Summary

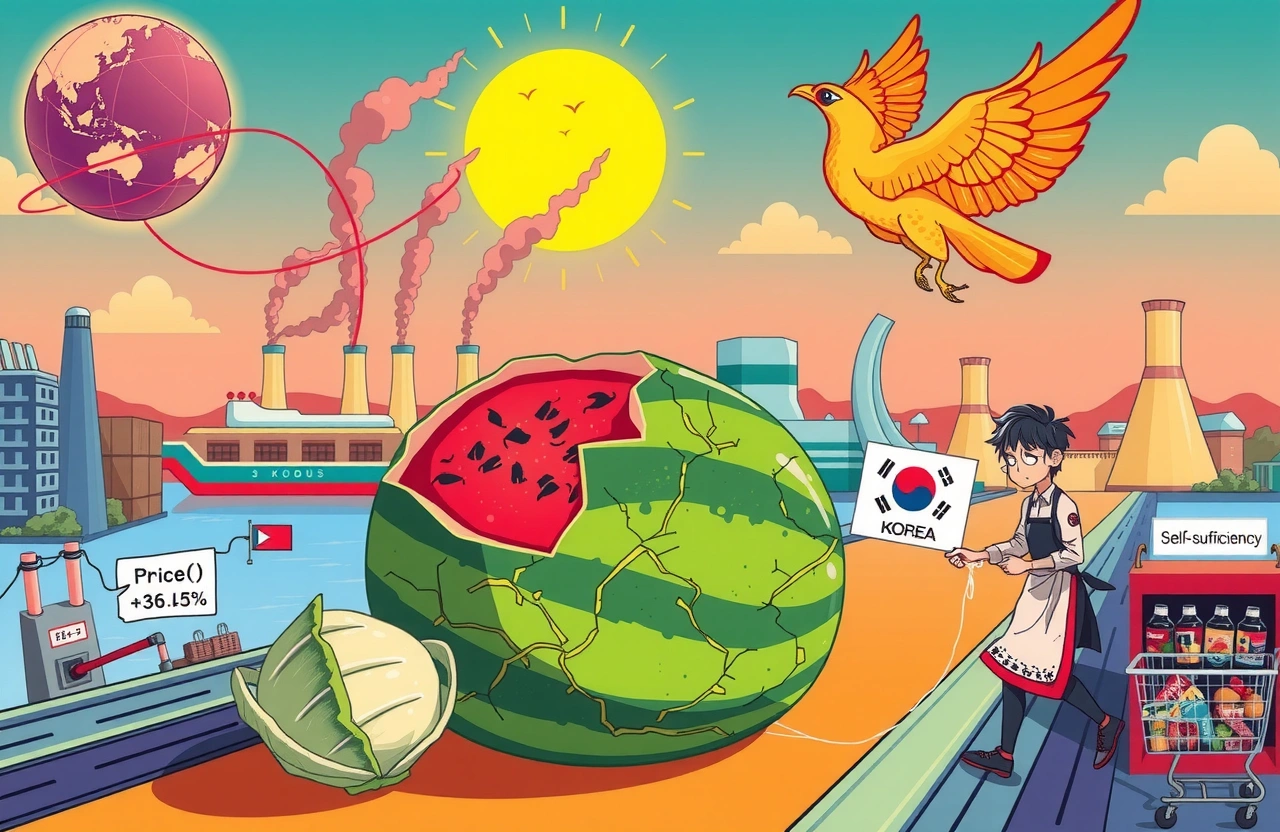

– Extreme weather events in mid-2025 pushed watermelon prices to $21 (156 yuan) and cabbage prices up 27% weekly in Korea

– Longstanding agricultural protectionism shelters inefficient farms while blocking affordable imports

– Heavy reliance on semiconductors/energy imports creates critical vulnerabilities when global supply chains shift

– New US tariffs compound export challenges amid inflationary pressure from climate disruption

– Government relief measures struggle with deep structural reforms needed to address economic fragility

In July 2025, Koreans faced supermarket sticker-shock: watermelons costing 29,115 won ($21/156 yuan) and cabbages priced at nearly 50% premium. While blistering heatwaves scorched crops, this sudden inflation spike revealed deeper fractures in South Korea’s economic foundations.

The convergence of extreme weather volatility with structural weaknesses has triggered what economists term ‘thermal inflation’ – temporary yet disruptive price surges that disproportionately impact daily essentials. Record-breaking temperatures simultaneously boosted watermelon demand while reducing yields after June’s heavy rainfall disrupted crop development. With agriculture contributing just 2% to GDP yet deeply embedded in Korean food culture and price indexes, these fluctuations rapidly translate into tangible economic discomfort. As Dong Xiangrong (董向荣) from Chinese Academy of Social Sciences observes: “Price volatility during temperature extremes appears dramatic for newcomers to Korea, but locals understand this vulnerability stems from longstanding systems, not merely today’s thermometer readings.” This analysis examines how climate disruption ignited Korea’s inflationary flareup while scanning the entrenched economic vulnerabilities now burning beneath the surface.

Extreme Weather and Inflation Acceleration

The July 2025 heatwave acted as catalyst for Korea’s inflation surge, with agricultural products becoming the frontline indicator. According to Korea Agro-Fisheries & Food Trade Corporation data:

– Weekly watermelon price increases reached 22.5%

– Year-over-year cabbage price jumps hit 36.5%

– Egg prices climbed to 7,000 won ($5.10) per 30-count carton

The Crop Collapse Mechanism

Excessive heat accelerated produce spoilage while ballooning logistics costs as transporters implemented climate-control measures. Meanwhile, poultry farms reported chicken mortality spikes during peak temperatures – precisely when traditional “Boknal” summer recipes boosted demand. This created a classic demand-supply imbalance: consumers sought more hydrating fruits and healthy proteins while farmers struggled with reduced yields and faster spoilage rates.

Columnist Chang Luowen explained: “Korean inflation cycles now lockstep with weather extremes. Last year’s floods and drought already depleted reserves before 2025’s record heat compounded agricultural stress.” The Korea Meteorological Administration confirmed July 2025 as the hottest month since standardized record-keeping began in 1973.

Beyond Short-Term Shocks

While temperature-triggered price spikes dominate headlines, experts emphasize Korea’s distinctive sensitivity to such disruptions originates elsewhere. As Dong Xiangrong notes: “The fundamental issue isn’t thermometers – it’s trade volumes. Extreme weather merely exploits existing vulnerabilities.” Limited agricultural imports leave minimal buffer when domestic harvests falter.

Structural Weaknesses in Farming and Trade

Korean agriculture operates within what economists call “the double-bind of protectionism” – policies simultaneously shielding farmers while inflating consumer costs.

The Cost of “Sunto Oi” Philosophy

The national “Sunto Oi” (meaning “local foods suit local bodies”) philosophy promotes domestic agriculture through cultural messaging and import barriers. While preserving farmland and rural livelihoods, this ideal:

– Limits competition keeping farms inefficient

– Forces consumers to absorb premium prices

– Creates import-dependency crises during shortages

Recent measures exposing this flaw include Seoul approving 1,100 tons of Chinese cabbage imports strictly for processors – forbidden from supermarket sales – highlighting selective protectionism.

Import-Reliance Traps

Li Chengri (李成日) from Chinese Academy of Social Sciences pinpoints Korea’s dangerous dependencies: “Over 90% reliance on imported energy and food staples creates systemic fragilities.” The absence of meaningful agricultural self-sufficiency means global grain market fluctuations transmit rapidly into local prices. Meanwhile, lack of ethanol/biofuel alternatives when petroleum prices surge creates compounding transport-cost inflation.

Korea’s food self-sufficiency rate sits at just 45.8% according to Ministry of Agriculture data – compared to Japan’s 38% and Australia’s 200+%. During climate disruptions, this means minor domestic harvest declines trigger major price volatility.

Industrial Monoculture Challenges

Beyond agriculture, Korea faces macroeconomic vulnerability from concentrated export dependencies described by economists as “the semiconductor curse”.

Core Industry Exposure

Semiconductors and heavy industries collectively contribute over 35% of export revenues, creating hazards when:

– China-US trade tensions shift chip demand

– Automotive tariffs disrupt sales patterns

– Petrochemical production sways with volatile energy costs

The US-China microprocessor wars directly reduced Korea’s chip exports by 18% year-over-year in Q2 2025 according to Korea International Trade Association data. Similarly, new 25% tariffs on Korean steel threaten vital refinery profits.

Logistics Domino Effect

Export disruptions trigger domestic ripple effects:

– Container shipping rates tumble reducing port activity

– Factory shutdowns cascade through subcontractor networks

– Warehousing demand crashes impacting property markets

This pattern illuminates Korea’s lack of diversified middle-technology enterprises capable of absorbing sector-specific shocks. The OECD ranks Korea 25th among industrialized nations for economic complexity – trailing neighbors Japan (#1) and China (#16).

External Pressure Amplification

Beyond self-imposed constraints, international developments compound Korea’s economic stress points.

The Tariff Domino Effect

President Joe Biden’s August 2025 tariffs specifically target Korean export strengths:

– 25% on passenger vehicles

– Steel/aluminum import restrictions

– Semiconductor fabrication equipment duties

Notably, Hyundai exports 61% of its US-bound production from Korean factories, exposing the automaker to devastating margin erosion that may force North American price hikes. Treasury projections suggest potential export contraction of up to $7.3 billion annually.

Chang Luowen describes the dilemma: “Korea essentially pays ‘ally taxes’ – framework-qualifying tariffs that nonetheless strain competitiveness while creating downstream consumer inflation.”

Currency Complications

The Korean won’s dollar-pegged vulnerability manifests uniquely in consumer markets:

– Imported replacement parts become pricier for manufacturers

– Foreign food/fuel purchases require more domestic currency

– Consumers effectively “pay US pricing for Asian goods given currency correlations” according to Korea Development Institute analysis

During temperature-triggered inflationary periods, this transmission mechanism exacerbates price pressure on essentials. The Bank of Korea’s limited dollar reserves restrict traditional market intervention options too.

Policy Response: Challenges and Opportunities

The Lee Jae-myung (이재명) administration faces high-stakes calibration balancing immediate relief against systemic reform needs.

Temporary Stabilization Tools

Current measures prioritize damage control:

– Targeted energy/food subsidies for vulnerable households

– Strategic agricultural import relaxations

– SME debt restructuring programs

– Consumer voucher distribution

Economists note limitations: “These solutions resemble applying bandages when surgery is needed. Climate-proofing infrastructure requires decade-scale commitments.” Seoul’s response echoes 2020 pandemic tactics prioritizing rapid cash injections over structural change.

The Governance Gap

With ministerial positions still vacant three months into the new government, policy paralysis threatens critical decisions on:

– Semiconductor diversification funding

– U.S. trade negotiation mandates

– Renewable energy grid expansion

Bureaucratic turnover creates risks of disjointed execution. Emergency imports lowered cabbage prices to 9,680 won ($7.06) – demonstrating measurable impact – yet lacking continuity plans.

As Korea confronts climate-intensified economic pressures, lasting solutions demand dismantling silos between farming, industry and trade policy. The remarkable 156 yuan watermelon perfectly symbolizes how mundane realities expose systemic vulnerability. Protectionism may preserve cultural identity over generations, but without pragmatic adaptation to climate realities and supply-chain globalization, it risks becoming national economic incineration. For meaningful change, Seoul must urgently embrace «smart specialization» – preserving strategic capacities where Korea competes globally while dismantling inefficient protections where dependency creates weakness.

Finance Minister Chu Kyung-ho’s emphasis on “building resilience through enzymatic reforms” suggests recognition that piecemeal solutions won’t suffice. Readers tracking Asia-Pacific economic trends should monitor: Korea’s semiconductor diversification investments, U.S. FTA renegotiation progress, and agricultural zoning reforms. To see monthly price fluctuations versus climate patterns, download the Bank of Korea’s Inflation Outreach App. The Korea Meteorological Administration website provides early heatwave alerts critical for export planning. Ultimately, Korea’s economic stress tests illuminate how industrial middle powers worldwide must develop integrated climate-economic frameworks.