Latest Market Trends Overview

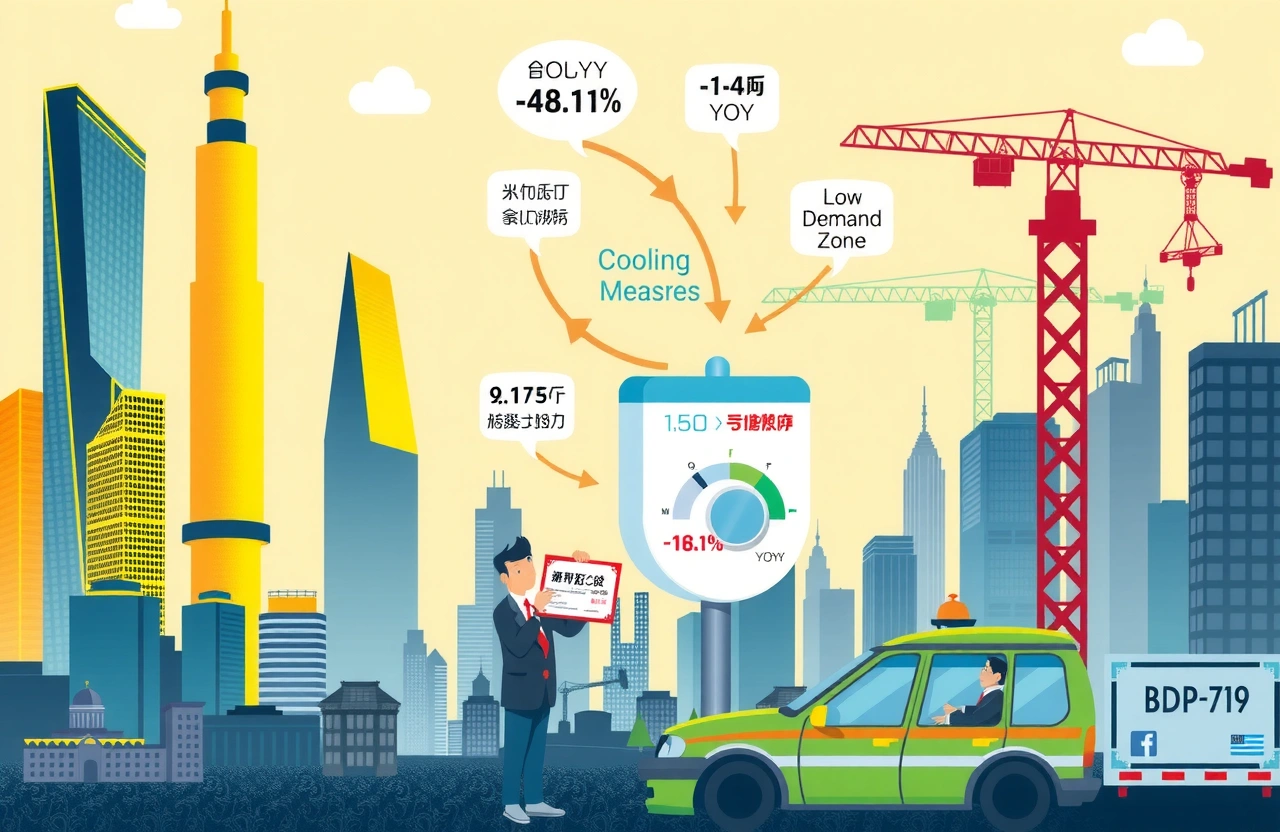

Seeking signals in China’s cooling property landscape, real estate experts scrutinize new National Bureau of Statistics (NBS) data showing a year-on-year 1.4% decline in first-tier new home prices for June 2025. Released Thursday morning, this report captures pivotal shifts across tiered urban markets as policymakers navigate persistent deflationary pressures amid broader economic recalibration. Most significantly, while Shanghai recorded positive momentum with a 6% annual gain, Beijing’s -4.1% contraction illustrates deepening regional divergence.

June Performance Highlights

- – Average monthly price declines accelerated at 0.3% for first-tier cities

– Secondary markets saw steeper deterioration with used home prices falling 0.7%

– Guangzhou (-5.1%) and Shenzhen (-2.5%) registered strongest retreats among metropolises

Detailed City-Level Performance Breakdown

New Construction Market Comparisons

The NBS findings reveal widening variations between tiered cities:

| City Tier | MoM Change | YoY Change |

|---|---|---|

| First-tier (Avg) | -0.3% | -1.4% |

| Shanghai | +0.4% | +6.0% |

| Beijing | -0.3% | -4.1% |

| Second-tier Cities | -0.2% | -3.0% |

Such fragmentation reflects localized policy experiments and buyer confidence levels according to Jiahe Chen of Beijing Normal University’s Real Estate Research Center: "Regulatory fine-tuning has replaced blanket interventions. Districts optimizing household registration reforms attract concentrated demand."

Secondary Market Dynamics

Used home prices contracted faster than primary markets:

- – Beijing led plunges at 1.0% monthly depreciation

– Guangzhou recorded steepest annual tumble at 5.9%

– Third-tier cities saw 6.7% year-on-year declines despite marginal narrowing

Underlying Market Pressures

Economic Policy Interactions

The People’s Bank of China Deputy Governor Zhang Qingsong (张青松) acknowledged "imported economic turbulence" requiring structural adjustments during July FSB meeting presentations. With developers facing persistent liquidity constraints, supply-side bottlenecks depress new launches even as project financing reforms gradually ease credit access. According to Moody’s Analytics property specialist Denise Wong, "Commodity inflation pressures simultaneously elevate construction costs while dampening household purchasing power."

Demand-Side Psychology Factors

Potential homebuyers exhibit heightened caution:

- – Agent surveys indicate 62% postpone purchases anticipating further corrections

– Project suspension risks remain elevated outside flagship cities

– Rental yields continue contracting versus financial asset alternatives

Betty Wang, ANZ China Economist notes: "Accumulating household savings bypass property channels after developers’ trust-busting episodes as buyers demand construction-completion certainty."

Tiered City Performance Analysis

First-Tier Differentiation Patterns

Shanghai’s outperformance reflects:

- – Competitive talent retention policies expanding buyer pools

– Strict land auction discipline preventing oversupply

– Global financial hub advantages sustaining high-income demand

Meanwhile Guangzhou/Shenzhen manufacturers increasingly relocate operations responding to industrial upgrading policies according to CGS-CIMB research.

Secondary Urban Market Pressures

Smaller municipalities face compounded challenges:

- – Population outflows accelerating amid regional GDP gaps

– Fiscal constraints limiting local stimulus instruments

– Inventory absorption timelines stretching to 30+ months

The findings parallel Peking University Huang Yiping’s recent warnings about "middle-income trap property correlation risks."

Future Market Trajectories

Short-Term Policy Responses

Ministry of Housing advisors project imminent measures:

- – Refined down payment reductions outside prime districts

– Expanded developer ‘whitelisting’ financing mechanisms

– Graduated property tax allowances for multi-child households

Morgan Stanley analysts forecast "targeted easing through Q3 focused on project viability assurance" in their July Emerging Markets Outlook.

Long-Term Structural Shifts

Sustainable recalibration requires:

- – Land revenue dependency reduction via municipal tax reforms

– REIT frameworks accommodating rental pipeline monetization

– Demographic-supportive housing designs for aging communities

China Real Estate Association Chairperson Wang Menghui (王蒙徽) emphasizes "synchronizing urban renewal objectives with living standard upgrades" during recent industry dialogues.

Investor Implications and Opportunities

Sector volatility breeds selective niches:

- – Premium rental operators expanding amid ownership delays

– Renovation specialists capitalizing on existing stock upgrades

– Prefab construction technologies gaining policy support

As price discovery mechanisms normalize after extreme price cycles, market transparency metrics like July’s NBS housing indices provide essential navigation frameworks.

The June data crystallizes China’s deliberate transition from property-driven growth toward diversified economic foundations. While localized corrections stabilize pricing imbalances regionally, developers reforming delivery systems will capture durable market share. Prospective buyers should prioritize completion track records when evaluating purchase horizons, while policymakers balance stability preservation during managed market normalization.