Key Developments

Hailun Piano (SHE:300329) announced dramatic ownership changes on July 17, 2025, triggering an immediate 12% stock surge before trading suspension:

– Controlling shareholders Chen Hailun (陈海伦), Jin Haifen (金海芬), and Chen Chaofeng (陈朝峰) initiated control change negotiations

– Trading halted effective July 18 with maximum 2-day suspension planned

– Market valuation reached ¥2.6 billion amidst heavy afternoon trading

– Controlling entities hold 44% company shares valued above ¥1.1 billion

Founding Dynasty’s Potential Exit

Piano Empire at Crossroads

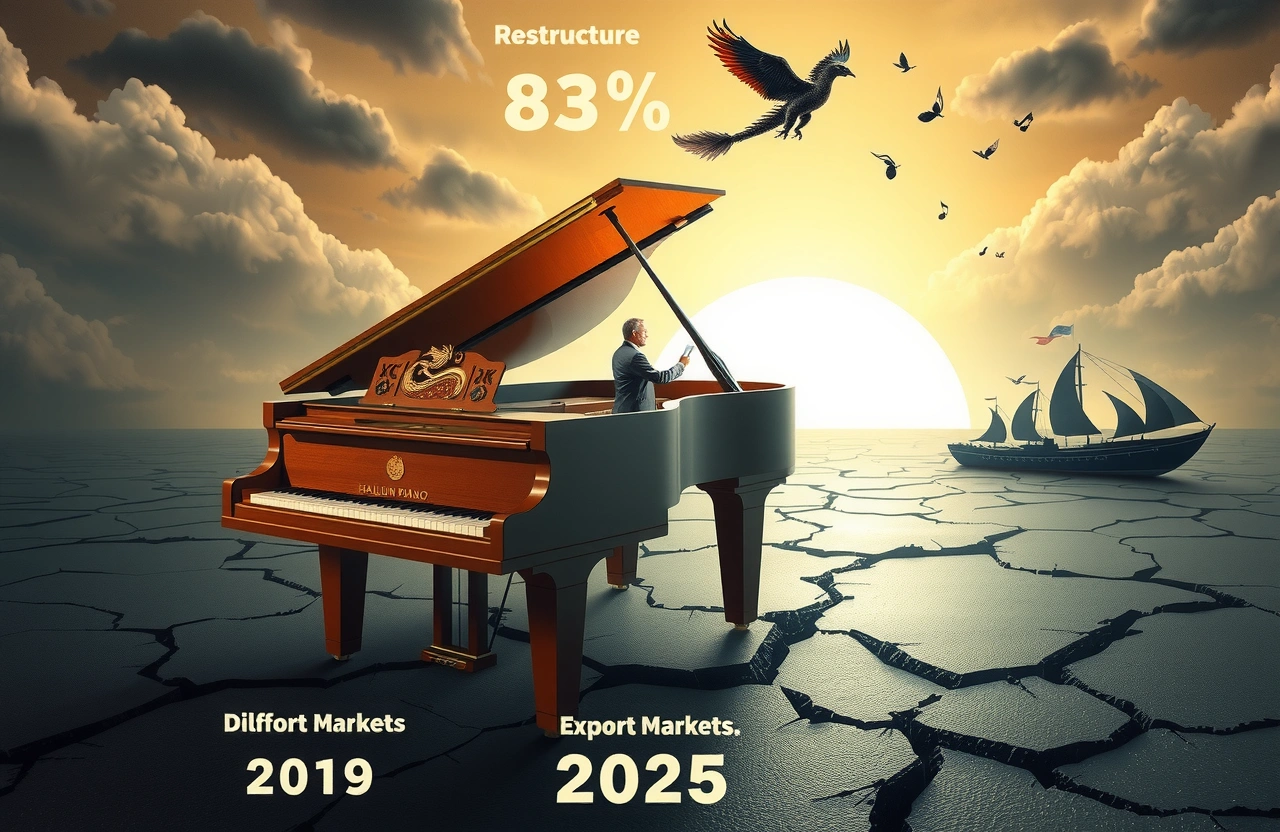

Seventy-year-old founder Chen Hailun (陈海伦) faces pivotal decisions as China’s piano market contracts catastrophically. Established in 2001 and named after its founder – a rarity in Chinese instruments – Hailun Piano achieved Olympic prestige when selected as official performance instrument for Beijing’s 2008 Games. Chen’s family maintains full control through:

– Chen serving as Chairman

– Wife Jin Haifen (金海芬) as Board Director

– Son Chen Chaofeng (陈朝峰) as Director & CEO

Brand Identity Implications

Potential departure of founding members threatens corporate identity cultivated through product philosophy. Company literature explicitly links corporate reputation to Chen’s personal credibility: “We bind corporate credibility to Chen Hailun’s personal reputation.” Alumni export strength includes:

– 200+ North American/European dealerships

– Dozens of Japanese outlets

– Global network of 700 distributors

Industry Headwinds

Market Collapse Statistics

Traditional piano sales plummeted from 500,000 units (2019) to 85,000 (2025) – an 83% market retraction. Hailun’s operational struggle includes:

| Metric | 2024 Performance | Yearly Change |

|---|---|---|

| Sales Volume | 10,370 units | -49.75% |

| Revenue | ¥159 million | -46.47% |

| Net Profit | ¥-97.92 million | Negative Swing |

Leadership’s Market Assessment

Chen frankly admitted during May shareholder meetings: “Instrument industry pressures affect piano enterprises severely.” Company engineers now prioritize smart electric instruments targeting seniors/children – markets Chen considers “immense potential” growth frontiers.

Restructuring Mechanics

Ownership Transition Framework

Corporate filings reveal:

– No finalized documents executed

– Complex transaction structuring underway

– Details undisclosed during negotiation phase

– Trading suspension protects investor interests

Market Response Analysis

The double-digit intraday surge defies industry gloom, suggesting investor optimism regarding ownership transition outcome:

– Shares gained steadily throughout afternoon

– Volume spiked to abnormal levels

– Market reaction defied sinking sector trends

Strategic Outlook

Industry Transformation Essentials

The piano’s decline necessitates radical adaptability. Analyst consensus suggests successful new ownership must:

– Accelerate smart instrument deployment

– Build subscription-based teaching platforms

– Target community education initiatives

– Downsize acoustic production judiciously

Legacy Milestone Relevance

Hailun’s improbable journey from workshop to global brand represented Chinese manufacturing advancement. Its Olympic supplier status symbolized artistic recognition beyond commercial metrics.

Optimizing Transition Outcomes

All stakeholders eagerly await formalized ownership restructure details when trading resumes. Retail investors should monitor:

– Ownership dilution parameters

– New controlling entity qualifications

– Explicit business continuity guarantees

– Medium-term restructuring strategies

Pending ratification documents will determine whether recent bullishness indicates sustainable recovery or fleeting optimism in China’s evolving musical instruments landscape.