Understanding China’s Landmark Intellectual Property Regulation Shift

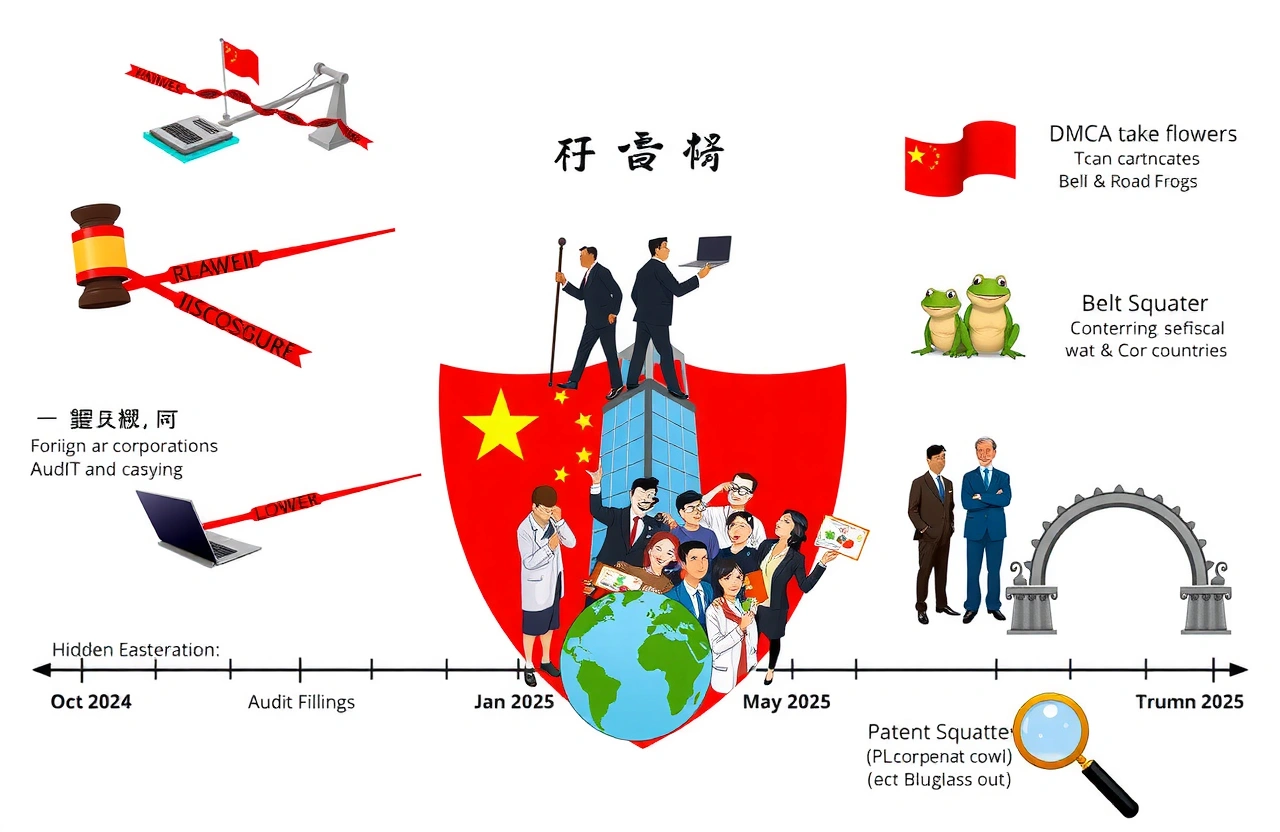

On May 1, 2025, China will activate its most significant intellectual property protection mechanism to date—the Regulations on Handling Foreign-Related Intellectual Property Disputes (国令第801号). This watershed legislation marks China’s evolution from passive IP enforcer to active regulator of global intellectual property conduct. At the 2025 China Enterprise Globalization Forum in Shenzhen, legal pioneer Zhang Huawei (张华薇) spotlighted how these regulations empower Chinese authorities to precisely target foreign entities exploiting intellectual property rights.

These comprehensive measures emerge amid China’s transition toward innovation-driven growth. With intellectual property constituting over 15% of China’s GDP according to World Intellectual Property Organization metrics, the Regulations represent a calculated defense of national economic interests.

Historical Context: China’s IP Protection Evolution

China’s intellectual property framework has undergone radical transformation since joining the WTO:

- – 2001: Trademark Law amendments establishing infringement penalties

- – 2008: National Intellectual Property Strategy launch

- – 2021: Establishment of specialized IP courts across major cities

- – 2024: Supreme People’s Court guidelines on punitive damages

The new Regulations fill crucial gaps in China’s ability to counteract extraterritorial IP actions where Chinese enterprises become targets.

Decoding the Regulations’ Enforcement Mechanisms

The Regulations establish three pillars for combating foreign IP abuse:

- – Proactive investigation protocols for questionable infringement claims

- – Evidence-standard reversals when foreign entities initiate serial litigation

- – Multilevel penalty structures ranging from fines to market access restrictions

Defining ‘Abuse’ Under Chinese Legal Framework

The Regulations precisely define abusive behaviors warranting intervention:

- – Patent trolling without commercial implementation intent

- – Strategic litigation targeting Chinese competitors with disproportionate claims

- – Trademark squatting involving bad-faith registrations

- – Copyright misuse through DMCA-style takedowns without verification

Examples triggering enforcement may resemble previous cases like when Australian manufacturer BluGlass exhausted Chinese competitors through serial patent challenges.

Operational Impact on Global Enterprises

Multinational corporations face immediate compliance demands:

- – Comprehensive IP audit filings for Chinese operations due within 180 days

- – Mandatory disclosure of foreign litigation histories involving Chinese parties

- – Restricted ability to pursue injunction-based market-blocking tactics

Dispute Resolution Transformation

The regulations pioneer streamlined resolution pathways:

| Dispute Type | Resolution Avenue |

|---|---|

| Standard Infringement Claims | Shenzhen International IP Arbitration Center |

| Complex Cross-Border Conflicts | Designated Specialized IP Courts |

| Suspected Abuse Cases | Administrative Review Panels |

Strategic Insights From Legal Pioneer Zhang Huawei (张华薇)

As Director of Yingke Global’s Foreign-Related Legal Research Institute, Zhang Huawei (张华薇) emphasizes proactive measures:

Foreign enterprises operating in China must fundamentally reassess intellectual property strategies. Dual-track IP protection systems distinguishing defensive rights from competitive tools are essential.

Zhang forecasts sector-specific implications:

- – Tech firms: Heightened scrutiny of patent pooling agreements

- – Pharmaceuticals: Enhanced examination of patent evergreening tactics

- – Creative industries: Standardization of copyright revocation procedures

Implementation Timeline Implications

Critical milestones for enterprise adjustment:

- – October 2024: Draft procedural guidelines circulate

- – January 2025: Mandatory workforce retraining deadlines

- – May 2025: Full enforcement commences

China’s Maritime Silk Road Parallel Initiative

The Regulations interface strategically with China’s Belt and Road intellectual property infrastructure:

- – Coordinated enforcement across 18 Bilateral IP Protection MoUs

- – Standardized IP infringement thresholds along trade corridors

- – Reciprocal recognition mechanisms for legitimate licensing arrangements

Southeast Asian manufacturing hubs report 35% reduction in predatory patent filings since pilot programs launched.

Data Flow Protection Synergies

The Regulations intersect with China’s data governance requirements:

- – Patent evidence transfers trigger Cybersecurity Law compliance

- – Foreign discovery requests face enhanced security reviews

- – Litigation support services require certified domestic providers

Benchmarking Global IP Enforcement Approaches

China’s framework builds upon international precedents while innovating:

| Jurisdiction | Distinguishing Features |

|---|---|

| United States | ITC exclusion orders lack proportionality safeguards |

| European Union | Unified Patent Court simplifies infringement claims |

| Japan | Abuse determinations restricted to patent sphere |

Unlike US FTC actions triggering multiyear reviews, China’s administrative penalties activate within 90 days of violation determination.

Enterprise Readiness Assessment Framework

Global enterprises should conduct three-dimensional audits:

- – Portfolio analysis: Document strategic patent ratios

- – Litigation mapping: Track proceeding patterns against Chinese entities

- – Governance gap assessment: Verify executive-level IP oversight

Building Resilient Intellectual Property Governance

Compliance essentials include:

- – Establishing internal IP committees with Chinese legal expertise

- – Implementing litigation greenlight protocols with proportionality thresholds

- – Creating China-specific IP holder structures

German automotive suppliers demonstrate effectiveness through partner-focused licensing models increasing royalty collections by 22%.

Future Horizons: Predictive Enforcement Trends

Zhang Huawei (张华薇) anticipates three-phase evolution:

- – Phase 1 (2025-2026): Selective high-impact enforcement actions

- – Phase 2 (2027-2028): Expanded administrative penalty precedents

- – Phase 3 (2029+): Reciprocity policies influencing trade partner legislation

Litigation Environment Transformations

The Regulations will redefine foreign-related dispute dynamics:

- – Predicted 15-25% decrease in serial patent assertions

- – Increased administrative objection filings displacing court actions

- – Emerging specialized legal practices focusing on Regulation compliance

Navigating the Regulatory Transition

Preparation priorities before May implementation:

- – Intellectual property portfolio structural realignment

- – Licensing documentation harmonization

- – Emergency response protocol development

The Beijing Patent Examination Center offers specialized consultancy certifications starting October 2024.

Strategic Partnership Opportunities

Forward-thinking enterprises leverage the transition:

- – Joint R&D protected through pre-approved IP frameworks

- – Technology transfer accelerated via compliance certification

- – Cross-border litigation financing structures stimulating cooperation

Reinforcing Competitive Integrity Through IP Balance

The Regulations embody China’s dual commitment: safeguarding domestic enterprises against unfair practices while reinforcing global intellectual property norms. Foreign companies embracing transparent IP management discover expanded market access opportunities while sidestepping enforcement actions.

With strategic preparation, multinational corporations can implement intellectual property frameworks that:

- – Mitigate enforcement risks entirely

- – Unlock collaborative innovation channels

- – Establish competitive differentiation in China’s premium innovation ecosystem

Executives should immediately initiate Regulation-specific compliance audits and leverage specialized domestic expertise. Register for Shanghai’s International IP Compliance Summit (September 18-20, 2024) to access implementation resources and ministerial guidance sessions shaping enforcement priorities.