The Regulatory Turnaround Story

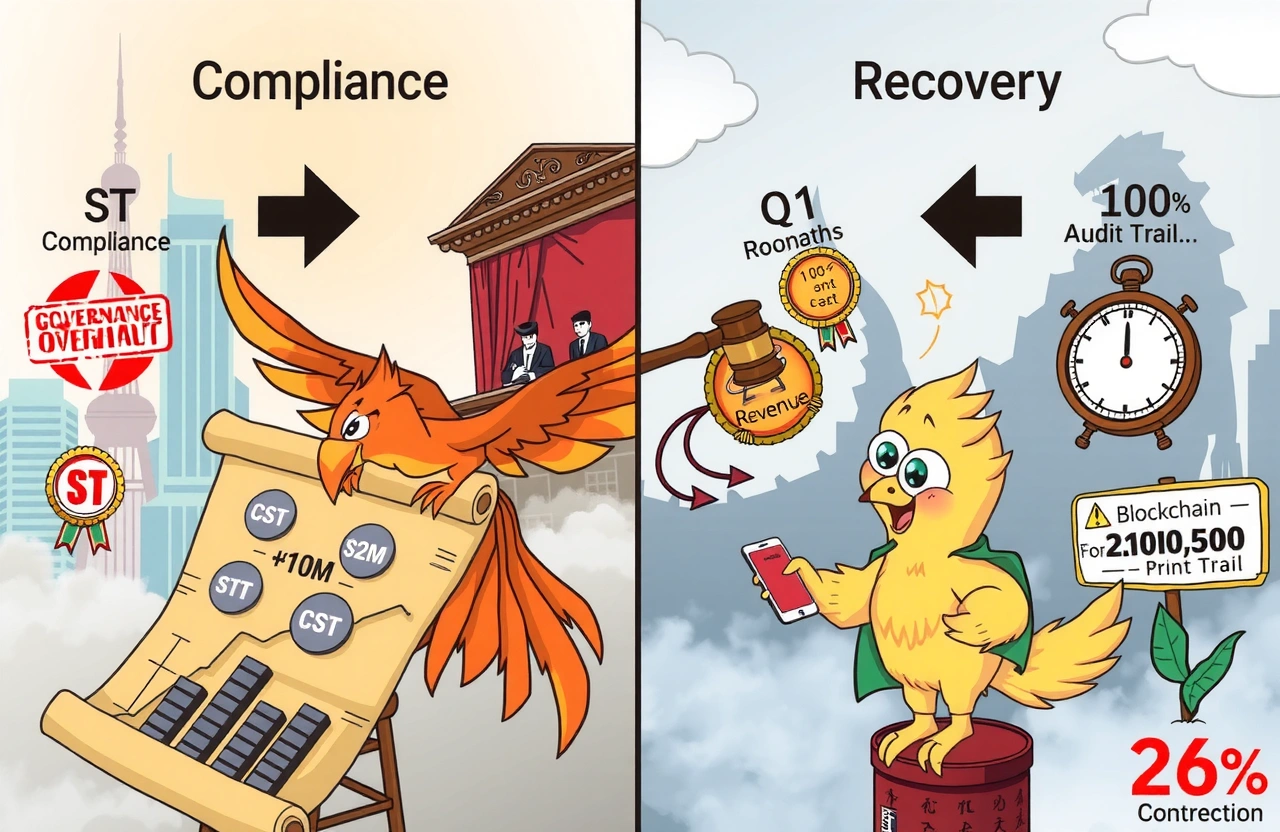

Shenzhen Special Optoelectronics Information Co., Ltd. (stock code: 000070) achieved a significant milestone on July 9, 2025, officially removing its ST (Special Treatment) designation after over a year under regulatory scrutiny. This delisting marks a corporate resurrection for the fiber-optic communication pioneer, whose shares surged 6% on reopening while triggering renewed investor debates about China’s risk-warning mechanisms. The company’s journey from disgrace to compliance presents a textbook case on navigating China’s capital market penalties.

The turnaround culminated when Phoenix Optoelectronics announced:

- Trading suspension on July 8 ahead of delisting

- Stock ticker reverting from ‘ST Phoenix’ to original designation

- Daily price fluctuation limit restored to 10% from 5%

- $1.4 million provisioned for investor compensation claims

Anatomy of a Fraud Scandal

Subsidiary Deception Uncovered

The descent began when regulators discovered systemic fraud at subsidiary Shenzhen TEDA Dongzhi Technology spanning 2015-2019. Investigation findings revealed:

- Fictitious transactions inflating revenues

- Cross-period cost manipulation distorting profits

- Financial restatements showing $35.7M in fictitious profits

Regulatory Repercussions

On May 10, 2024, the China Securities Regulatory Commission (CSRC) issued penalties including market bans for executives. The Shenzhen Stock Exchange applied ST status effective May 14, 2024 – triggering 9 consecutive limit-down trading sessions that vaporized 45% of market capitalization within two weeks.

The Rehabilitation Pathway

Corrective Measures Implemented

To satisfy delisting conditions, management executed:

- Comprehensive financial restatements for 2015-2019

- Ernst & Young audit certification of corrections

- Corporate governance overhaul

Investor Reconciliation Strategy

Proactive liability management included establishing a ¥10.07 million ($1.4M) compensation fund – a necessary step demonstrating responsibility acknowledgment per China Securities Regulatory Commission regulations.

Market Response Analysis

Despite negative net profits persisting into Q1 2025 (-$211,000), investor confidence staged a remarkable recovery. Technical analysis shows:

| Period | Share Price | Change |

|---|---|---|

| ST Designation Date (May 14, 2024) | ¥4.21 ($0.58) | – |

| 1-Year Low (June 2024) | ¥3.88 ($0.54) | -7.8% |

| Delisting Date (July 7, 2025) | ¥8.03 ($1.11) | +90.7% |

Ongoing Business Challenges

Financial Performance Pressures

Delisting clears regulatory obstacles but doesn’t resolve operational weaknesses evident in:

- 2024 revenue decline to $6.1B (-10.69% YoY)

- $558M net loss in 2024

- 26% Q1 2025 revenue contraction

Strategic Business Realignment

Leadership pins recovery hopes on four restructuring pillars: cable manufacturing, smart services, technology integration, and property leasing – though analysts question near-term monetization timelines.

Regulatory Framework Implications

This case illuminates critical aspects of China’s ST delisting mechanics. The dual compliance requirements demand:

- Historical financial restatement completion

- Minimum 12-month penalty period fulfillment

Shenzhen Stock Exchange data reveals only 38% of ST companies achieve delisting within 24 months, making Phoenix Optoelectronics an outlier success. This reflects heightened regulatory oversight following 2023 reforms to China’s capital market supervision framework.

Broader Market Lessons

Phoenix Optoelectronics offers actionable insights for stakeholders navigating China’s special treatment landscape:

- Institutional investors: Post-delisting volatility often creates tactical entry points within 60-day window

- Corporate governance: Material subsidiary oversight requires blockchain-grade audit trails

- Regulatory trend: CSRC increasingly links penalty removal to compensation mechanisms

The path forward requires sustained operational discipline. With ST designation lifted, Phoenix Optoelectronics now faces its toughest challenge: transforming compliance achievement into commercial viability during China’s fiber-optic infrastructure transition period. Market watchers should monitor quarterly cashflow patterns and government contract awards as leading performance indicators.

For Chinese enterprises facing regulatory actions, this case underscores that reputation rehabilitation begins with substantive governance reform – not just symbolic compliance. Stakeholders navigating similar challenges should consult CSRC circulars on continuous disclosure obligations and engage forensic accounting specialists during remediation planning stages.