– Record-breaking passenger and vehicle traffic across the Qiongzhou Strait (琼州海峡) following Hainan’s border closure, with tickets sold out days in advance.

– Surge in tourism and retail spending, particularly in duty-free shopping, driven by policy incentives from the Hainan Free Trade Port (海南自由贸易港).

– Significant infrastructure strains and scalping issues highlighting urgent capacity expansion needs for sustainable growth.

– Positive implications for Chinese equity sectors like transportation, tourism, and retail, with increased investor attention on Hainan-related stocks.

– Government measures, including extended ticket预售期 and emergency运力, but long-term planning is crucial for capitalizing on economic opportunities.

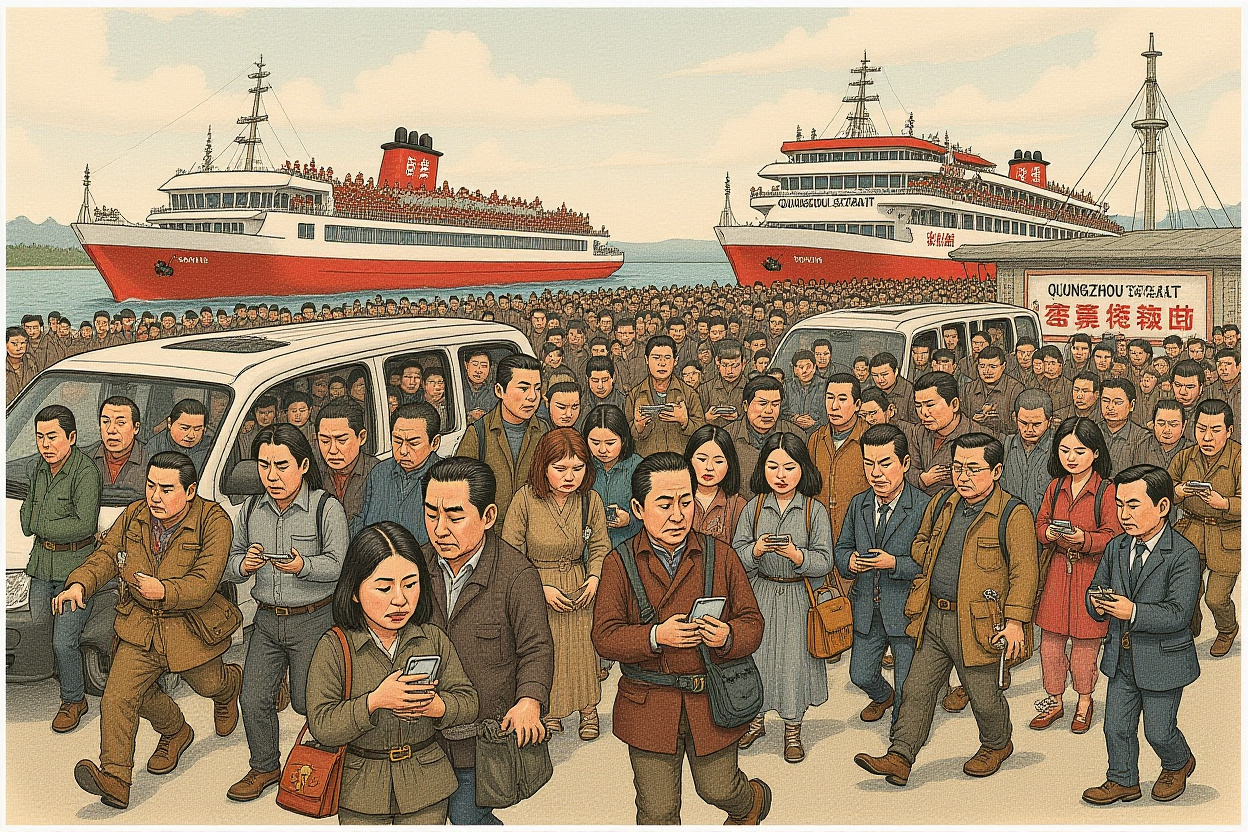

The scene at Xuwen Port in Guangdong province was nothing short of chaotic during the 2026 Spring Festival travel rush. For Mr. Li, a migrant worker who had driven home to Hainan for years, this season brought an unexpected hurdle: all vehicle tickets for crossing the Qiongzhou Strait (琼州海峡) were sold out, forcing his family to abandon their car and navigate a makeshift path to catch a passenger ferry. This personal story encapsulates the broader frenzy unleashed by Hainan’s historic border closure, a move that has reshaped travel patterns and economic dynamics across the region. As the first major migration period since the island implemented its封关运作 (border closure operation), the sold-out tickets signal not just logistical challenges but also profound shifts in consumer behavior and investment landscapes. The Hainan border closure has catalyzed a travel surge that is testing infrastructure limits while opening new avenues for growth in Chinese equities tied to tourism and retail.

H2: The Unprecedented Travel Surge Post-Hainan Border Closure

The Hainan border closure, officially launched on December 18, 2025, as part of the Hainan Free Trade Port (海南自由贸易港) initiative, has transformed the island into a magnet for travelers seeking policy benefits like duty-free shopping. This has directly fueled a spike in Spring Festival travel, with the Qiongzhou Strait (琼州海峡) serving as a critical choke point. Data from the Hainan Release (海南发布) official WeChat account reveals that in the first nine days of the春运 (Spring Festival travel rush) from February 2 to February 10, 2026, comprehensive transport客流 in Hainan reached 4.8639 million人次, a 6.34% year-on-year increase. Specifically, the strait handled 1.012 million passengers and 257,900 vehicles, including 42,000 new energy vehicles—up 14.0%, 8.2%, and 74% respectively from 2025. These numbers underscore how the Hainan border closure is driving record demand, with single-day records broken on February 9: 355航次 (sailings) transporting 133,200 passengers and 32,100 vehicles.

H3: Record-Breaking Passenger and Vehicle Numbers

– The Qiongzhou Strait Ferry Butler (琼州海峡轮渡管家) platform reported全部售罄 (sold out) for vehicle tickets from February 9 to 12, with extended预售期 (advance booking periods) to 15 days for entry and 30 days for exit failing to alleviate the crunch.

– By February 13, only 17 tickets remained for a single early-morning sailing, highlighting the sustained pressure.客服 (customer service) representatives cited the Hainan border closure as a key factor, attributing the influx to increased tourist interest in免税购物 (duty-free shopping) and winter getaways.

– Comparative analysis shows that this surge exceeds typical seasonal peaks, suggesting structural changes in travel behavior post-closure.

H2: Economic Implications of Hainan’s Border Closure

The travel frenzy is more than a logistical issue; it’s a economic bellwether. The Hainan border closure has unlocked significant consumer spending, particularly in retail sectors buoyed by duty-free incentives. In the first month after closure, Hainan’s air ports saw 311,000 inbound and outbound passengers, a 48.8% jump, while离岛免税购物金额 (duty-free shopping sales) hit 4.86 billion yuan, up 46.8% year-on-year. Shopping人次 reached 745,000, with 3.494 million items purchased—growth rates of 30.2% and 14.6% respectively. For instance, at the Haikou Meilan Airport Duty-Free Shop, an Omega watch priced at 81,300 yuan domestically sold for 67,900 yuan, offering savings of 13,400 yuan. Similarly, an Apple 1TB 17Air phone retailed at 9,940 yuan versus 11,999 yuan mainland, though stock shortages emerged due to high demand. This spending spree translates to direct benefits for listed companies in the retail and tourism sectors, such as China Tourism Group Duty Free Corporation (中国旅游集团中免股份有限公司) and Hainan Airlines (海南航空控股股份有限公司), whose stock performances may reflect these tailwinds.

H3: Boost to Tourism and Retail Sectors

– Consumer anecdotes, like that of Mr. Chen from Inner Mongolia, who traveled to Hainan for winter and免税购物, illustrate the draw of post-closure perks. He reported savings of over 10,000 yuan on 100,000 yuan in purchases.

– Financial analysts note that the Hainan border closure could elevate Hainan’s GDP contribution, with tourism-related revenues potentially boosting local equities. The island’s role as a consumption hub aligns with broader national goals of stimulating domestic demand.

– Data from the Ministry of Commerce (商务部) indicates that duty-free policies are a key driver, with Hainan aiming to capture a larger share of China’s luxury goods market, estimated at over 100 billion yuan annually.

H2: Infrastructure and Logistics Challenges

Despite the economic upside, the sold-out tickets expose critical infrastructure gaps. The Qiongzhou Strait (琼州海峡), a vital link between Hainan and mainland China, is operating at capacity, with reports of vehicle queues stretching over ten kilometers. The Qiongzhou Strait Ferry Butler (琼州海峡轮渡管家) has implemented应急疏运预案 (emergency transport plans), adding sailings, but demand continues to outstrip supply. This congestion has spawned a black market for tickets, with scalpers or黄牛 (huangniu) charging up to 800 yuan per ticket on platforms like Xiaohongshu (小红书) and Xianyu (闲鱼), pushing total costs to nearly 1,200 yuan including the base fare. Some travelers have fallen victim to scams, paying for non-existent tickets. The Hainan border closure has thus highlighted vulnerabilities in transportation networks that could hinder long-term economic gains if unaddressed.

H3: Capacity Constraints at Qiongzhou Strait

– Current运力 (transport capacity) includes a fleet of roll-on/roll-off vessels, but daily sailings have peaked at 355, with plans for dynamic optimization by the Hainan Provincial Department of Transport (海南省交通运输厅).

– The surge in new energy vehicles, up 74%, adds complexity due to safety regulations for battery-powered transport on ferries, requiring specialized handling and potentially limiting slots.

– Expert insights suggest that without significant investment in port facilities and alternative routes, such as undersea tunnels or bridges, the Hainan border closure could face backlash from frustrated travelers and investors.

H2: Policy Responses and Future Outlook

Authorities are actively responding to the crisis. The Hainan Provincial Government has extended ticket预售期 and introduced往返套票 (round-trip packages) to better manage flow. In the longer term, the Hainan border closure is part of a strategic vision to transform the island into a global free trade hub, with plans for enhanced connectivity under the Overall Plan for the Hainan Free Trade Port (海南自由贸易港建设总体方案). This includes potential infrastructure projects like the Qiongzhou Strait Cross-Sea Channel (琼州海峡跨海通道), which could alleviate pressure but require substantial capital expenditure. For investors, monitoring policy announcements from bodies like the National Development and Reform Commission (国家发展和改革委员会) is crucial, as they may signal opportunities in construction and logistics stocks.

H3: Government Measures to Alleviate Congestion

– Immediate actions include加班加开航班 (adding extra flights) and digital monitoring via platforms like琼州海峡轮渡管家 to track预约 (reservations) and候补 (waitlists).

– The Hainan border closure has prompted discussions on integrating smart transport systems, such as AI-based调度 (dispatching), to improve efficiency during peak periods like Spring Festival.

– Forward-looking statements from officials emphasize balancing tourism growth with sustainability, ensuring that the Hainan border closure does not degrade visitor experiences or economic stability.

H2: Investment Insights for Chinese Equities

For institutional investors and fund managers, the Hainan border closure presents a nuanced play. Sectors directly impacted include transportation—companies like COSCO Shipping (中远海运控股股份有限公司) and Hainan Strait Shipping (海南海峡航运股份有限公司) may see revenue boosts from increased ferry traffic. Tourism and retail stocks, such as those in the duty-free and hospitality industries, are poised for gains given the spending surge. However, risks abound: infrastructure bottlenecks could cap growth, while scalping issues may erode consumer confidence. The Hainan border closure should be viewed as a catalyst for re-evaluating portfolios, with a focus on companies leveraging Hainan’s policy dividends. Data from the Shanghai Stock Exchange (上海证券交易所) shows increased trading volumes in Hainan-related概念股 (concept stocks) since the closure, indicating market anticipation.

H3: Sectors to Watch: Transportation, Tourism, Retail

– Transportation: Firms involved in ferry operations, port management, and logistics may benefit from capacity expansion drives. For example, Hainan Airlines (海南航空控股股份有限公司) has seen higher ticket prices, with business class fares reaching 5,180 yuan on sold-out flights.

– Tourism and Retail: Duty-free operators like China Duty Free Group (中国免税品集团) are key beneficiaries, with sales growth metrics directly tied to passenger influx post-Hainan border closure.

– Investment strategies should consider both short-term volatility during travel rushes and long-term structural shifts, as the Hainan border closure aligns with China’s dual circulation strategy promoting domestic consumption.

The sold-out tickets at the Qiongzhou Strait (琼州海峡) are more than a travel snag; they are a testament to the transformative power of the Hainan border closure. This event has catalyzed record economic activity, from duty-free sales to tourism inflows, while exposing critical infrastructure needs that must be addressed for sustainable growth. For the financial community, the implications are clear: Hainan’s evolution into a free trade port is accelerating, creating opportunities in equities tied to transport, retail, and tourism. Yet, investors must remain vigilant about capacity constraints and regulatory responses that could shape market outcomes. As Hainan refines its policies post-closure, those who monitor these dynamics closely will be best positioned to capitalize on the island’s ascent. Consider deepening your research into Hainan-focused ETFs or engaging with analysts covering the Guangdong-Hainan economic corridor to stay ahead of these trends.