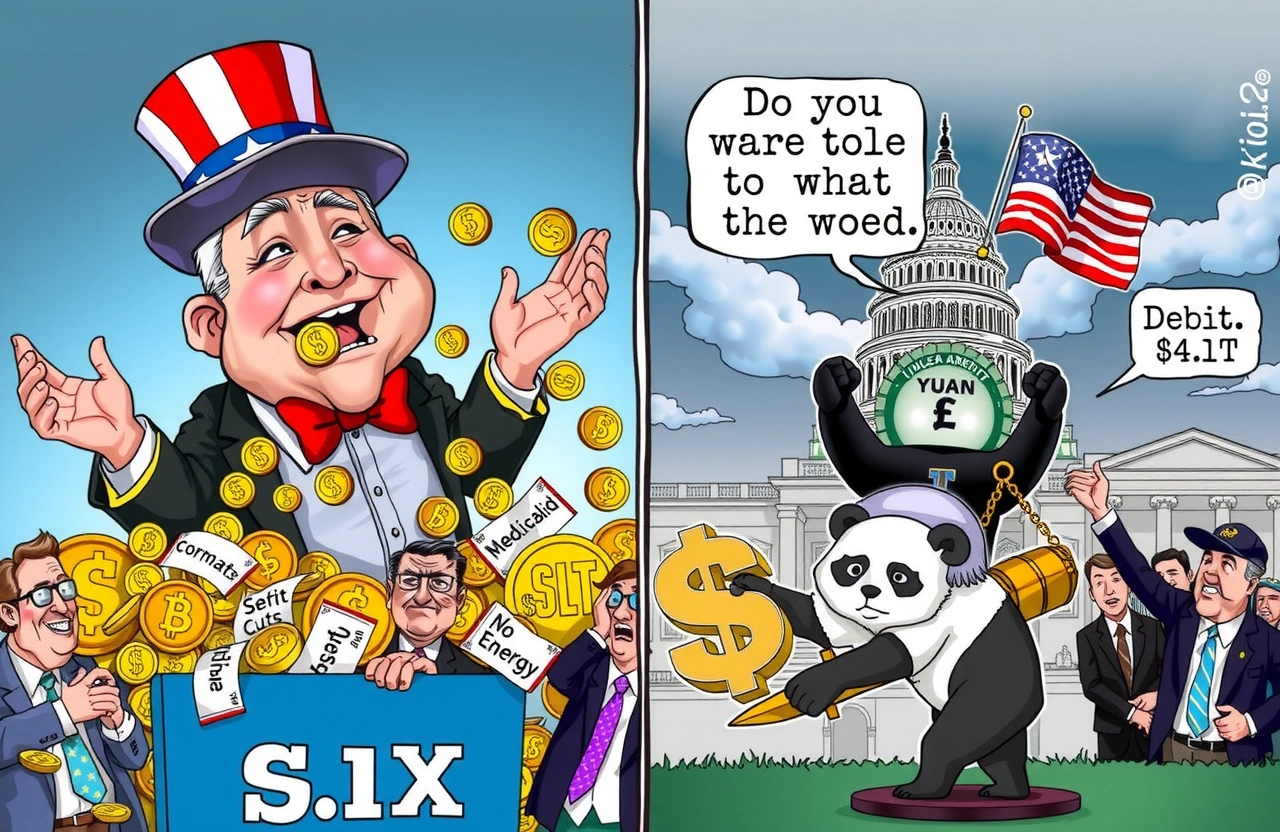

America’s Landmark Economic Legislation

Former President Donald Trump signed the $4 trillion ‘Big and Beautiful Act’ into law on July 4, 2025, triggering immediate market reactions and policy debates. This sweeping legislation extends corporate tax cuts while imposing deep Medicaid reductions, creating sharp divisions – Morning Consult polls show 50% voter disapproval against 36% support. As the S&P 500 hit record highs following its passage, concerns mount over the projected $4.1 trillion debt surge through 2034. Our analysis examines how this Big and Beautiful Act reshapes U.S. industry portfolios and dollar-denominated assets amid conflicting market signals.

Anatomy of the Big and Beautiful Act

The package merges corporate tax incentives with social spending cuts, prioritizing military funding while dismantling clean energy programs. Its passage narrowly overcame Senate resistance through procedural maneuvers tied to debt ceiling negotiations.

Corporate Tax Windfalls

Key business provisions include:

– Full cost expensing restoration allowing immediate deduction of equipment purchases

– Semiconductor manufacturing tax credits exceeding $52 billion

– Extended R&D amortization benefitting tech giants

Business Roundtable CEO Joshua Bolten praised these measures: ‘The Big and Beautiful Act unlocks capital investment precisely where America needs industrial renewal.’ However, Tesla CEO Elon Musk (马斯克) countered: ‘Destroying clean energy incentives to subsidize legacy industries is economically irrational.’

Controversial Social Cuts

The Medicaid overhaul introduces:

– Strict work requirements demanding 80+ monthly hours

– Coverage verification procedures starting in 2027

– State funding caps forcing eligibility reductions

According to KFF research, these changes could strip coverage from 11.8 million Americans. Missouri Senator Josh Hawley (乔希·霍利) warned colleagues: ‘Trading healthcare for tax cuts is both morally indefensible and politically suicidal.’

Market Reactions Diverging

Equity Market Euphoria

Despite deficit concerns, the S&P 500 surged 7% YTD as the Big and Beautiful Act cleared Congress. Morgan Stanley strategist Michael Wilson (迈克尔·威尔逊) projects further gains: ‘We maintain our 6,500 price target based on earnings resilience and anticipated Fed rate cuts.’ Drivers include:

– Tech sector profits exceeding estimates by 6 percentage points

– Dollar weakness boosting multinational overseas revenue

– Vietnam trade deal reducing tariff uncertainty

BlackRock’s investment committee confirms: ‘We retain overweight U.S. equities positions due to AI leadership and corporate adaptability.’

Fixed-Income Anxiety

Standard Chartered strategist Eric Robertsen (罗伯逊) observes: ‘The Big and Beautiful Act refocuses attention on deteriorating U.S. fiscal health. We expect Treasury volatility to intensify as yields climb.’ Key pressure points:

– $1 trillion debt maturities requiring refinancing

– Thirty-year yields testing 5% resistance

– Foreign holders reducing exposure

PIMCO’s Andrew Balls adds: ‘While terminal rates near 3.25% are achievable, duration positioning favors 5-10 year maturities over long bonds.’

Dollar Dominance Under Pressure

The greenback has surrendered all Fed-hike gains, with EUR/USD rising 14% as the Big and Beautiful Act compounded deficit worries. Though 90% of global transactions remain dollar-denominated, Eric Robertsen notes: ‘Investors are actively diversifying from overweight dollar positions after decades without alternatives.’

The Dollar Substitution Debate

Contrasting views emerge:

– Euro’s 2025 surge suggests diversification momentum

– Structural barriers prevent rapid reserve shifts

– U.S. asset managers see 10%-20% dips as historically normal

‘Currency shifts take generations, not legislation cycles,’ notes a custody bank strategist. ‘Dollar displacement requires rewriting global operating systems.’

Strategic Portfolio Implications

Equity Allocations

The Big and Beautiful Act creates selective opportunities:

– Domestic manufacturers gain immediate expensing advantages

– Pharma/insurance firms benefit from Medicaid redesign

– Tech remains resilient via global revenue streams

Fixed-Income Positioning

Duration strategy adjustments recommended:

– Underweight 30-year Treasuries

– Focus on 3-7 year corporate debt

– Monitor municipal bonds for Medicaid fallout

Currency Hedging Approaches

With dollar volatility elevated:

– Increase non-USD reserve allocations incrementally

– Implement option collars above EUR/USD 1.20

– Monitor central bank diversification signals

Navigating the Fiscal Transformation

While the Big and Beautiful Act boosts near-term corporate earnings, its long-term debt consequences demand vigilance. Tactical pivots toward multinational equities and shortened Treasury exposure mitigate emerging risks. Investors should monitor three unfolding developments:

– Medicaid litigation challenging 2027 work requirements

– Semiconductor capex response to manufacturing credits

– Treasury auction demand indicators

As yield curves steepen and dollar alternatives gain attention, diversified portfolios offer resilience amid America’s fiscal recalibration. Consult asset managers biweekly to navigate this reshaped landscape.