The High-End Hotpot Contender’s Public Debut

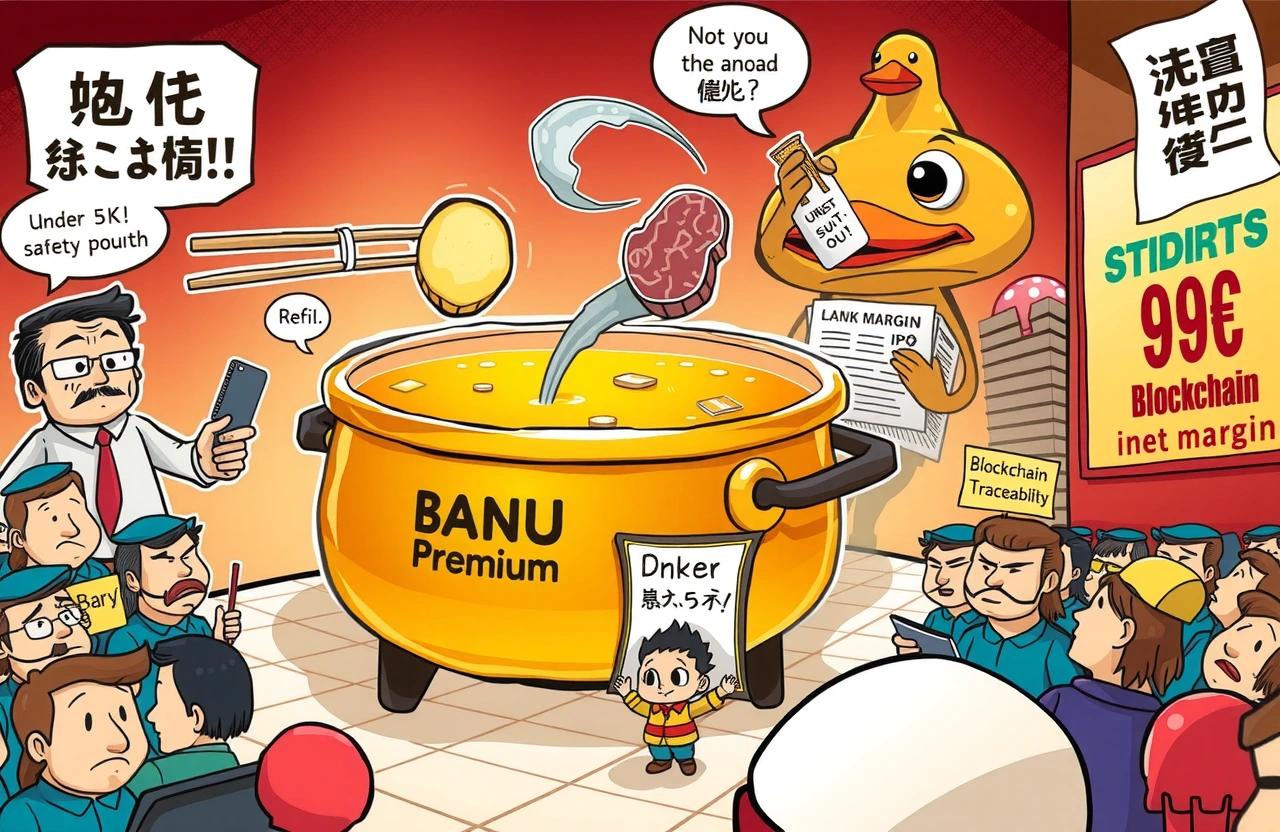

Du Zhongbing (杜中兵) is making waves by taking his premium Banu Hotpot chain public in Hong Kong, but the path hasn’t been smooth. Positioned squarely at China’s rising middle class with prices nearly double the industry average, this high-end hotpot chain faces critical questions about sustainable growth. Recent controversies—from an $18 potato scandal to lamb adulteration incidents—threaten the very “product superiority” narrative that justifies its premium pricing. As Banu expands rapidly, declining same-store sales and founder missteps reveal the vulnerabilities beneath the upscale branding. This IPO represents not just a financial milestone but a stress test for premium dining concepts in China’s competitive market.

Premium Pricing Strategy Under Scrutiny

Banu’s positioning as a high-end hotpot chain comes with eye-watering price tags. According to Hongcan Big Data, the average Chinese hotpot customer spends under 75 RMB ($10) per meal. Banu charges 142 RMB ($20)—40% higher than industry giant Haidilao’s 97.5 RMB average. This premium strategy faces two critical challenges:

The Value Perception Gap

Banu’s marketing directly targets Haidilao with slogans like “Service isn’t our specialty—tripe and mushroom broth are” and “No excessive service, only meticulous standards.” Yet operational missteps undermine this positioning:- The infamous “overpriced potato” incident saw customers paying 18 RMB for five slices- Testing revealed advertised “selenium-rich potatoes” contained 90% less nutrients than claimed- Subsequent removal of common vegetables like cabbage reinforced elitist perceptions

Profitability vs. Peers

Despite premium pricing, Banu’s financial performance trails competitors:- 2024 net margin: 8.5% vs Haidilao’s 11%- Revenue scale: 2.3B RMB vs Haidilao’s 42.8B RMB- Per-store revenue declined 11.9% year-over-year in 2024The high-end hotpot chain’s premium pricing hasn’t translated to superior unit economics, raising questions about its IPO valuation narrative.

Expansion-Driven Growth Masks Efficiency Decline

Banu’s store count surged 67.4% from 2022-2024, reaching 144 locations. This expansion-driven growth hides troubling efficiency metrics that could jeopardize the high-end hotpot chain’s IPO prospects.

Deteriorating Store Performance

Key operational metrics show consistent decline:- Average daily customers per store: Down 6.5% YoY in 2024- First-tier city sales: 25.5% drop over two years- Same-store sales growth: Negative 9.9% in 2024The chain’s growth increasingly relies on new openings rather than organic performance—a red flag for investors evaluating this high-end hotpot chain’s sustainable value.

The Maturity Challenge

Established locations show worrying trends:- Pre-2022 stores saw sales drop from 56,500 RMB to 53,900 RMB daily- Stores opened in 2022 declined 18.2% by 2024New locations appear to cannibalize existing stores while part-time staff surged 140% in 2024—suggesting cost-cutting that may impact service quality at this premium-priced chain.

Brand Crises and Controversial Leadership

Banu’s “product-first” branding has suffered repeated blows, creating reputational headwinds for the high-end hotpot chain’s public offering.

Food Safety Failures

The 2023 “lamb mixed with duck” scandal exposed systemic issues:- Influencer tests revealed duck DNA in lamb products at subsidiary brand Chaodao- Parent company denied responsibility despite shared supply chains- Resulted in 426,000 RMB fine for violating food safety lawsThese incidents directly contradict Banu’s premium positioning and quality promises.

Tone-Deaf Leadership

Founder Du Zhongbing (杜中兵) exacerbated problems through controversial statements:- “Don’t eat hotpot if you earn under 5,000 RMB monthly”- “Hotpot isn’t for lower-class people”Such remarks alienated the core middle-class demographic this high-end hotpot chain targets, contradicting Banu’s purported “boat tracker spirit” of humility.

Financial Performance and Market Positioning

Banu’s IPO filing reveals a business at odds with its premium image. While revenue grew from 1.43B RMB (2022) to 2.31B RMB (2024), profitability remains modest:- Adjusted net profit: 196M RMB (2024) on 8.5% margins- Q1 2025 profit: 76.7M RMBThe high-end hotpot chain’s store-level economics show concerning trends:

Regional Disparities

– Henan province (53 stores) remains strongest base- First-tier city performance deteriorating fastest- Average ticket value down 13% in premium markets since 2022

Cost Control Tradeoffs

While store operating margins improved from 15.2% to 21.5% (2022-2024), this came alongside:- 140% increase in part-time staff- Potential service quality compromises- Reduced full-time employee growth relative to store expansionFor a high-end hotpot chain promising premium experiences, these staffing patterns raise service consistency concerns.

Competitive Landscape and Market Realities

China’s hotpot sector remains fiercely competitive, with Banu’s positioning creating unique challenges. The high-end hotpot chain occupies a narrow segment between mass-market players and ultra-luxury dining:

Haidilao’s Dominance

– 9x more stores than Banu- 18x greater revenue- Higher profitability despite lower pricesHaidilao’s service innovation and scale advantages create formidable competition for this aspiring high-end hotpot chain.

Changing Consumer Sentiment

Post-pandemic diners show increased value sensitivity:- 24% of middle-income consumers reduced dining out frequency (Mintel 2024)- Premium foodservice growth slowed to 8.3% in 2024 vs 14.7% in 2022Banu’s value proposition faces scrutiny as economic pressures mount.

Rebuilding Trust in the Premium Proposition

For Banu to succeed post-IPO, this high-end hotpot chain must address critical vulnerabilities in its business model. Key priorities include:

Supply Chain Integrity

– Implement blockchain traceability for premium ingredients- Third-party auditing of all suppliers- Transparent ingredient sourcing disclosuresRebuilding credibility after food scandals is essential for any premium food brand.

Balanced Growth Strategy

– Slow expansion to protect unit economics- Invest in existing store upgrades- Develop suburban locations with lower rentsThe high-end hotpot chain must prove it can grow without compromising quality or efficiency.

Brand Realignment

– Retrain staff on inclusive hospitality- Launch accessible menu tiers- Engage food influencers for transparency initiativesMoving beyond “elitist” perceptions is crucial for mass-market appeal.

Navigating the Public Markets

Banu Hotpot’s IPO represents both an achievement and an accountability milestone. Investors should scrutinize:- Same-store sales recovery in H2 2025 reports- Marketing expenditure as percentage of revenue- New store payback periodsThe high-end hotpot chain must demonstrate it can translate premium pricing into premium returns. For consumers, the true test remains whether Banu can deliver consistent quality that justifies its prices without alienating its core market. As China’s dining landscape evolves, Banu’s journey offers critical lessons about balancing ambition, authenticity, and sustainable growth in the competitive world of premium dining.