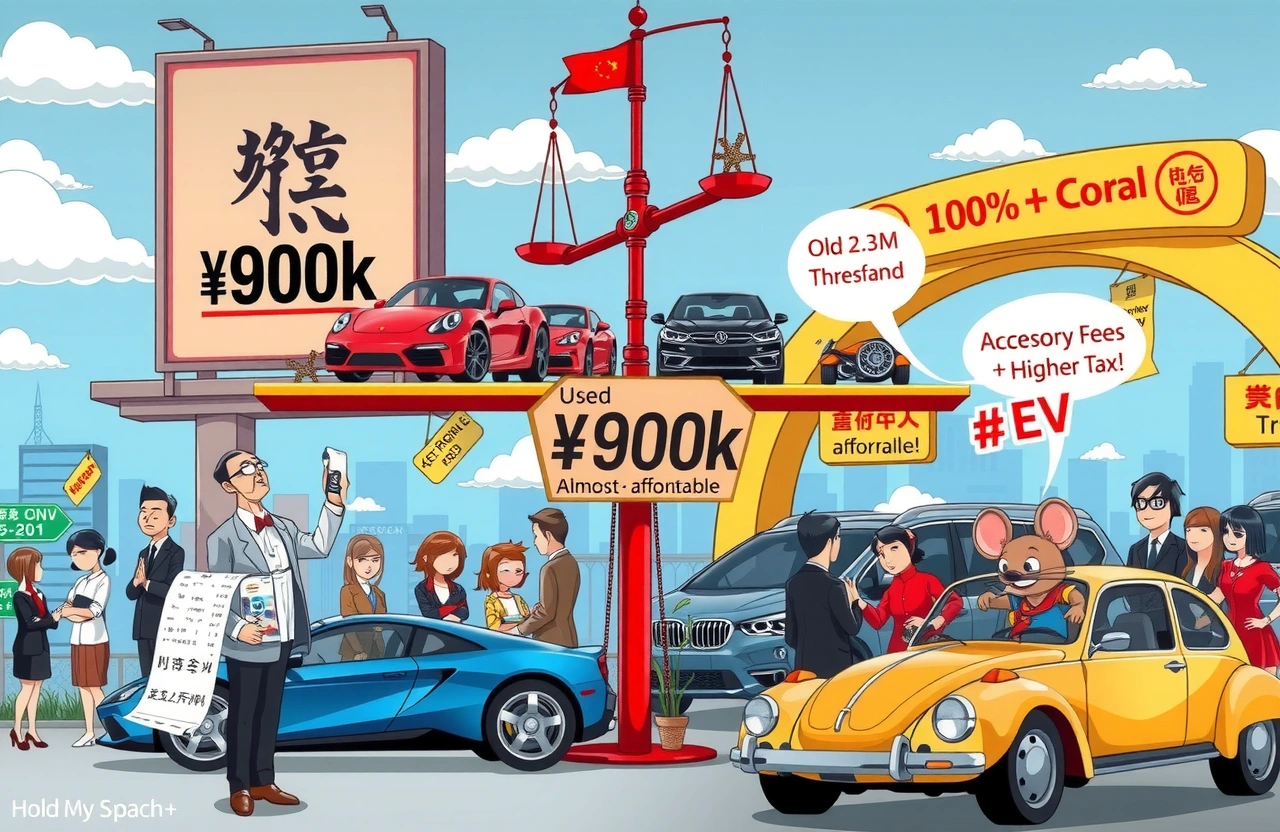

– China’s luxury car tax threshold reduced 30% from ¥1.3 million to ¥900,000

– New policy includes electric/fuel cell vehicles under consumption tax coverage

– Used luxury vehicles completely exempt from consumption tax

– Retailers must include all accessory/service fees in taxable pricing

– Changes take effect July 20, 2025 across all provinces

Major Policy Shift Targets High-End Vehicle Market

China’s Ministry of Finance and State Taxation Administration have fundamentally reshaped the luxury car consumption tax landscape. Effective July 20, 2025, the price threshold triggering additional consumption tax plunges from ¥1.3 million to ¥900,000 (excluding VAT). This sweeping adjustment brings substantially more premium vehicles – including pure electric and hydrogen models – into the luxury car consumption tax net for the first time. The 30% reduction in the qualifying threshold represents Beijing’s most significant recalibration since introducing the luxury car consumption tax framework in 2016.

Understanding the New Regulatory Framework

The revised policy radically expands what constitutes a “super luxury” vehicle:

— Scope Expansion Criteria —

Price Threshold Adjustment

The new ¥900,000 ceiling replaces the previous ¥1.3 million benchmark. This adjustment means vehicles costing over ¥970,000 including VAT now qualify – equivalent to approximately $135,000 USD.

Inclusion of Alternative Powertrains

Electric and hydrogen fuel cell vehicles face luxury car consumption tax despite their emissions profiles. Treasury clarification emphasizes all “power types including pure electric” now fall under policy guidelines.

— Tax Collection Mechanics —

Special Provisions for EVs

Electric vehicles lacking traditional engines will pay consumption taxes exclusively at retail stage, benefiting from streamlined administration under China’s luxury car consumption tax framework.

Used Vehicle Market Exemption Among Key Changes

Used Car Transactions

Sellers face no consumption tax obligations when transferring ownership of registered pre-owned luxury vehicles.

— Policy Parameters —

Commercial Definition

“Secondary luxury vehicles” specifically exclude salvage/rebuilt cars and encompass only legally registered units sold before reaching mandatory national scrapping thresholds.

Expanded Taxable Basis Definition

Practically all customer-facing charges become included in the taxable base:

– Mandatory accessories installation fees

– Premium interior/exterior packages

– Extended warranty/service contracts

Tax authorities cite past loopholes exploiting optional equipment classifications to avoid luxury car consumption tax obligations.

Implementation Timeline and Industry Impact

The Ministry of Finance timeline grants automakers and dealers 12 months to adjust operations:

— July 2025 Transition Policy —

Manufacturer Adaptation

Leasing/Electric Vehicle ImplicationsLuxury EV manufacturers including Nio and Li Ideal must recalculate total ownership costs as previously exempt models become taxable above ¥900,000 retail.

Strategic Consumer Considerations

Prospective buyers navigating the changing luxury car consumption tax landscape should:

– Review purchase timing relative to July 2025 deadline

– Calculate comprehensive fees incorporating tax liabilities

– Evaluate lease-versus-buy alternatives

High-net-worth individuals may accelerate purchasing plans before implementation, potentially creating pre-deadline demand spikes.

Future Market Implications

China’s luxury car consumption tax revision signals commitment to equitable taxation regardless of powertrain, while stimulating secondary market liquidity through used car exemptions. Automakers should anticipate tiered manufacturing strategies with precise pricing corridors below critical tax thresholds. Financial professionals predict this policy may push premium manufacturers toward subscription and mobility services as alternatives to direct sales.