– Singapore maintains #1 position for luxury good prices globally for third consecutive year

– London surpasses Hong Kong to claim second place in luxury spending costs ranking

– Shanghai plummets from 2022’s top position to sixth place after sharp decline

– Global luxury basket prices fell 2% – first drop since tracking began in 2020

– Hong Kong’s new residency program attracts wealthy despite slipping ranking

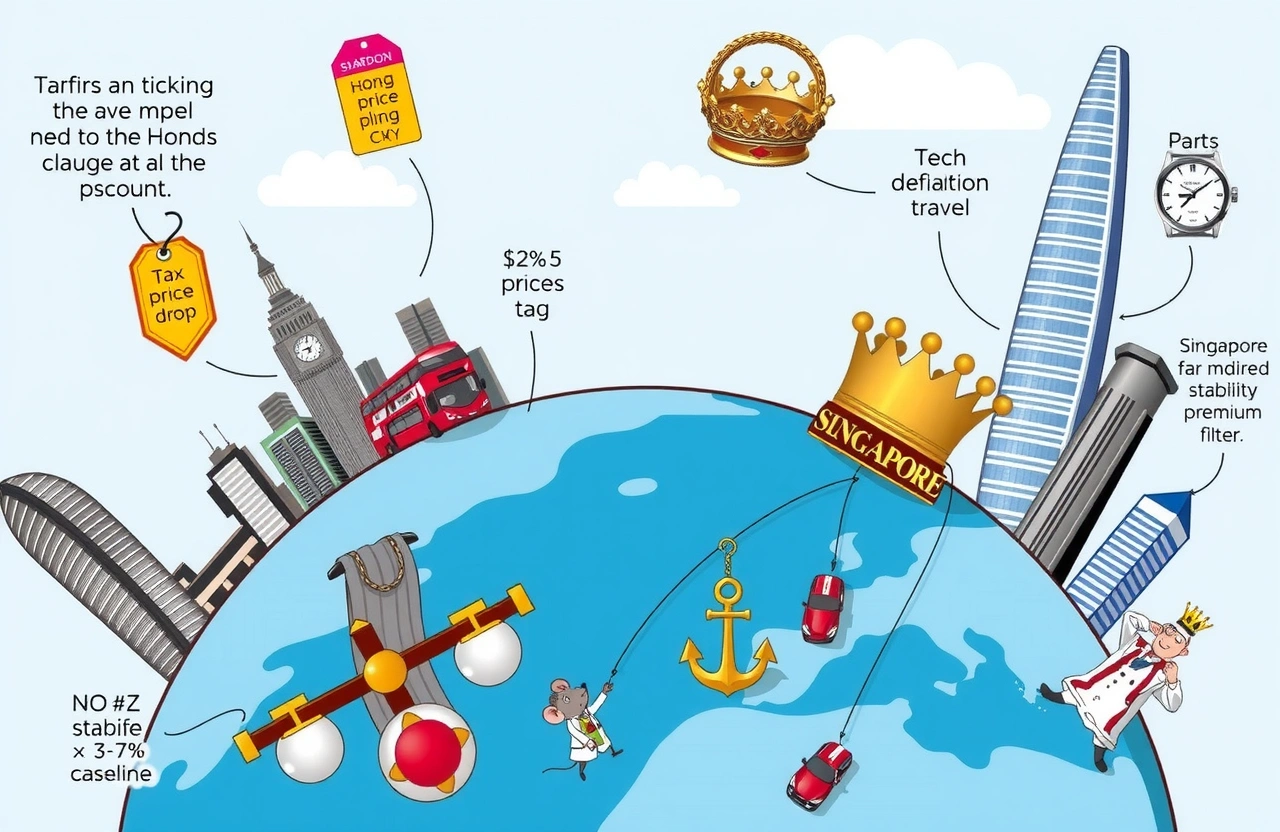

Singapore has reaffirmed its status as the world’s most expensive city for luxury consumption, marking the third straight year the Southeast Asian financial hub topped Julius Baer’s influential Global Wealth and Lifestyle Report. The comprehensive study examining luxury spending costs across 25 global cities reveals dramatic shifts in purchasing power dynamics, with London overtaking Hong Kong while Shanghai tumbled dramatically down the rankings. This unexpected reshuffling comes as the report documents the first-ever price decline in its luxury basket of goods and services since the survey’s inception – a 2% drop Julius Baer researchers characterize as exceptionally unusual for a sector historically showing inflationary resilience. The findings highlight how geopolitical stability, currency movements, and targeted policy initiatives are rapidly reshaping luxury spending costs across global financial centers.

Singapore: Unmatched Luxury Spending Costs Cement Leadership

True to its reputation as Asia’s premier wealth management hub, Singapore now commands the global pinnacle position for luxury spending costs. Several converging factors elevate the city-state above rivals:

– High import tariffs elevating costs for luxury automobiles (up to 220% tax)

– Premium real estate valuations translating to elevated retail rental rates

– Sustained demand from ultra-high-net-worth individuals (5.5% UHNWI population growth)

– Regional tourism recovery increasing competitive pressure on inventories

The Stability Premium Factor

Amid global turbulence, Singapore has leveraged its perceived safety and political continuity to attract capital. This ‘stability premium’ manifests across luxury spending costs through increased elite patronage and reduced discounting pressure. According to Julius Baer analysts, luxury brands maintain 3-7% higher baseline pricing locally, reflecting market confidence in the affluent consumer base and the absence of demand destruction through instability.

London’s Luxury Resurgence and European Counterparts

London staged a remarkable comeback in the luxury spending costs hierarchy, climbing to second position as it displaced its longtime Asian rival. Key drivers behind the shift:

– Sterling appreciation (13% against USD since last report)

– Luxury retailers absorbing Brexit trade complications via price adjustments

– Renowned craftsmanship traditions sustaining premium positioning

Following closely were European enclaves Monaco and Zurich, benefitting from concentrated wealth density that supports elevated price structures regardless of broader economic headwinds.

The Currency Conundrum

Currency fluctuations proved pivotal in altering luxury spending costs globally. The British pound’s strength exacerbated London pricing for international visitors while mainland China’s renminbi depreciation systematically lowered Shanghai’s relative standing. For luxury aficionados tracking purchasing power parity across financial centers, these foreign exchange movements created surprising expense realignments.

The Asian Slide: Hong Kong and Shanghai’s Position Shifts

Asia’s luxury landscape experienced seismic shifts, with previous titans conceding ground. Hong Kong dropped to third position after long dominating the luxury spending costs apex, while Shanghai’s sixth-place finish marked one of the most dramatic falls in the report’s history.

Primary factors behind the retreat:

– Hong Kong: Reduced mainland tourist volumes impacting sales velocity

– Shanghai: Ecommerce discounting wars compressing price points

– Regional competition from emerging Southeast Asian destinations

– Reduced foot traffic from international business visitors

Hong Kong’s Strategic Countermeasures

Despite its slip in luxury spending costs positioning, Hong Kong launched aggressive measures to retain financial prominence. The revamped Capital Investment Entrant Scheme offers residency through US$3 million investments, already generating what Julius Baer calls ‘substantial interest’ among billionaires hedging against geopolitical risks. Observers anticipate this may restore Hong Kong’s luxury expenditure leadership long-term.

The Anomaly: Luxury Prices Retreat Globally

Contrary to established economic assumptions, Julius Baer documented a 2% dip in its luxury basket prices – representing the first expenditure reduction in the report’s five-year history.

Noteworthy shifts driving this unexpected reset:

– Technology Deflation: Premium electronics costs dropped 6.2% year-on-year

– Travel Adjustment: International business class fares declined 11% post-pandemic surge

– Dining Readjustment: Fine dining costs retreated 3.7% from unsustainable peaks

– Fashion Recalibration: Designers reduced several accessory categories by 3-4%

Historical Context and Projections

Research Head Christian Gattiker contextualized the reversal: ‘Typically, luxury spending costs inflate at double consumer price acceleration. This retreat reflects a complex alignment of economic tremors before impending challenges.’ With tariff concerns emerging in key markets, this pricing ease may prove temporary as brands prepare for renewed manufacturing and distribution disruption.

Impact Factors Reshaping Future Luxury Spending Costs

Beyond currency valuations, fundamental transformations are reorienting luxury expenditure globally:

– Generation Evolution: Millennials and Gen-Z now drive 65% of purchases requiring digital-first strategies

– Supply Chain Reconfiguration: Increased ESG compliance adding 7-12% to production expenses

– Taxation Sensitivity: Property-based wealth taxes affecting discretionary budgets

– Experience Premium: Luxury travel overtaking goods in expenditure focus

The Destination Advantage Equation

Singapore’s success underscores that luxury ambition requires balanced strategy beyond retail offerings. Cities commanding premium spending costs increasingly leverage:

– Legal Safeguards: Intellectual property protection premium

– Logistics Synergies: Proximity to artisanal workshops and distribution hubs

– Lifestyle Perks: Safety, education, and healthcare infrastructures valued at ~18% premium

Accelerating this consolidation, the world’s twelve primary financial centers now capture 78% of high-value personal asset placements – creating reinforcing luxury ecosystem benefits.

Consumer Strategies Amid Price Volatility

Sophisticated shoppers navigate the shifting luxury spending costs landscape through deliberate approaches:

– Regional Alignment: Purchasing high-tax items in low-tariff zones

– Currency Arb Opportunities: Exploiting FX movements for cross-border acquisition

– Provenance Focus: Purchasing limited editions expected for valuation appreciation

– Portfolio Approach: Leveraging expert acquisition networks across jurisdictions

For high-value assets like watches, established collectors implement city-specific purchasing models saving 18-28% versus single-market acquisition cost structures.

Global Horizons in Premium Consumption

The Julius Baer index provides sobering perspective on luxury accessibility gaps worldwide. An equivalent basket consuming:

– Singapore: Requires 2.8% average household income

– Shanghai: Now demands 1.9% of household resources

– Mexico City: Absorbs just 0.4% of resident earnings

Such discrepancies fuel divergence where premium brands calibrate product assortments, marketing, and pricing tiers to region-specific socioeconomic conditions.

Julius Baer’s findings demonstrate that luxury spending costs serve as precise thermometers for financial stability, wealth concentration, and consumer confidence differentials across global capitals. While Singapore’s triple crown achievement underscores its institutional strengths, London’s ascent and the Shanghai adjustment reveal market fluidity beneath incremental rankings. For international consumers and investors, this report codifies practical approaches to premium consumption: monitoring tariff windows, leveraging diplomatic distribution routes, and recognizing when regional pricing anomalies represent opportunity rather than excess. As the luxury sector absorbs rising trade friction while catering to evolving generational priorities, understanding these spending cost variances has become essential navigation knowledge. Subscribe for our breakdown of quarterly luxury sector investment prioritizations based on these adjusted rankings.