Election Countdown Fuels Yen Vulnerability

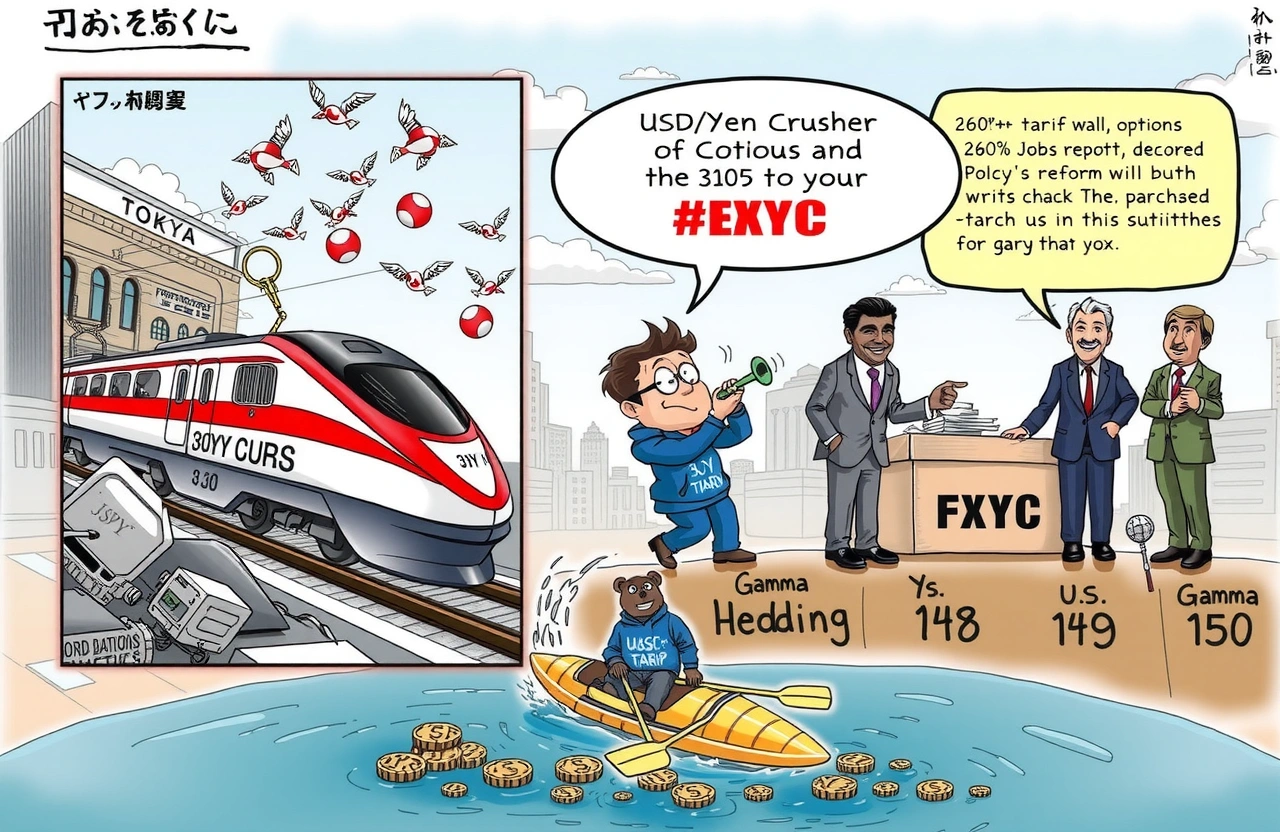

Tokyo’s financial markets brace for tectonic shifts as Japan’s July 20 Upper House election approaches, with investors accelerating bearish bets against the yen. Polls indicate Prime Minister Fumio Kishida’s ruling coalition may lose its Upper House majority—a scenario that could paralyze fiscal decision-making amid Japan’s unsustainable debt trajectory. Currency traders now flood derivatives markets with USD/JPY call options, strategically positioning for the Japanese currency’s decline toward the psychologically critical 150 level.

Key Election Implications

-

– Ruling coalition faces 50/50 odds of losing Upper House control per UBS analysis

– Opposition gains could trigger consumption tax cut debates, worsening fiscal concerns

– Dual-chamber deadlock risk threatens economic reform momentum

The resurgent yen shorts materialized rapidly: CME data reveals July 11 saw USD/JPY call option volume double put contracts. Simultaneously, CFTC reports show asset managers holding 89,331 net long USD/JPY futures contracts—the most lopsided positioning since spring. This concentrated bet exploits structural vulnerabilities exposed by Japan’s political calendar.

Derivatives Market Signals Intensify

Foreign exchange desks report unprecedented demand for election-timed derivatives. ‘There’s explosive interest in one-month USD/JPY call options precisely covering the election window,’ notes Graham Smallshaw (斯曼绍), Nomura’s senior FX trader. ‘Traders anticipate election turbulence amplifying existing U.S.-Japan trade uncertainties.’

The Technical Setup

– Current USD/JPY trading range: 147.00-147.50

– Key technical target: 200-day moving average at 149.71

– Barrier options accumulating north of 150.00

Citi’s Japan markets chief Akira Hoshino (星野昊) confirms institutional accumulation continues: ‘We see funds layering USD/JPY longs pre-election, expecting yen weakness across multiple pairs.’ The strategic reloading of resurgent yen shorts demonstrates conviction in breaking spring’s consolidation pattern.

Bond-JPY Nexus Accelerates

Long-dated JGB yields skyrocket as elections approaches:

-

– 30-year yield surges 12.5bps to 3.165% (near May record)

– 20-year yields hit 2.625%—highest since 2000

– 40-year yields spike 17bps to 3.495%

‘USD/JPY now trades with an 89% correlation to 30-year JGB yields,’ explains HSBC strategist Paul Mackel. ‘Each basis point increase in the super-long sector translates to approximately 0.35 yen depreciation.’ This linkage makes JGB auctions critical directional triggers.

Fiscal Domino Effect

Election pressures already force fiscal reconsiderations. With Japan’s debt-to-GDP approaching 260%, competitive local infrastructure pledges could sabotage the BOJ’s normalization roadmap. UBS economist Daiju Aoki (青木大树) warns losing Upper House control may ‘spark consumption tax debates, worsening debt concerns.’

The synchronized bond-currency resurgent yen shorts trade reflects Japan’s policy trilemma: Stimulus needs conflict with yield curve control credibility and exchange rate stability.

External Catalysts Amplify Momentum

Global developments strengthen the bearish yen case:

-

– U.S. non-farm payrolls beat (206K jobs) delays Fed pivot expectations

– Trump threatens auto tariffs jumping to 25% post-August 1

– Positive U.S. inflation prints revive dollar carry trade appeal

Carry Trade Renaissance

‘Robust U.S. data recalibrated Fed cut timelines,’ observes Nomura’s Smallshaw. ‘This revives funding-currency demand for yen.’ With BOJ rates frozen near zero against 5.5% Fed funds, the interest differential powers textbook carry flows into higher-yielding assets.

Traders implementing resurgent yen shorts now monitor Friday’s U.S. retail sales data—another upside surprise could validate funding-currency dynamics ahead of election weekend.

Tactical Positioning Ahead of Election Day

Sophisticated money reduces exposure to binary outcomes:

-

– Staggered option structures hedge against unexpected coalition survival

– Gamma hedging increases near strike concentrations at 148/149/150

– Rotation into USD/CNH longs offsets concentrated Japan exposure

The tactical caution stems from BOJ surprise capacity. Despite election noise, Governor Kazuo Ueda retains tools including unscheduled bond buying or emergency FX intervention. Still, sustained JGB weakness suggests limited direct support until yields threaten financial stability.

Post-Election Pathway

Bank of Tokyo-Mitsubishi strategists outline potential scenarios:

-

– Ruling coalition holds: Brief JPY rally quickly reversed on fiscal realities

– Opposition gains: Accelerated yen depreciation toward 152

– Under either outcome higher JGB yields structurally weaken JPY

Foreign reserves offer potential relief valve intervention potency. Japan’s $1.3 trillion warchest remains formidable, though deployment requires bureaucratic coordination and political cover. Any intervention below 150 may prove unsustainable unless synchronized with U.S. Treasury support.

Critical Tax Policy Shift

The election’s greatest policy impact could come through consumption tax debates. With sales tax contributing 18% of revenues, any downward revision threatens to widen Japan’s primary deficit—already projected at 3.2% of GDP for 2025.

This fiscal imbalance underpins structural bearishness behind today’s calculated resurgent yen shorts positioning. Unlike spring’s momentum-driven shorts, current exposure prioritizes yield divergences and fiscal deterioration visible beyond election cycles.

Strategic Trading Considerations

Risk-tolerant positions emerge:

-

– Three-month USD/JPY call spreads capturing move through 150

– JPY-weighted baskets versus AUD/CAD commodity exporters

– Selective long JGB volatility options hedging tail risks

The asymmetric setup affords stronger position construction than speculative spring positioning. With U.S.-Japan trade friction escalating at precisely the moment Japan faces political transition, leveraged funds target strategic advantages absent immediate intervention threats.

Election results won’t alter Japan’s fundamental fiscal trajectory—prolonging BOJ policy divergence preserves resurgent yen shorts viability through December BOJ meetings.

For tactical traders, liquidity conditions remain favorable: Bid/ask spreads on USD/JPY one-month options compressed to sub-$400,000 per contract—well below April premiums. Major banks quoting back-month volatility legs suggests institutional acceptance of elevated JPY risk.

Beyond election headlines confirms sustained JPY weakness requires concurrent Treasury yield expansion and stagnant Fed dovishness—a narrow path markets currently deem probable. Position sizing remains paramount amid potential BOJ surprises.