The Regulatory Penalty: Breaking Down the Fine

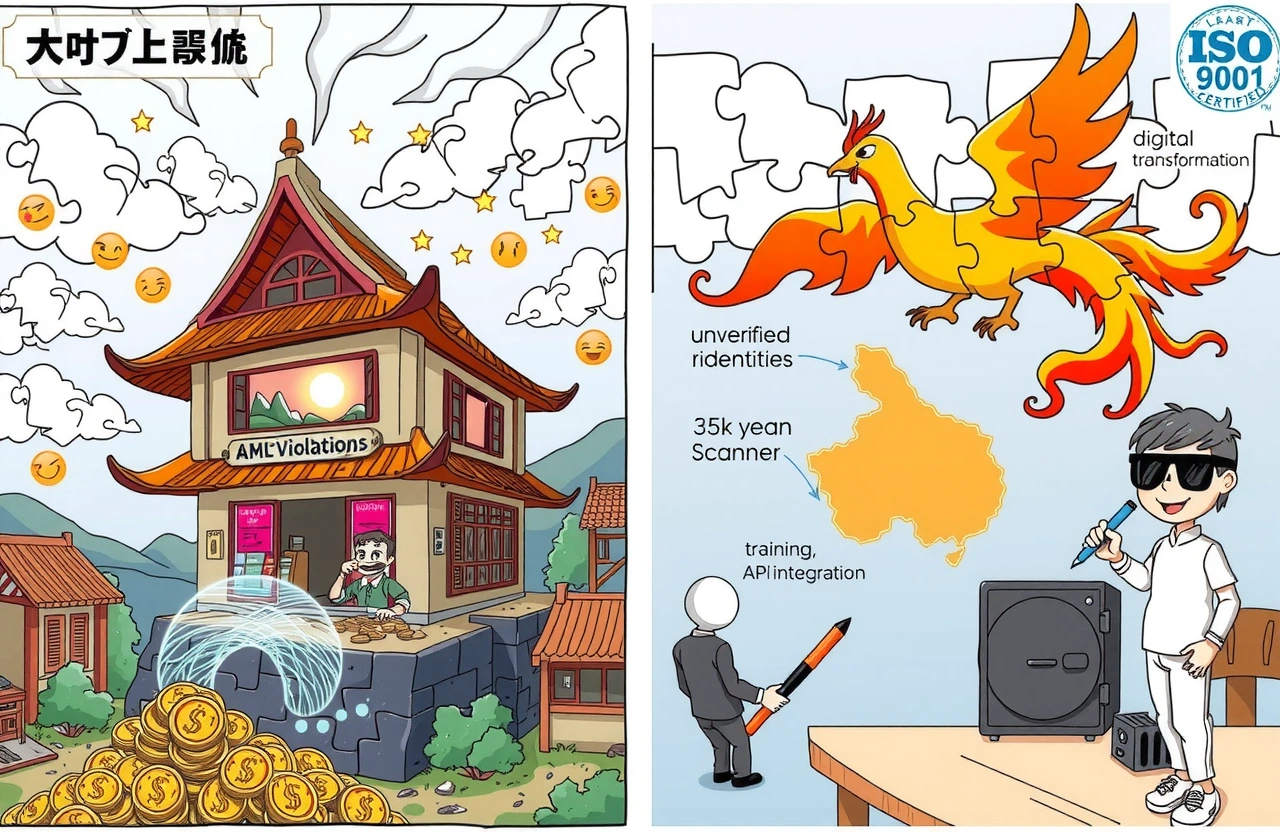

On July 8, 2025, China’s central bank levied a 960,000 yuan ($132,000) penalty against Chongqing Yubei Ginza Village Bank for violating anti-money laundering (AML) regulations. According to official notices from the People’s Bank of China Chongqing Branch, inspectors identified two critical failures during compliance audits:

Identified Violations

– Failure to properly verify customer identities during account openings

– Engaging in transactions with unidentified parties across multiple transfers

Individual Accountability

The monetary sanction extended beyond institutional liability to individual responsibility. Fan Mouxing, former General Manager of the bank’s Operation Management Department, received a personal fine of 35,000 yuan ($4,800) for supervisory failures. Regulatory documents explicitly cited his department’s inadequate oversight of front-line compliance procedures.

Understanding Anti-Money Laundering Regulations

China’s AML framework rests on Article 9 of the Financial Institutions Anti-Money Laundering Regulations, mandating rigorous customer due diligence. Village banks face disproportionate compliance challenges due to:

Structural Vulnerabilities

– Limited compliance staffing versus national banks

– Higher proportion of cash-intensive small business clients

– Resource constraints inhibiting technology investments

According to the International Monetary Fund’s 2024 assessment, China ranks among the top 5 jurisdictions for AML enforcement intensity globally. Regulatory penalties increased 27% year-over-year through Q2 2025.

Patterns in Recent AML Enforcement

The Chengdu branch penalty follows emerging patterns in Chinese banking oversight:

Geographic Focus

– 58% of 2025 AML penalties targeted western region institutions

– Municipal banks represent 76% of non-major bank sanctions

Common Weaknesses

– Inadequate transaction monitoring systems

– Backdated customer identification documentation

– Poorly trained front-line staff

Implementation Roadmap for Smaller Institutions

Village banks can strengthen AML compliance through prioritized upgrades:

Customer Verification Protocols

1. Implement biometric authentication

2. Integrate national ID verification APIs

3. Require secondary manager approval

Transaction Monitoring

– Threshold-based alerts for cash transactions exceeding $5,000

– Pattern detection for structured deposits

– Third-party auditing quarterly

Training Requirements

Regulators now mandate:

– Quarterly AML certification for client-facing staff

– Executive liability attestations

– Mystery shopper testing programs

Sector-Wide Implications

This enforcement action signals broader priorities:

Digital Transformation Pressure

Small banks increasingly partner with fintech providers like Tencent AML Cloud Solutions adopting AI-powered monitoring. The PBOC incentivizes tech adoption through:

– Reduced examination frequency for institutions with certified systems

– Fast-track approval for compliance-focused capital raises

Cross-Border Coordination

China’s participation in FATF mutual evaluations requires consistency in sanctions regardless of institution size. The Chengdu case demonstrates alignment with:

– Singapore’s pay-for-compliance fintech grants

– Hong Kong’s risk-based supervision framework

Strategic Compliance Integration

Forward-looking institutions embed AML considerations into product development lifecycles:

Technology Integration Framework

Implement tiered solutions based on transaction volume:

– Tier 1 (under $500M assets): Cloud-based platforms

– Tier 2 ($500M-$2B assets): Hybrid AI models

– Tier 3 (over $2B assets): Customized machine learning

The Monetary Authority of Singapore offers successful implementation benchmarks through its Digital Acceleration Grant Program.

Navigating New Regulatory Realities

Proactive adaptation separates high-compliance institutions from penalized peers. Begin today with these actions:

1. Conduct AML gap analysis against international standards

2. Budget 45% of 2026 IT spending for compliance upgrades

3. Initiate quarterly board-level risk reviews

The Chengdu Village Bank penalty serves as a crucial reminder that compliance infrastructure directly impacts institutional resilience and client trust.