The Fundamental Cost Disparity for Chinese Investors

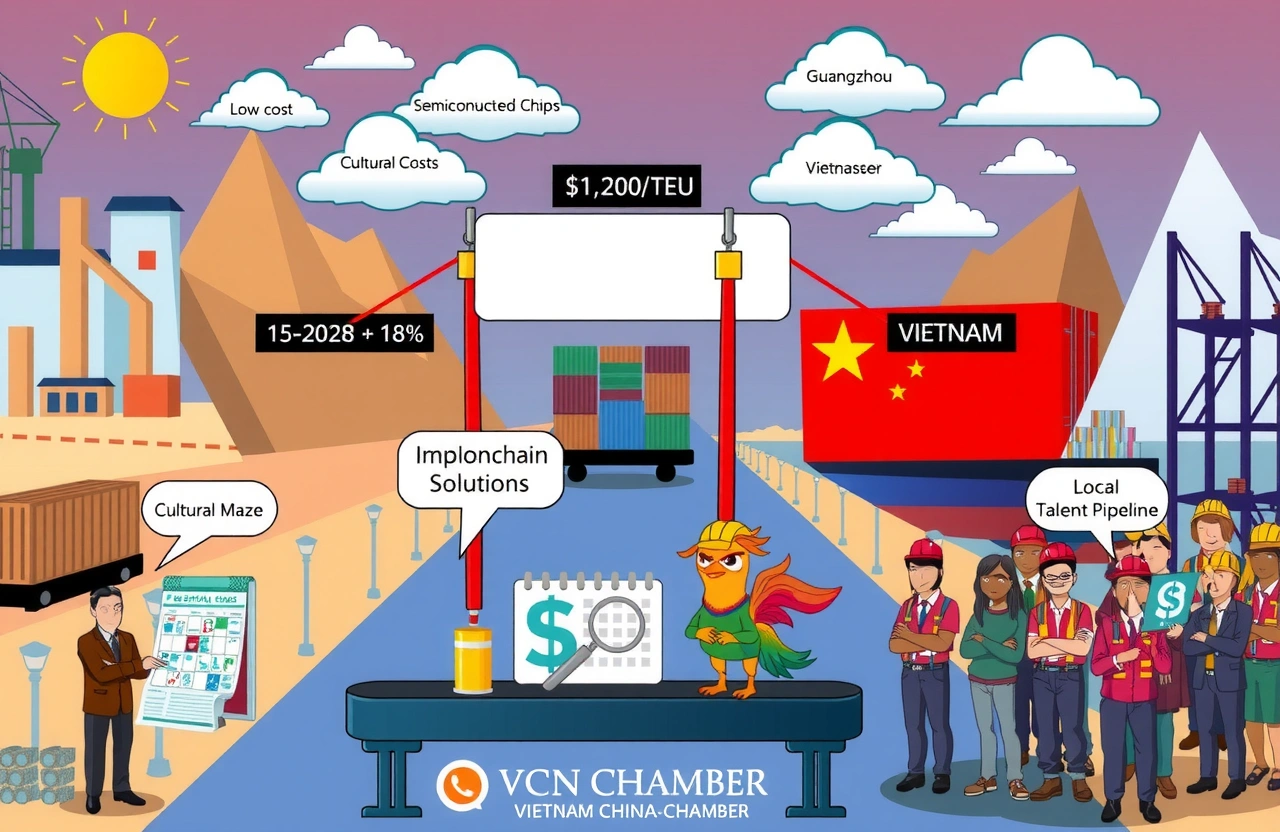

At the recent 2025 China Enterprise Overseas Summit Forum in Shenzhen, Vietnam China Chamber of Commerce and Industry Deputy Chairman Miao Renlai (缪仁赖) delivered a sobering assessment: Chinese enterprises investing in Vietnam face costs 15-20% higher than in China. This revelation came during pivotal discussions about global supply chain restructuring. Contrary to popular perception of Vietnam as a low-cost alternative, companies confront significant financial hurdles when relocating operations.

The Core Cost Drivers

Multiple structural factors contribute to this cost premium:

– Supply chain immaturity requiring imported materials

– Acquiring skilled technicians at premium wages

– Underdeveloped logistics increasing freight expenses

A manufacturing case study reveals air freight costs from Ho Chi Minh City 40% above comparable routes from Guangzhou, undermining expected savings.

Operational Realities Behind the 15-20% Gap

Chinese enterprises investing in Vietnam face costs 15-20% higher than in China primarily due to transitional expenses bridging infrastructural gaps. According to Miao Renlai’s decade of field observations, these expenses manifest differently across sectors:

Electronics Industry Breakdown

Component sourcing constraints elevate raw material spending:

– PCB boards: 18% procurement premium

– Semiconductor chips: 22% import markup

– Plastic injection molds: 12% transport surcharge

Vietnam’s nascent supply chain remains heavily dependent on Chinese imports – Vietnam China Chamber of Commerce data confirms 65% of industrial inputs originate across the border.

The Hidden Expense of Cultural Adaptation

Beyond tangible costs lie substantial operational friction points. Miao Renlai emphasized: “Cultural adaptation forms an invisible cost tier averaging 8% of project budgets.” Management teams require months to comprehend Vietnamese work patterns and belief systems.

Three Cultural Adjustment Pain Points

– Religious calendar observance decreasing productivity 5-7 days annually

– Hierarchical communication styles slowing decision cycles

– Diet/exercise accommodations increasing facility costs

A Guangdong textile firm reported requiring six management rotations before stabilizing Vietnamese operations.

Persistent Infrastructure Challenges

Logistics networks remain primary contributors to why Chinese enterprises investing in Vietnam face costs 15-20% higher than in China. Forty percent of manufacturers cite port congestion extending delivery windows:

Logistics Comparison

| Cost Factor | Vietnam | China |

|---|---|---|

| Sea Freight (per TEU) | $1,200 | $850 |

| Port Handling Fees | 18% higher | Base rate |

| Customs Clearance Time | 7 days avg. | 2 days avg. |

Double-handling at overburdened terminals adds $35/metric ton – impactful for bulk commodity shippers.

Strategies for Cost Containment

Forward-thinking firms mitigate the reality that Chinese enterprises investing in Vietnam face costs 15-20% higher than in China through three strategic approaches:

– Partnering with local universities to develop technical talent pipelines

– Co-investing in industrial parks to share infrastructure expenses

– Implementing blockchain documentation accelerating customs processes

Successful adaptation ultimately requires patience – most break-even timelines extend beyond initial projections.

Navigating Vietnam’s Evolving Regulatory Landscape

The Vietnam China Chamber of Commerce advocates proactive engagement with regulatory shifts. Tax incentives introduced through Decree 218 spark cautious optimism but require careful navigation:

Five Compliance Considerations

– Environmental protection bonds for heavy industries

– Periodic retraining obligations under new labor codes

– Local sourcing quotas exceeding 25% by Year 3

– Provincial licensing variations creating jurisdictional complexity

– Intellectual property protections requiring onsite registration

Companies aligning early with sustainability mandates report smoother permitting processes.

Positioning for Long-Term Success

Despite the reality that Chinese enterprises investing in Vietnam face costs 15-20% higher than in China, Vietnam offers unique advantages. Rising middle-class consumption offsets tariffs redirected from Western markets. Savvy investors focus on tier-2 provinces like Binh Duong and Hai Phong where infrastructure investment concentrates.

Businesses should develop phased roadmaps addressing immediate cost challenges while leveraging Vietnam’s strategic trade position. Industry associations facilitate crucial knowledge exchange – we encourage enterprises to join Vietnam China Chamber networks for latest compliance updates. Comprehensive market analysis remains essential before any relocation decision.