Automotive Titan’s Unprecedented Financial Crisis

Guangzhou Automobile Group (GAC Group) plunged into uncharted territory on July 11, 2025 with its shocking forecast: projected half-year losses between RMB 2.62-3.8 billion ($360M), marking the company’s first biannual deficit in 20 years. This catastrophic financial hemorrhage extends 2024’s struggles, exposing systemic vulnerabilities in GAC’s electric vehicle transition and competitive positioning within China’s hyper-competitive auto market. As shareholders flee and shares plummeted nearly 20% year-to-date, Chairman Feng Xingya (冯兴亚) declared an organizational shift to “wartime state”—an extraordinary crisis response signaling fundamental restructuring.

The dramatic reversal of fortunes stems from converging pressure points:

- Historic ¥2.6B deficit representing GAC’s worst financial performance since 2005

- Catastrophic declines at Honda/Toyota joint ventures – formerly profit engines

- Plummeting sales at EV subsidiary Aion with IPO plans postponed indefinitely

- Leadership declaring urgent operational restructuring across all business units

- Market value evaporation exceeding $3B amid investor confidence collapse

Financial Meltdown: Anatomy of a Record Deficit

Market Shockwaves and Investor Flight

GAC Group’s July 11 trading session became a case study in market panic. Within hours of the earnings warning, A-shares plunged 1.2% while Hong Kong-listed stock dipped nearly 1%, extending year-to-date losses exceeding 19% on mainland exchanges. Trading forums flooded with doomsday predictions as stakeholders absorbed the brutal math: estimated net losses of RMB 1.82-2.6 billion for shareholders, with core operations bleeding RMB 2.12-3.2 billion after excluding non-recurring items.

Historical Context: From Profit Leader to Loss Leader

The scale of deterioration becomes stunning when viewed against GAC’s historical performance. Just two years earlier in 2023, the automaker recorded RMB 129.7 billion in revenue only to see profits crater 45% year-over-year to RMB 4.429 billion. This alarming regression accelerated throughout 2024, with full-year guidance projecting a shocking 73-82% net profit collapse—reverting profitability to levels unseen since 2012. Industry analysts attribute this freefall to strategic miscalculations in an era when competitors like BYD secured 61.5% growth through aggressive EV portfolio development.

Joint Venture Implosion: Honda/Toyota Collapse

The disintegration of GAC’s Japanese partnerships represents the most striking symbol of its reversal of fortune. These ventures historically contributed over 70% of group profits during their combustion-engine heyday, but now hemorrhage market position.

Symptomatic Declines at Flagship Operations

Financial reports reveal GAC Honda’s 2024 sales tumbled 26.5% year-over-year while revenues contracted 27%—mirrored by GAC Toyota’s parallel 22.3% volume slump and 28.3% revenue plunge. Critically, these formerly dominant brands failed to recover momentum entering 2025. CPCA data confirms Toyota’s H1 retail volume stagnated at 364,200 units—a microscopic 0.6% improvement dwarfed by BYD’s 16% growth to 1.61 million units during the same period.

Structural Vulnerabilities Exposed

Industry diagnostics identify core flaws in the JV model: cumbersome decision hierarchies delaying electric model development, profit-sharing structures inhibiting critical R&D investment, and brand positioning misaligned with China’s premium EV preferences. Unlike nimble domestic rivals releasing multiple EV iterations annually, Honda/Toyota’s glacial development cycles proved disastrous against manufacturers refreshing entire lineups quarterly.

Stalled Electric Revolution: The Aion Dilemma

GAC’s electric future now hinges on rescuing subsidiary Aion from its accelerating tailspin. Once China’s third-largest EV producer with monthly peaks exceeding 38,000 units, Aion’s deliveries halved to just 18,100 monthly average in H1 2025—a crisis threatening GAC’s entire strategic repositioning.

Rental Reliance and Brand Perception

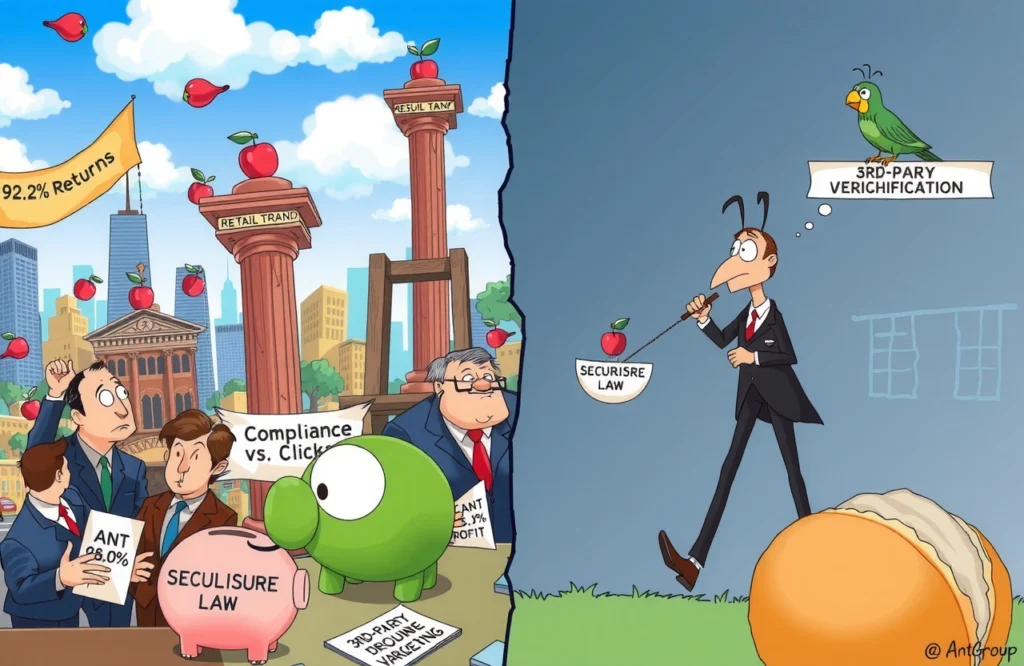

The roots of Aion’s crisis trace directly to its commercial vehicle dependency—over 60% of sales historically targeted ride-hailing fleets through bulk discounts. This poisoned brand perception among retail buyers while exposing Aion to market saturation when competitors prioritized private consumer experience. Industry studies reveal brand awareness among private buyers below 18% compared to NIO’s (蔚来) 53%—a catastrophic perception gap Aion urgently must bridge.

IPO Delays and Credibility Questions

Compounding operational woes, Chairman Feng Xingya confirmed indefinite postponement of Aion’s eagerly anticipated IPO amid unfavorable market conditions—a move interpreted by investors as institutional pessimism regarding near-term recovery. The implicit admission that “now isn’t the right time” carries significant credibility damage after years of public projections positioning Aion as GAC’s transformational spearhead.

Root Cause Analysis: Four Critical Failure Vectors

GAC Group’s official earnings announcement isolated four structural deficiencies driving crisis conditions:

- EV Sales Collapse: New energy vehicles missed volume targets by over 35% during Q1-Q2 2025 sales cycles

- Channel Misalignment: Legacy dealership networks resisting EV-focused commission structures and showroom configurations

- Operational Fragmentation: Failed integration between autonomous brand R&D/production/marketing functions

- International Immaturity: Export contribution remains negligible at 3.1% of sales versus Geely’s 38% overseas penetration

Ecosystem Implications

These self-acknowledged weaknesses represent microcosms of China’s broader automotive transition pains: an inability to pivot dealer relationships toward direct-sales models, supply chain realignments toward localized EV components, and international distribution partnerships prioritizing emerging EV markets. Competitors navigated these transitions through aggressive ecosystem partnerships—from CATL battery joint ventures to Baidu autonomous driving alliances.

Wartime Response Framework: Chairman Feng’s Transformation Blueprint

The “wartime state” declaration at Beijing’s China Automotive Forum on July 12 outlined three warfare fronts reshaping GAC:

Strategic Doctrine Elements

Product Value War: Accelerating technical unification across group R&D using Haobo E-an architecture, while prioritizing August Haobo HL PHEV launch as flagship recovery model

Consumer Demand War: Organizational restructuring creating unified user operations centers collapsing previous brand silos

Service Experience War: Revolutionizing dealership interactions through integrated software platforms synchronizing digital/physical engagement

Crisis Management Precedents

Industry observers note parallels with Huawei’s 2019 “battle mode” emergency response when facing U.S. sanctions—implementing flat decision hierarchies prioritizing rapid market feedback over bureaucratic protocols. The wartime framework potentially unlocks faster approvals for ground-level innovations like Aion’s recently tested fast-charging partnerships with Sinopec petrol stations.

Path Forward: Survival Imperatives

GAC’s roadmap from crisis requires synchronizing multiple recovery vectors:

- Joint Venture Reformation: Renegotiating JV terms for autonomous EV development and flexible distribution

- Aion Repositioning: Installing new management focused on premium retail branding

- Software Integration: Developing proprietary operating systems across models to capture data value

- Global Acceleration: Prioritizing ASEAN/Middle East regions for plug-in hybrid exports

Industry Inflection Implications

GAC’s wartime transition represents a decisive stress-test for China’s industrial policy. While BYD and Li Ideal demonstrate successful EV transitions leveraging capital access and software talent, GAC embodies state-linked conglomerate adaptation challenges. Its outcome shapes perceptions about hybrid SOE-private hybrids within China’s next-gen manufacturing ambitions.

Emerging From Crisis Through Fundamental Realignment

GAC Group confronts China’s automotive inflection point in unexpected weakness rather than traditional strength. Chairman Feng Xingya’s wartime declaration signals recognition that incremental adjustments cannot reverse the structural market shifts eroding its foundation. The success horizon belongs to automakers successfully bridging three divides: electrification and digitalization; direct customer connections and showroom partnerships; global ambition and domestic consolidation.

Recovery demands disciplined execution prioritizing its August Haobo PHEV launch as first battlefield victory—with failure threatening existential consequences. For legacy automakers worldwide navigating disruption, GAC’s struggle offers critical lessons in anticipating transitions before markets enforce them violently. Track the Haobo HL’s market reception as leading indicator whether GAC’s wartime mobilization yields operational breakthroughs.