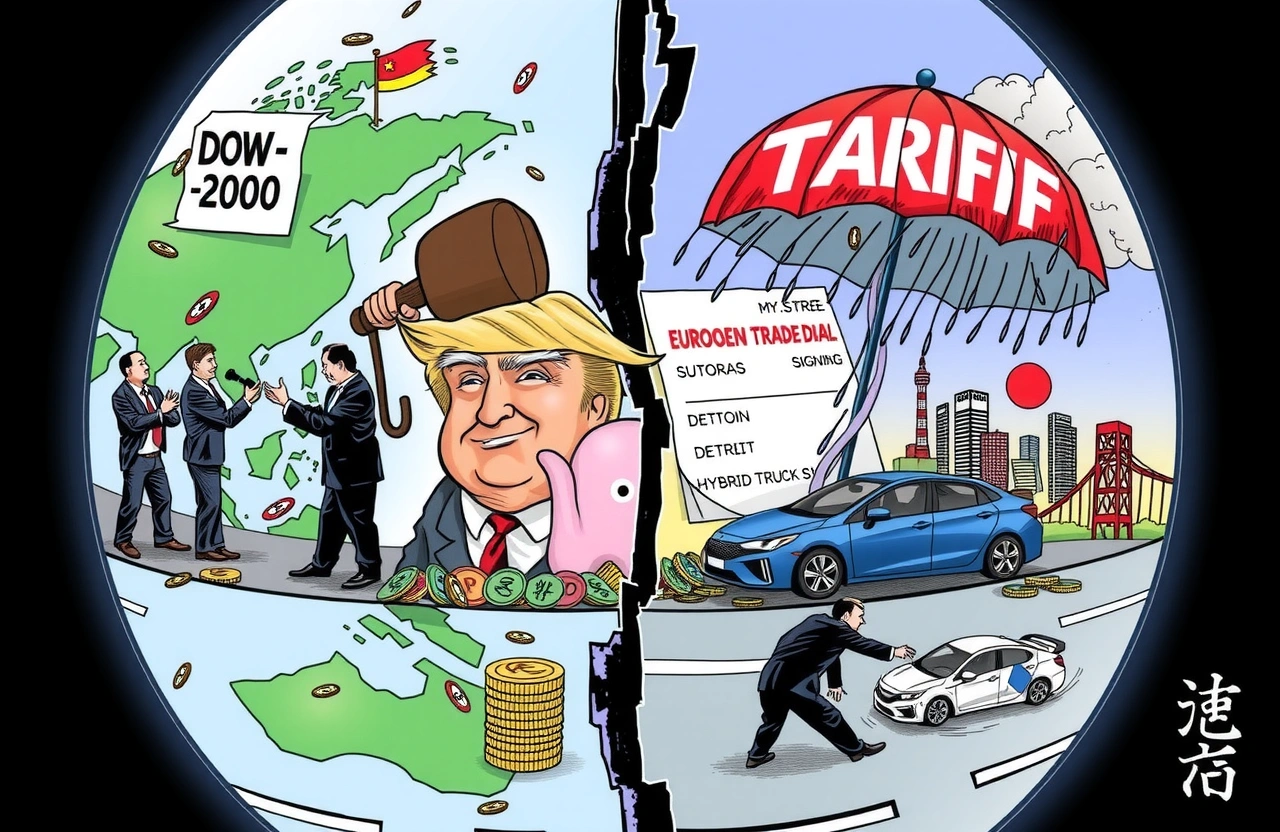

– Sweeping tariffs: Trump targets Japan, South Korea and 12 other nations with import duties effective August 1, causing immediate market disruption. – Financial tremors: US stocks see biggest drop in three weeks as auto stocks plunge and dollar surges against Asian currencies. – Corporate fallout: Honda halts EV projects, Nissan races to raise funds, Toyota shares drop 4% on tariff impacts. – High-stakes negotiations: EU rushes to secure interim trade deal before August deadline to avoid 50% tariff catastrophe. The thunderclap echoed through trading floors from New York to Tokyo when former President Donald Trump announced sweeping tariffs on 14 major economies. Coming without warning, the Aug. 1 deadline sent U.S. stocks tumbling and triggered currency tremors across Asia. This latest escalation in Trump’s tariff war threatens to derail corporate strategies from Stuttgart to Seoul, forcing manufacturers into emergency survival mode while the world waits to see if Brussels can avert catastrophe through last-minute negotiations.

Trump’s Tariff Offensive Unveiled

Following weeks of speculation, Donald Trump confirmed new tariffs targeting key allies including Japan and South Korea. The measures, confirmed through Reuters sources, mark an aggressive expansion of Trump’s protectionist agenda during his reelection campaign. All fourteen affected nations face duties across multiple product categories, though the announcement notably excluded critical relief timelines for some sectors. International trade experts warn these Trump tariffs could potentially ignite retaliatory responses through complex global trade disputes.

Comprehensive Coverage: Who Gets Hit

The presidential proclamation confirms Japan and South Korea face a staggeringly high 25 percent duty rate on select exports to America. Market analysts confirm at least twelve additional trading partners now face tariff threats that have not yet been formally disclosed. These measures follow Trump’s earlier warnings against potential retaliation from the U.S. government in ongoing global economic disputes. All of these developments underscore the volatile nature of current geopolitical trade relations under the Trump administration’s hawkish approach.

EU’s Provisional Lifeline

While most nations face imminent tariffs, the European Union temporarily dodged immediate disaster. Trump unexpectedly delayed impending US tariffs on EU goods until early August, creating a narrow negotiating window. According to Bloomberg sources, EU trade envoys urgently seek exemptions worth billions – particularly for aircraft components and specialty spirits – as part of a framework agreement. Without a last-minute deal, EU exports would face catastrophic 50 percent duties instead of 10 percent.

Financial Shockwaves Spread Globally

Within hours of Trump’s tariff announcement, financial markets began reflecting the gravity of the new economic reality. The precedent remains crystal clear: whenever Trump threatens significant tariffs, market instability follows. Despite that obvious pattern, many seasoned Wall Street players seemed unprepared for this economic storm level of disruption that quickly materialized.

Equity Markets Tumble

U.S. markets led the financial retreat: – The S&P 500 index declined nearly 0.8 percent, the worst single-day performance in three weeks – Japan’s Nikkei 225 futures signaled a 0.5 percent drop at the Tokyo open – Wall Street analysts confirmed similar Trump tariff threats had created significant market turbulence throughout recent years. That lingering apprehension influenced investors’ increasingly defensive positioning heading into these renewed global trade tensions.

Currency and Commodity Turbulence

Currency markets reflected accelerating uncertainty about tariff pressures: – The U.S. dollar surged against major global currencies amid perceived safe-haven demand – Both Japanese yen and South Korean won fell sharply, dropping over 1 percent against the strengthening dollar Geopolitical risk escalated further as commodity prices fluctuated unpredictably following this latest round of trade-related developments. The combination of currency movements and Trump tariffs creates dangerous crosscurrents for multinational corporations using complex hedging strategies.

Automotive Industry Under Siege

Automakers globally face acute exposure to the new Trump tariffs. Supply chains stretching from Detroit to Fukushima face restructuring as the world’s major vehicle manufacturers begin reassessing their business strategies in response to these challenging new trade conditions. Trump tariffs quickly translated into steep stock declines across the entire global auto sector.

Japanese Auto Giants Stumble

U.S.-listed shares for major Japanese brands nosedived immediately: – Toyota shares dropped 4 percent during Monday trading – Honda shares declined 3.9 percent during the same volatile session – Mazda stocks plummeted more than 5 percent, showing investor fears This significant erosion of market value reflects apprehension about Trump tariffs significantly impacting the business models for Japanese automakers reliant on cross-border supply chains spanning numerous nations.

Premium European Brands Struggle

Mercedes-Benz announced its passenger vehicle and van sales collapsed 9 percent throughout the second quarter primarily because of cascading tariff pressures. The company reported particularly damaging declines in core American markets: – Total second quarter global deliveries fell sharply to 547,100 units – Electric vehicle sales plummeted even more dramatically, down 18 percent to just 41,900 The brutality of these Trump tariffs creates fundamental challenges for European automakers’ carefully laid business strategies intended to fund their shift toward electrification.

Corporate Reckoning: Adapt or Fail

Executives from Detroit to Yokohama initiated emergency board meetings following Trump’s latest tariff threat. Some manufacturers immediately implemented significant strategic shifts while others accelerated financing moves to build critical war chests for navigating this increasingly uncertain world of trade tensions. The common denominator: nearly every multinational corporation must reconsider business planning in the shadow of Trump tariffs.

Honda’s Pivot to Hybrids

Honda Motor executives confirmed they canceled the development of their flagship electric SUV as Trump tariffs reinforcing weakening U.S. EV demand. Nikkei Asia reports the company will instead redirect significant resources: – Prioritize hybrid vehicle production with stronger near-term profitability – Review all electric vehicle commitments under original manufacturing plans Completely terminating the large SUV marks a sharp reversal from Honda’s previous commitment to introduce seven electric models before 2030.

Nissan’s Emergency Financing

Nissan raced to raise $4 billion through innovative bond sales as preemptive insurance against corporate uncertainty. The Japanese automaker plans important capital allocation: – Fuel accelerated electrification research efforts – Protect vital new technology development funding The company announced an ambitious financing strategy combining convertible and traditional bonds despite market jitters driving Nissan shares down 5 percent in domestic trading.

The EU’s Race Against Time

European Union trade negotiators scramble to secure interim agreements before the August deadline triggers potentially devastating economic catastrophe. Brussels aims to broker a narrow escape before Trump tariffs escalate from burdensome to ruinous for EU exports destined for huge U.S. markets.

Framework Deal Requirements

EU Commission envoys presented member states with urgent proposals to establish temporary relief: – Securing special exceptions for aircraft and spirits from punitive Trump tariffs – Preventing duty rates surging from 10 percent to an untenable 50 percent – Establishing formal negotiation parameters for comprehensive long-term agreement European officials confirmed maintaining intense negotiations but declined providing specific concessions sought to avoid punishing tariff scenarios once the current grace period expires.

Political Shockwaves Beyond Trade

Trump tariffs create collateral damage beyond industrial supply chains, capturing Elon Musk directly in their geopolitical wake. Tesla shares plunged 6.9 percent Monday primarily because market signals suggest complex political entanglements magnify corporate exposure beyond pure economic considerations.

The Musk Factor: Political Gambles Backfire

Investor approval of Elon Musk plummeted as news surfaced regarding his own ambitious political strategy: – Musk floated creating a possible “America Party” on platform X – Significant shareholder disapproval followed these political aspirations as evidenced by sharp stock declines His perceived connections with Trump compounded Wall Street anxieties, becoming costly distractions according to finance veterans. Tesla stock plunged 40 percent from its December peak even before absorbing these additional tariff pressures.

Global Backlash and Strategic Maneuvering

World leaders immediately pushed back against Trump’s tariff offensive through both diplomatic channels and public confrontations. Brazil’s President Luiz Inácio Lula da Silva (卢拉) delivered a blistering rejoinder: “The world changed, we don’t need emperors.” Japanese officials meanwhile sought openings for negotiation despite anxiety including the possibility of generating tremendous political consequences leading to leadership changes inside their government. These developments reveal increasing pushback against Trump tariffs across global capitals and the emerging world order.

Contingencies and Survival Tactics

Multinational corporations must prepare immediately for tariff escalations and extended financial uncertainty. Global trade now depends on complex planning that includes: – Developing diversified manufacturing footprints across multiple nations – Maintaining larger cash reserves specifically for absorbing unexpected duties – Modeling worst-case scenarios including potentially significant delays in negotiations Finance professionals should actively reassess portfolio exposure while business strategists should explore creative free trade alternatives beyond traditionally concentrated markets.

Navigating Uncharted Territory

The unprecedented scale of Trump tariffs demands coordinated responses extending beyond national boundaries. Multinationals must engage allies, industry coalitions and governments to craft pressure points for bargaining. Investors should actively monitor ongoing developments across critical geographies while preparing hedging strategies mitigating currency and equity turbulence simultaneously. Neither capitulation nor confrontation offers simple solutions – corporate diplomacy becomes paramount. Surviving this trade war requires agility, clever positioning and resilience precisely when political shockwaves create significant operational challenges worldwide. The path forward means making proactive moves today, rather than reacting belatedly to chaotic consequences tomorrow.