Regulatory Action Against Minsheng Bank Shenyang

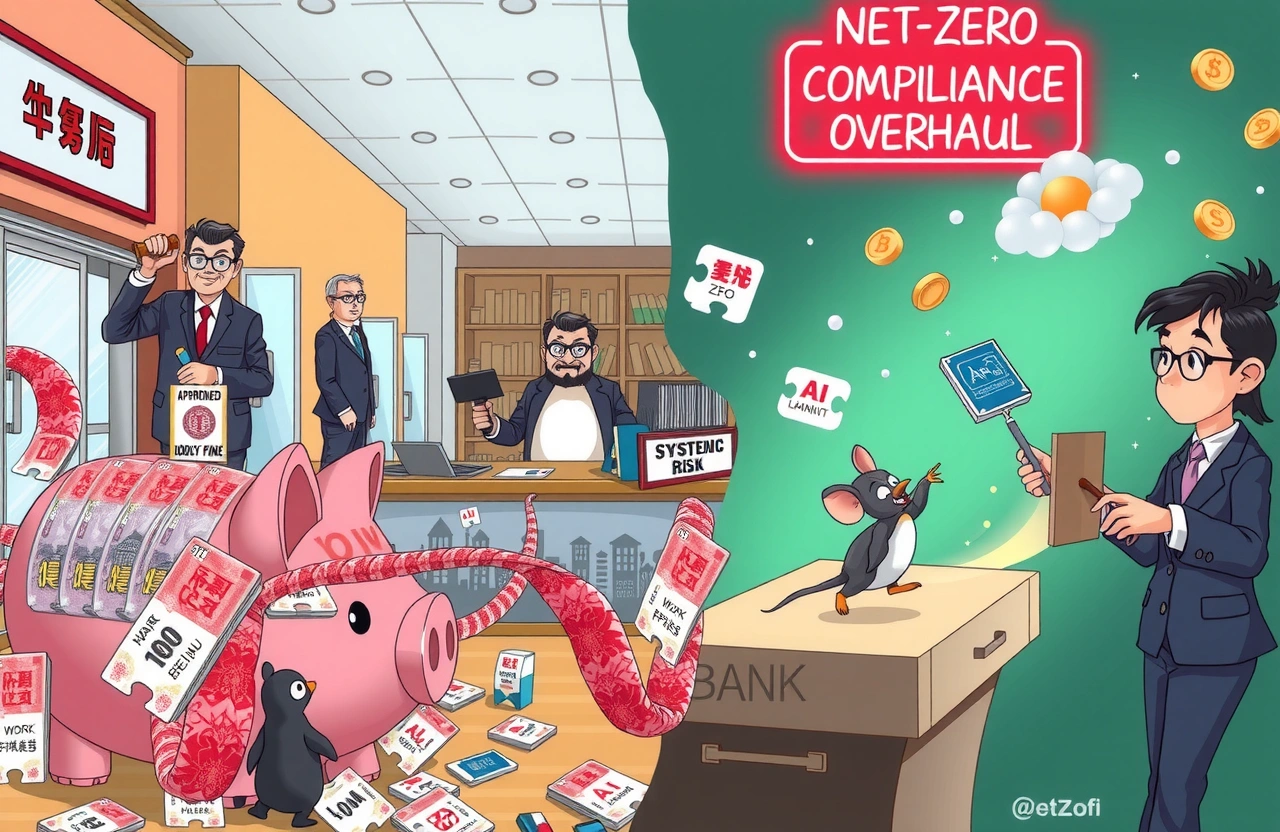

China’s National Financial Regulatory Administration has fined China Minsheng Bank Shenyang Branch 600,000 yuan for two critical lending violations. The penalty underscores regulators’ intensified scrutiny over credit risk management amid concerns about systemic vulnerabilities in China’s banking industry. According to the July 18 announcement, investigators discovered improper handling of commercial loans allowing borrowers to circumvent regulations – a pattern seen increasingly nationwide during post-pandemic economic stress.

Key revelations:

– 600,000 yuan penalty issued through formal administrative order

– Violation of credit fund circulation protocols enabling borrowers improper access

– Approval of loans exceeding documented operational capital requirements

– Personal accountability imposed on former business department executive Chen Xiaolu (陈晓璐)

Deconstructing the Violations

Loan Fund Recycling Mechanisms

Bank inspectors discovered loan proceeds illegally cycled back to borrowers—a practice violating Article 27 of China’s Commercial Bank Law. This funneling typically involves shell companies or fabricated trade documents creating circular transactions. Monetization withdrawals exceeded approved purposes despite regulatory requirements maintaining borrower-lender segregation.

Examples observed:

1. Short-term bridge loans deposited directly into borrowers’ personal accounts

2. Equipment financing diverted to refinance undisclosed existing debts

Systemic Impacts

Such fund recycling elevates systemic risk by obscuring borrowers’ actual leverage ratios. Banking crises frequently begin when authorities cannot assess true debt exposure—exactly what triggered China Evergrande’s collapse. Regulators prioritize loan regulation compliance precisely to counteract these blind spots.

Inadequate Working Capital Analysis

The second violation involved approving loans surpassing demonstrable operational needs. Section 35 of China Banking Regulation Law mandates proportional lending to genuine production requirements. Loan approval assessments neglected rigorous working-capital-gap analysis, permitting overleveraged borrowing without collateral tail coverage.

Individual Accountability in Banking Oversight

Chen Xiaolu—then Assistant General Manager of Minsheng’s Shenyang Business Department—received an official warning sanction. This individual penalization signals regulators’ shift toward personal accountability frameworks mirroring Hong Kong Monetary Authority actions after recent banking scandals. Her approval signature authorized loans exceeding verifiable operational needs without adequate compensating controls.

Regulatory precedents established:

– Direct liability for senior executives approving non-compliant transactions

– Mandatory ethics training orders alongside financial sanctions

– Public disclosure of disciplinary actions through Financial Regulatory Administration bulletins

The Evolving Regulatory Landscape

China’s 2023 Banking Risk Management Guidelines emphasize loan regulation compliance through:

– Real-time fund-flow monitoring via blockchain

– Debt-service coverage ratio benchmarking

– Unified enterprise credit registry examination

Regional regulators now deploy artificial intelligence tools tracing suspicious transaction chains across institutions—detecting hidden vulnerabilities before triggering cascading defaults. Failure adapting invites escalating sanctions: Industrial Bank’s Fujian branch suffered 1.3 million yuan penalties last March for similar violations during system audits.

Sector-Wide Implications

Parallel enforcement actions against Ping An Bank and China Merchants Bank indicate regulatory consistency penalizing normalization proceedings bypassing. Rating agency Fitch estimates loan review times have slowed 18% nationwide as banks implement mandatory cooling-off periods between application approvals.

Experts note:

“Mid-tier banks face greatest adaptation pressure avoiding penalization” – Wu Bin, Shanghai Banking Association

“Investor confidence increases with demonstrable compliance maturity” – Goldman Sachs Asia Banking Analysis Report

Strengthening Institutional Loan Regulation Compliance

Technical Controls

Leading institutions implement account-segregation protocols blocking funds transfers beyond approved recipients. Flagging systems trigger transaction suspensions if recipient banks mismatch declared purposes. This technological enforcement achieves what policy directives often struggle accomplishing manually.

Process Enhancements

Regulators recommend:

– Triple signatory requirements for loans exceeding 100 million yuan

– Third-party collateral valuation verification

– Independent credit committee oversight bypassing originating branches

Bank of Communications’ Northeast Division reports 92% violation reduction after adopting these frameworks during pilot programs.

The Call for Banking Integrity

While economic growth pressures tempt credit relaxation, unsustainable shortcuts inevitably trigger disproportionate consequences. China’s banking leadership must institutionalize loan regulation compliance—advancing beyond reactive penalties toward proactive monitoring. Financial institutions demonstrating compliance maturity attract investor premiums averaging 27% valuations growth alongside systemic risk reduction. Internal auditors should immediately test fund-flow monitoring against these Shenyang violations standards.