The Shocking Transformation Story

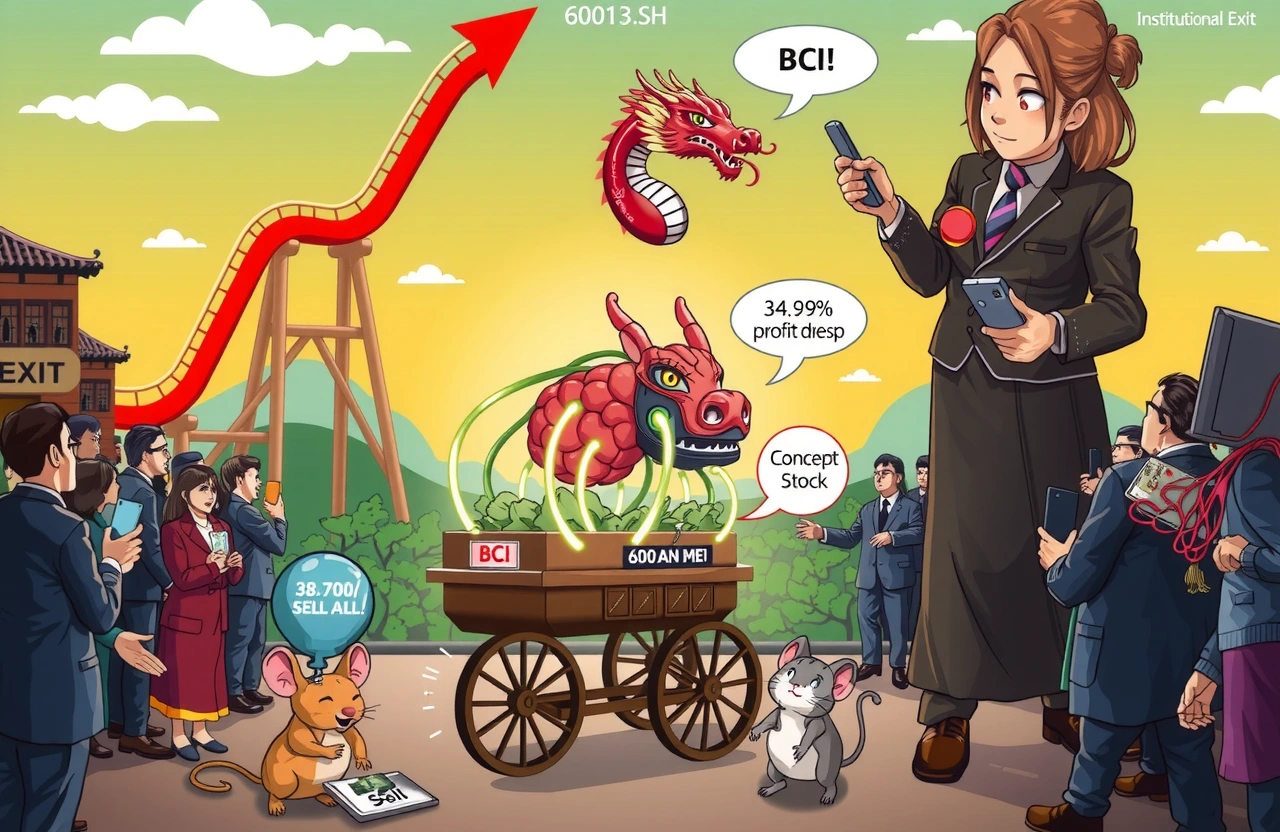

Zhejiang Dongri (600113.SH), a company primarily engaged in agricultural produce trading and wholesale market operations, experienced a financial earthquake in June 2025 when its stock price soared over 120% within weeks. This astonishing rally wasn’t driven by fundamentals in its core vegetable distribution business, but by a subsidiary’s announcement about brain-computer interface technology – catapulting this modest agricultural enterprise into the heart of China’s speculative trading frenzy.

Key Takeaways

- Zhejiang Dongri’s stock climbed over 120% in a month following its subsidiary Pei An Mei’s announcement about brain-computer interface technology research

- The Shanghai Stock Exchange imposed intensive supervision on July 14 after valuation metrics completely disconnected from company fundamentals

- Retail investors dominated trading activity, accounting for over 25 billion yuan in transactions while institutions strategically exited positions

- Pei An Mei, the subsidiary behind the announcement, generated an underwhelming 28,700 yuan revenue during the first five months of 2025

- The company now trades at 88x PE ratio – triple the industry average – despite income declining 34.94% year-over-year

The Spark That Ignited Market Frenzy

The market frenzy began on June 16 when Pei An Mei’s official WeChat account announced a collaboration with Capital Medical University to advance brain-computer interface technology development. This timing proved explosive, coinciding with a 283% single-day surge of neural technology company RGC on the Nasdaq just hours earlier. Market speculators immediately connected Zhejiang Dongri’s 40% stake in Pei An Mei to the exploding sector.

The Perfect Storm of Market Conditions

Trading data reveals how Zhejiang Dongri became trapped in a speculative vortex: retail investors piled in with extraordinary enthusiasm while institutional players quietly exited positions. Billions in leveraged positions entered through margin trading, with the company’s financing balance surging from 565 million yuan to 945 million yuan in under a month. Volume patterns showed unmistakable speculative mania characteristics, with shares trading hands rapidly as momentum traders chased short-term gains.

The Truth Behind Pei An Mei

From its founding in September 2024, Pei An Mei underwent striking metamorphosis. Originally established as “Pei An Mei (Zhejiang) Special Medical Food Co.,” Zhejiang Dongri announced its purpose as advancing nutritional research through university partnerships. By March 2025, filings showed radical directional shifts – rebranding as “Pei An Mei (Zhejiang) Technology Co.” while replacing food science objectives with entries for “intelligent robot research” and “brain-computer interface” development.

The Staggering Gap Between Hype and Reality

Corporate disclosures exposed alarming discrepancies between market perception and operational substance. By May 2025, Pei An Mei reported negligible 28,700 yuan revenue accompanied by 661,400 yuan in net losses. Despite triggering billions in valuation increases, brain-computer interface operations remained completely undeveloped – Zhejiang Dongri eventually admitted no written collaboration agreement existed with Capital Medical University. Financial analysis confirmed Zhejiang Dongri maintained zero meaningful R&D expenditure toward neural technology.

Regulatory Intervention and Market Consequences

The Shanghai Stock Exchange activated intensive monitoring protocols on July 14, implementing specialized surveillance parameters for Zhejiang Dongri trading activity. This ten-session oversight period authorizes stricter interpretation of abnormal transactions and follows SSE precedent applying enhanced supervision during speculative bubbles. Historical data demonstrates such interventions typically precede volatility compression as heat leaves overheated equities.

Warning Signs for Investors

- PE ratio reached 88x – triple the wholesale industry average

- Revenue declined 18.44% YoY to 723 million yuan

- Net profits dropped 34.94% to 135 million yuan

- 250% premium to historical valuation range

The Psychological Drivers Behind the Frenzy

Behavioral finance experts identify several cognitive distortions fueling Zhejiang Dongri’s rally: ‘concept stock’ mentality encouraged investors to overlook fundamentals while chasing tangential technological narratives. The herding effect became particularly pronounced when retail traders consistently ignored Zhejiang Dongri’s formal risk disclosures confirming no BCJ commitments. Neuroscience explains how dopamine-driven buying occurs when markets conflate potential technological revolutions with specific corporate capabilities.

Trading Patterns Reveal Market Psychology

Data visualizations of trading flows between June 16-July 14 display psychological tipping points: >30% intraday swings emerged when waves of stop-loss orders clashed with new speculative inflows. The temporary June 25 pullback after Zhejiang Dongri’s clarification announcement revealed brief rationality before speculative pressures rebuilt. These pendulum swings characterize concept-driven rallies detached from financial reality.

Sustainable Investment Strategies in Tech-Driven Markets

Surging neural interface technologies present genuine investment opportunities – but Zhejiang Dongri’s trajectory demonstrates critical due diligence requirements. Technical analysis and fundamentals must align before capital allocation: investors should prioritize enterprises with verifiable R&D expenditure, genuine academic partnerships, and prototype-stage technologies over nebulous associations.

Red Flags for Emerging Technology Investments

- Inconsistencies between official registrations and marketing claims

- Parent companies with unrelated core businesses

- Director backgrounds unrelated to claimed technologies

- Capitalization mismatch between claimed ambitions and funding

The Path Forward

The Zhejiang Dongri phenomenon exemplifies China’s growing pains balancing market innovation enthusiasm with rational capital allocation. While neural interface technologies hold transformative potential, concept-driven runs inevitably stabilize toward fundamentals. Investors navigating China’s technology equities must develop disciplined verification frameworks – separating genuine advancement from opportunistic market positioning. Ultimately, markets reward measurable progress over vague association, and Zhejiang Dongri’s trajectory remains a textbook case of speculative dangers emerging when technological aspirations collide with corporate reality.

For sustainable portfolio growth, prioritize enterprises demonstrating:

- Verifiable prototyping beyond press releases

- Revenue streams aligning with claimed technologies

- Patent holdings establishing competitive barriers

- Academic contributors publicly validating projects

Embrace emerging technologies judiciously using fundamental analysis identifiers – market opportunities exist beyond excitement cycles when approaching transformative technologies through diligent verification frameworks.