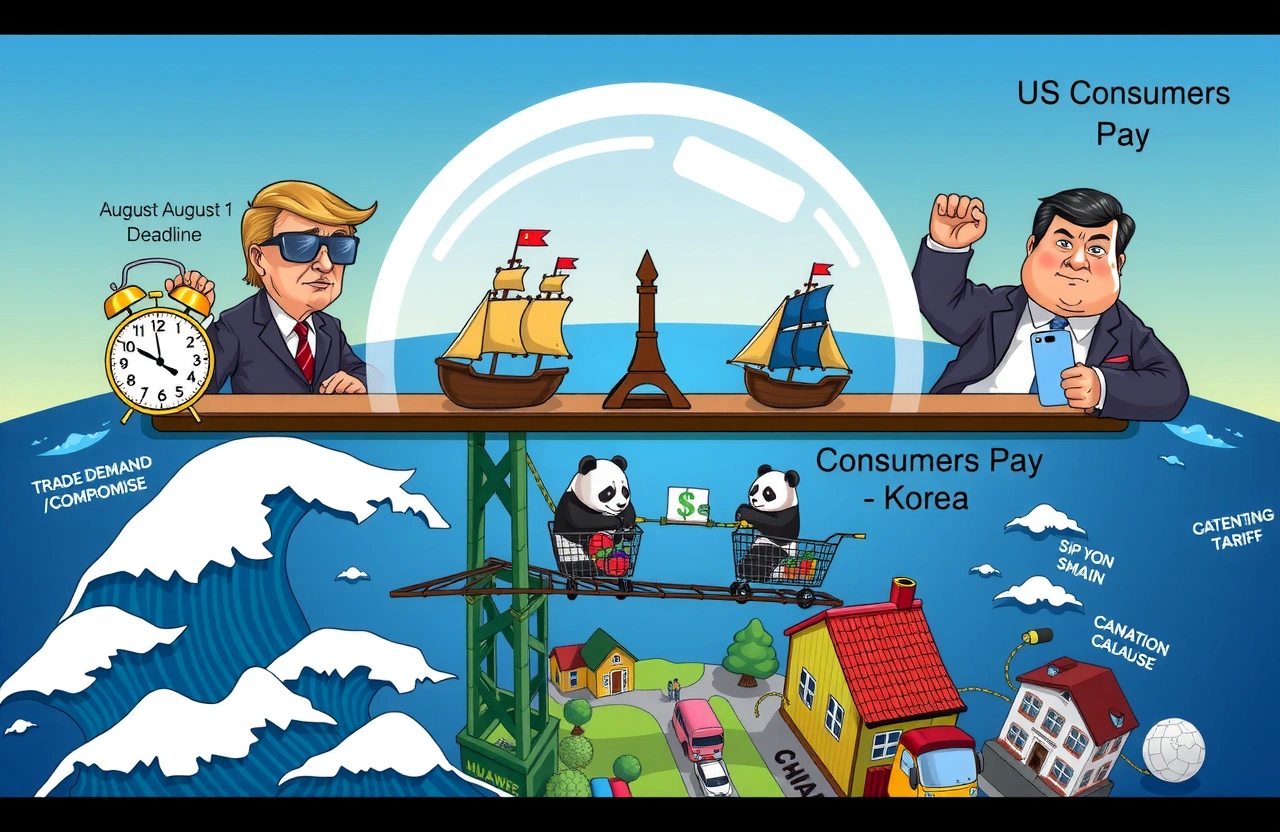

– Trump announces 25-40% tariffs on Japan, Korea, South Africa and others, delayed until August 1

– US explicitly leaves door open for trade negotiations despite pressure tactics

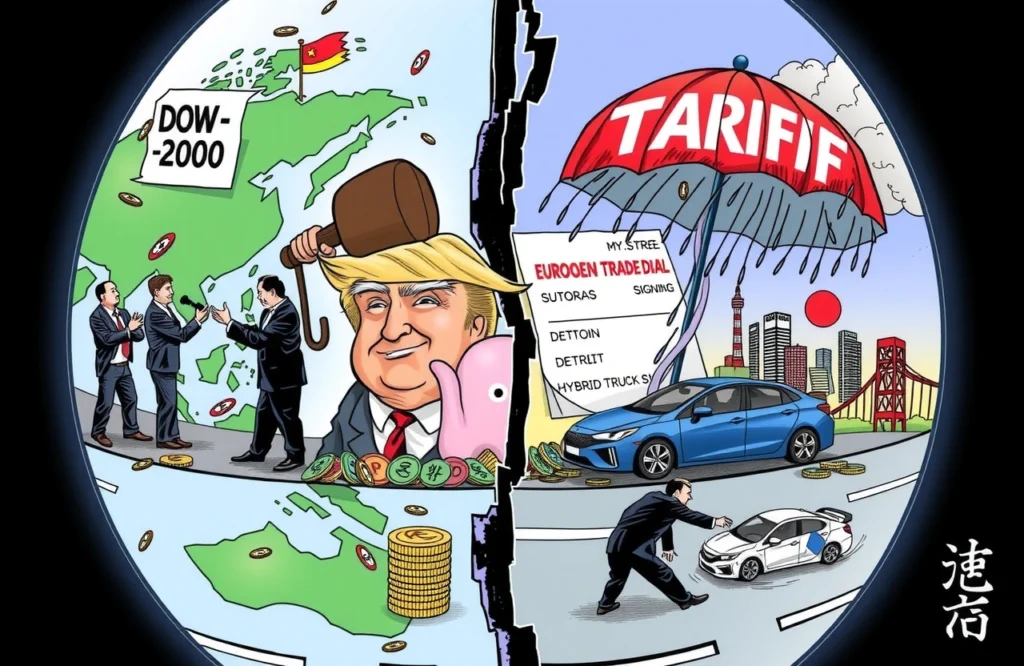

– Markets react sharply: Asian currencies tumble, automaker stocks plummet

– Complex trade negotiations loom as allies face political constraints at home

President Trump unveiled long-anticipated tariffs targeting key trading partners this week, but crucially delayed implementation until August 1 while explicitly signaling openness to trade negotiations. The surprise move offers a three-week window for affected nations—including major US allies like Japan and South Korea—to negotiate trade deals before steep tariffs of 25-40% take effect. This flexibility reflects Trump’s pattern of escalating pressure before potentially walking back demands through trade negotiations, though the current strategy risks market instability and diplomatic friction during the negotiation period. As White House Press Secretary Levy described it, targeting specific nations first reflects “presidential prerogative,” yet the administration simultaneously claims it’s “nearing” agreements with other partners, highlighting the administration’s dual-track approach to trade negotiations.

The Tariff Blueprint: Selective Pressure With Escape Hatches

President Trump strategically announced varying tariff rates against different trading partners, applying maximum pressure while building in negotiation flexibility.

Nation-Specific Tariff Matrix

Rates target specific vulnerabilities while exempting certain sectors:

– Japan & South Korea: 25% (excludes auto sector facing separate tariffs)

– Malaysia, Kazakhstan, Tunisia: 25%

– South Africa: 30%

– Laos & Myanmar: 40%

– Indonesia: 32%

– Bangladesh: 35%

– Thailand & Cambodia: 36%

– Bosnia and Herzegovina: 30%

– Serbia: 35%

The deliberate three-week delay provides essential breathing room for trade negotiations. Trump specifically stated the August 1 deadline is “not 100% certain” and the rates could be “tweaked,” directly referencing ongoing trade negotiations as a variable. His executive order formally implements this flexibility, creating a structured framework for trade negotiations while maintaining tariff leverage.

Market Tremors: Immediate Financial Fallout

Financial markets reacted instantly to the tariff announcements, signaling investor concern about global trade disruption despite negotiation opportunities.

Equity and Currency Impacts

By market close:

– S&P 500 dropped 0.8%

– NASDAQ 100 declined 0.8%

– Dollar index hit one-week high

– Japanese yen depreciated over 1%

– South Korean won fell more than 1%

– South African rand dropped over 1%

Major industrial stocks suffered significant blows during trade negotiations uncertainty:

– Toyota’s American Depositary Records plunged 4.3%

– Honda’s ADRs fell 3.9%

The Bloomberg US Trade Uncertainty Index, while down from April peaks, remains significantly higher than pre-election levels, reflecting persistent market anxiety during trade negotiations periods. These fluctuations highlight how trade negotiations create costly economic uncertainty even before implementation.

Negotiation Complexities: Political Minefields Abroad

Several targeted nations face domestic political obstacles that complicate trade negotiations with aggressive US timelines, potentially testing diplomatic relationships during trade negotiations.

Allies Under Pressure

Japan and South Korea—both key US military allies in Asia—present particularly delicate challenges:

– Japanese Prime Minister Fumio Kishida faces declining popularity and an unsteady coalition government

– South Korea grapples with contentious parliamentary dynamics following recent elections

Smaller economies like Laos and Cambodia have limited trade negotiation resources and bandwidth, placing them at significant disadvantage despite the additional time. Crucially, these nations must weigh tariff relief against other non-economic considerations, including:

– Precedent setting for other bilateral agreements

– Sovereignty concerns in trade negotiation frameworks

– Domestic industry impacts beyond tariffs

These constraints may force nations to make politically risky concessions during compressed trade negotiations, especially given the US threat assessment capabilities highlighted by White House Press Secretary Levy.

Economic Realities: Who Bears Tariff Costs?

Amidst the rhetoric of “fair” trade negotiations, economic analysis confirms US companies and consumers ultimately shoulder tariff burdens despite diplomatic claims otherwise.