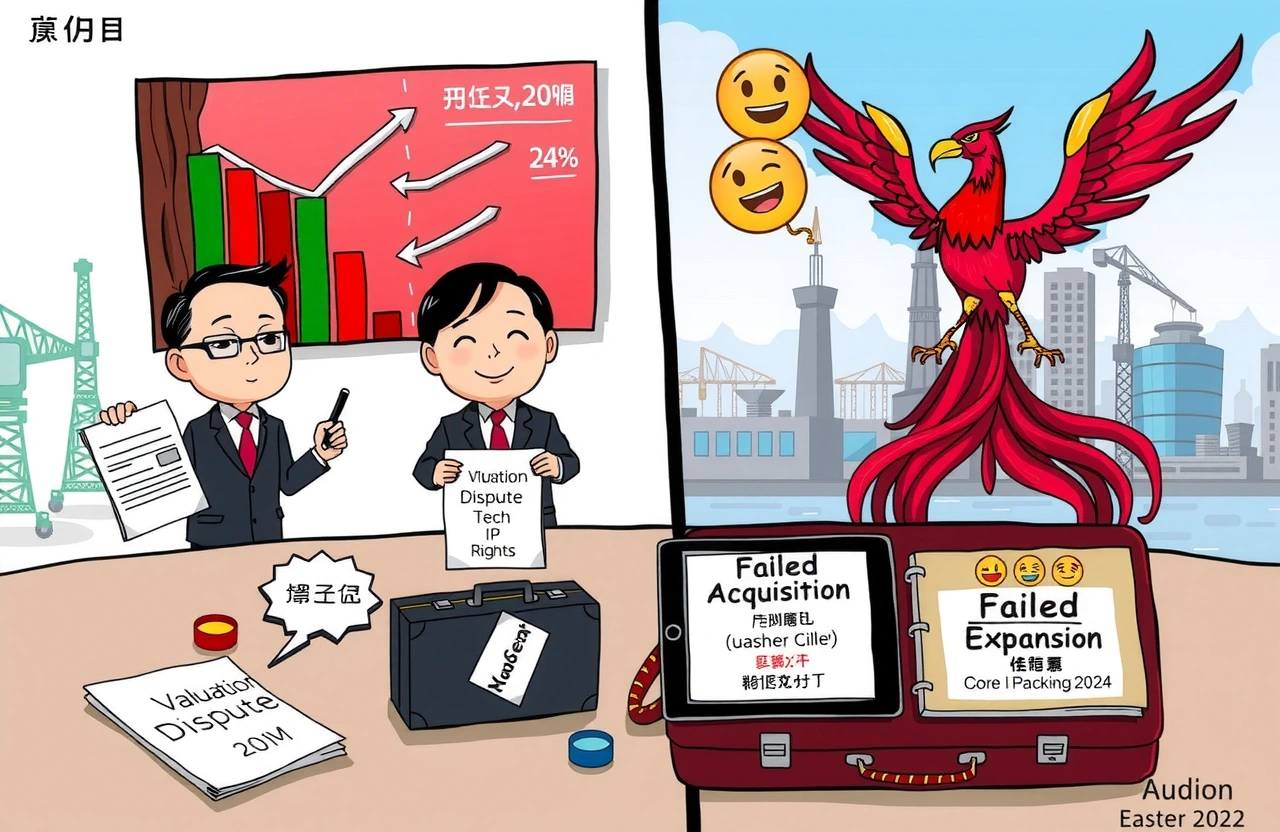

***Summary of Key Developments***

– Hongming Shares (301105) terminates acquisition of 83% stake in Shenzhen Chisu Automation after two-month negotiations

– Deal collapse attributed to irreconcilable differences in final transaction terms despite RMB 15.1 million deposit payment

– Company stock surged 20% following initial announcement but retreated 24% by termination date

– Packaging equipment manufacturer seeks full refund of deposit while maintaining original ownership structure

Major Corporate Acquisition Collapses After Protracted Talks

Hongming Shares (301105.SZ) formally announced the termination of its proposed acquisition of Shenzhen Chisu Automation Equipment following two months of intensive negotiations between the packaging machinery specialist and Shenzhen Chisu stakeholders. The termination highlights escalating corporate challenges in China’s industrial equipment sector as companies navigate post-pandemic consolidation pressures and valuation gaps.

The abandoned deal marks a significant setback for Hongming’s strategic expansion plans originally announced on May 21, 2025. Had the transaction proceeded, Hongming would have gained controlling 83% equity in Chisu Automation – a move designed to vertically integrate automated manufacturing solutions across packaging production lines.

The Failed Acquisition Timeline

The Initial Deal Framework (May 2025)

Hongming Shares announced on May 21 its intention to purchase Shenzhen Chisu Automation through cash transaction. Preliminary regulatory assessment by Hongming consultants determined the acquisition would qualify as “major asset restructuring” under CSRC guidelines. Critically, company disclosures emphasized:

– Transaction structure would maintain Hongming’s existing controlling shareholders

– Full cash consideration avoided equity dilution

– Binding exclusivity period established through initial deposit

Due Diligence Breakdown (June-July 2025)

Despite paying RMB 15.1 million ($2.1 million) acquisition deposit on June 21 into a jointly-controlled escrow account, negotiations stalled during the due diligence phase. Key friction points included:

– Valuation metrics for Chisu’s proprietary automation technology

– Post-acquisition management structure integration

– Performance guarantees for Chisu’s existing contracts

– Intellectual property ownership delineation

Financial advisors from both parties failed to bridge fundamental differences despite eight rounds of negotiation, culminating in formal termination on July 17.

Structural Reasons Behind Deal Collapse

Regulatory filings reveal core disagreements centered around three unresolved issues:

1. Final Valuation Methodology

Hongming insisted on performance-based earnout structure while Chisu shareholders demanded fixed valuation.

2. Post-Acquisition Control Rights

Disagreement emerged regarding operational independence of Chisu’s existing management team.

3. Technology Transfer Conditions

Terms governing patent portfolio consolidation proved irreconcilable during final drafting stages.

Corporate governance experts note that automation sector M&A negotiations frequently stumble on these fault lines—especially between publicly-listed acquirers and privately-held technology firms.

Market Reaction Throughout Deal Cycle

Hongming shares surged 20% to a 52-week high on May 22 following initial announcement. Retail investor interest spiked amid anticipation of automation market consolidation. Momentum proved unsustainable though as shares retreated dramatically:

– May 23 peak: ¥45.60/share

– July 17 closing: ¥37.75/share

– 24% valuation decline

The termination failed to trigger additional selloff, suggesting expectations of deal failure had been priced in. At ¥19 billion market capitalization, Hongming shares trade at 30x trailing P/E compared to industry average of 22x.

Hongming’s Core Packaging Equipment Business

Headquartered in Dongguan, Hongming manufactures specialized packaging machinery:

– Automated carton forming systems

– Intelligent packaging production lines

– Customizable finishing stations

The company derives 87% revenue from domestic packaging manufacturers with emerging export sales to Southeast Asia.

This abandoned acquisition represents Hongming’s second failed expansion beyond traditional packaging hardware following an unsuccessful VR equipment venture terminated in Q4 2024. Analysts monitor whether management will refocus capital expenditure on core operations.

What Lies Ahead for Stakeholders

The termination agreement formally requires Chisu Automation to refund Hongming’s RMB 15.1 million deposit in full. The industrial automation sector continues facing valuation pressures as:

– Automation equipment demand cools amid manufacturing production adjustments

– Sector multiples contract 18% year-over-year

– Strategic buyers become increasingly selective

For Hongming shareholders, critical questions emerge:

– Will available acquisition capital be redirected to R&D?

– Could dividend distributions increase as alternative capital deployment?

– How will management restore investor confidence?

Packaging industry consolidation continues accelerating across China despite this temporary setback. Investors should monitor CSR and sustainability-linked equipment upgrades driving long-term sector demand regardless of M&A outcomes.