Record-Breaking IPO Performance

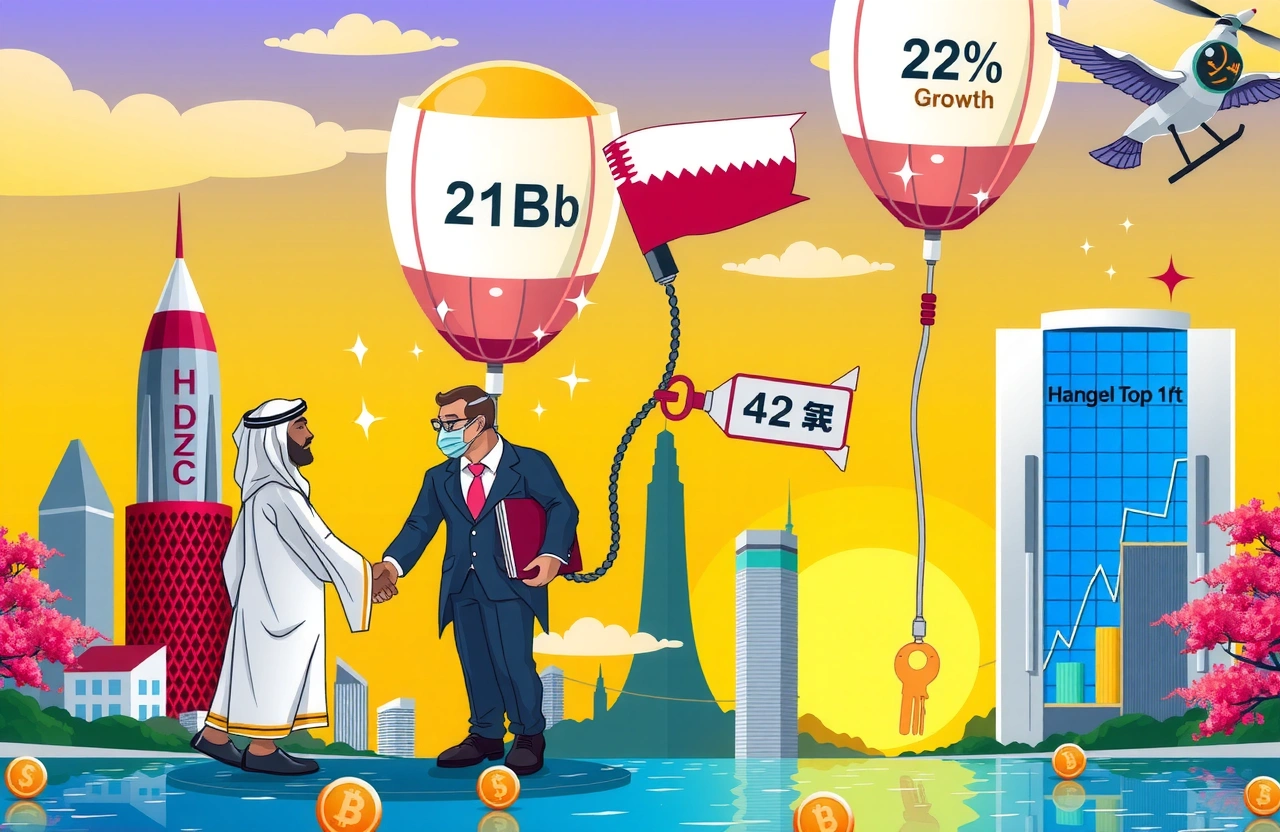

Hong Kong has seized the title of world’s top IPO destination during the first half of 2024, completing 42 initial public offerings that raised over HKD 107 billion (USD 13.7 billion). This staggering achievement represents a 22% increase over the entire previous year’s fundraising volume, placing Hong Kong firmly at the forefront of global capital markets according to data from HKEX.

Explosive Market Growth Metrics

The IPO surge accompanied broad market gains across Hong Kong exchanges. The benchmark Hang Seng Index climbed 20% during the period, adding over 4,000 points – marking its strongest first-half performance in history by point growth. Financial Secretary Paul Chan Mo-po (陈茂波) highlighted this milestone: ‘This achievement demonstrates Hong Kong’s robust market infrastructure and international appeal as a fundraising hub.’

Historic Context of IPO Dominance

Beyond claiming the global first position, the territory’s IPO volume substantially outperformed major exchanges:

– Dollar volume exceeded London and Tokyo exchanges combined

– Average deal size grew 37% year-over-year

– Private tech enterprises comprised nearly 40% of listings

Market Drivers Behind Hong Kong’s IPO Leadership

Several converging factors propelled Hong Kong’s capital markets to global prominence:

Strategic Geographic Positioning

Hong Kong’s location and regulatory framework have attracted unprecedented participation from Middle Eastern and Southeast Asian firms. Approximately 200 IPO applications are currently pending – double the applications recorded at the start of 2024. Major sovereign wealth funds from Qatar and Saudi Arabia supported recent listings by Abu Dhabi healthcare provider Burjeel Holdings and Singapore logistics provider CWT Systems.

Innovation-Led Growth Strategy

‘Innovation creates incremental growth – which in turn stimulates broader economic development,’ explained Chan. Exchange Traded Products (ETPs) emerged as crucial liquidity drivers, with HKEX actively developing theme-based ETFs spanning:

– ESG-focused renewable energy/climate solutions

– Frontier biotech innovation

– AI-powered technology platforms

– Blockchain/digital asset infrastructure

Market diversification reduced dependence on traditional financial listings while capturing investor enthusiasm for transformative technologies.

Vital Role of Exchange Traded Products

A quiet revolution in Hong Kong’s ETP ecosystem supported IPO growth:

Unprecedented Scale Expansion

ETP assets hit HKD 510 billion (USD 65.3 billion) in May – a 30% increase since 2020 while daily trading volume quintupled to nearly HKD 40 billion over the same period. Among the territory’s 210+ ETP products, digital asset offerings showed particularly explosive growth:

– Digital asset ETP assets totaled HKD 47 billion (USD 6 billion) as of June

– Year-over-year growth of 74% despite cryptocurrency volatility

– Asia’s first physical asset-linked ETFs launched successfully

International Hub Creation Catalyst

Hong Kong’s emergence as Asia’s premier ETP hub accelerated when the world’s fifth-largest ETF (>USD 300bn AUM) issued dual listings in Hong Kong and New York last February. Chan emphasized: ‘By satisfying investor appetites while directing capital toward high-growth sectors, we’re building Hong Kong’s status as Asia’s preferred ETF nexus.’

Market Correction Analysis and Valuation Positioning

Despite July’s mild pullback (Hang Seng down 1.52%, Tech Index down 2.34% through last week), fundamentals remain strong:

Comparative Global Valuation Metrics

Galaxy Securities analysts confirmed Hong Kong’s compelling pricing:

– Hang Index PE at 10.65x (73rd percentile since 2019)

– Hang Index PB at 1.12x (75th percentile)

– Tech Index PE at 19.76x – below 10th percentile historical range

‘In global equity rankings,’ their report stated, ‘Hong Kong offers notable absolute valuation advantages despite temporary volatility.’

Geopolitical Impact Assessment

Tariff tensions, Middle Eastern uncertainty, and bond yield fluctuations created headwinds but failed to derail Hong Kong’s competitive positioning. As Skybound Research’s TMT International Director Clarisse Kong (孔蓉) observed: ‘Hong Kong maintains pricing attraction versus global peers as evidenced by valuations.’

Top Sector Opportunities According to Analysts

Leading investment firms identified high-potential categories:

Technology Sector Primed for Leadership

BOCOM International analysts highlighted technology as the healthiest growth segment:

– Strong policy support for innovation enterprise listings

– Earnings growth significantly outperforming market averages

– Undemanding valuations despite AI adoption catalysts

They noted converging tailwinds: ‘Technology fatigue has dissipated after Q1’s market reset – creating durable platform for upside.’

Consumer and Dividend Plays Offer Stability

Galaxy Securities prioritized three strategic segments heading into H2:

1. Healthcare/Luxury Goods: Policy stimulus improving discretionary spending projections

2. High-Yield Stocks: Hedge against uncertainty during Fed rate transition

3. Renewable Energy Infrastructure: Capitalizing on sustainable investment mandates

Banking instruments targeting mainland savers seeking higher yields than Chinese deposits have driven significant liquidity into these segments.

Sustaining Momentum Through Innovation

Hong Kong’s IPO supremacy requires continued enhancement of competitive features:

Product Diversification Imperative

HKEX CEO Nicolas Aguzin underscored expansion priorities:

– Accelerating ESG thematic structuring support

– Standardizing feeder fund architectures between Hong Kong/Gulf states

– Simplifying SPAC frameworks revitalizing investor constituencies

The exchange seeks listings from climate technology developers and advanced biomedical firms leveraging streamlined VIE structuring.

Infrastructure Evolution Roadmap

Chan identified three critical focus areas:

– Expanding RMB-denominated settlements pathways

– Institutional-grade digital custody solutions

– Cross-border ETP mutual recognition frameworks

Organizations like CICC (中金公司) and China Everbright Securities are building mainland-facing financial bridges.

The Path Forward

Hong Kong’s achievement of global IPO leadership demonstrates successful structural reforms. Approximately HKD 300 billion in pending IPO applications creates substantial second-half momentum. With digital asset frameworks maturing and Gulf capital flows accelerating, Hong Kong represents the premier Asian investment gateway despite mild technical corrections.

Investors seeking exposure should evaluate Hong Kong’s innovators-specific ETFs while monitoring IPO pipeline companies through HKEX disclosures. Private banks report surging allocations to Hong Kong-listed science innovation instruments – institutions remain structurally committed despite interim volatility.