The High-Stakes Senate Showdown

Right now, America holds its breath as the Senate votes on one of the most contentious pieces of legislation in recent history. President Trump’s sweeping ‘Big and Beautiful’ bill teeters on a knife-edge—a proposal hailed by supporters as vital economic stimulus but condemned by critics as a fiscal time bomb. Passage is uncertain after it barely cleared the House in May and faced unified Democratic opposition in procedural votes. Last-minute delays forced a reading of all 940 pages, but the decisive moment has arrived.

At its core, this complex legislation combines massive tax cuts with targeted subsidies and security spending. Proponents promise it will deliver powerful economic stimulus through corporate tax relief and consumer spending boosts. Yet the nonpartisan Congressional Budget Office projects a staggering $3.3 trillion debt increase, igniting fears of fiscal recklessness. Wall Street giants are split: some see a growth catalyst, others foresee a debt bomb.

This deep dive examines the conflicting Wall Street assessments, breaks down the bill’s most critical stimulus and debt components, and outlines how its passage could reshape American economic policy for decades. With final voting underway as we publish, understanding this pivotal moment has never been more urgent for global markets.

The ‘Big and Beautiful’ Bill: Anatomy of a Mega-Legislation

Stretching across tax policy, social programs, and national security, this legislation represents the most ambitious fiscal experiment since the 2017 GOP tax overhaul. The core philosophy? Aggressive stimulus through supply-side economics.

Tax Cuts as Economic Stimulus Engine

The bill’s centerpiece locks in permanent extensions to expiring provisions of the Tax Cuts and Jobs Act. These include:

– Corporate tax rates maintained at 21% (versus scheduled post-2025 hike)

– Full deductibility for capital expenditures, accelerating equipment investments

– Expanded Child Tax Credit and individual tax brackets retained

Simultaneously, new targeted stimulus measures emerge:

– Manufacturing reshoring credits (up to 30% for semiconductor/biotech firms)

– Small business deductions for technology modernization

– Green energy subsidies for hydrogen, nuclear, and carbon capture projects

Republican lawmakers argue these combined measures will deliver potent economic stimulus by putting capital back into Main Street and corporate treasuries. As House Speaker Mike Johnson recently asserted: This stimulus package ensures ‘American workers won’t face punitive tax hikes right as the economy needs fuel.’

The Debt-Generating Expenditures

Opponents condemn the $267 billion in new spending commitments as unfunded liabilities that trigger a debt bomb scenario:

– $89 billion for border wall construction and surveillance tech

– $62 billion military procurement boost for Pacific theater assets

– $116 billion for ‘strategic stockpiles’ of critical minerals and pharmaceuticals

Unlike temporary pandemic relief, these outlays represent permanent additions to the federal baseline—funded entirely through borrowing. The Congressional Budget Office analysis reveals a $1 trillion cost overrun compared to the House version due to laxer pay-fors. With debt-to-GDP already at 122%, former Treasury Secretary Larry Summers warns: ‘You cannot solve inflation with stimulus then ignore the debt bomb ticking beneath your feet.’

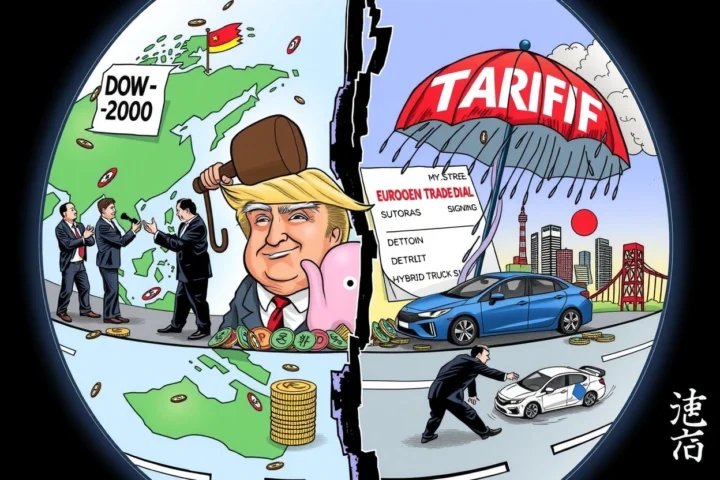

Wall Street’s Great Stimulus Divide

As voting neared, major institutions rushed to publish diametrically opposed analyses of the legislation’s economic impact. The central question: stimulus catalyst or fiscal suicide?

The Stimulus Optimists

Many finance houses see undeniable short-term stimulus effects. Nomura’s Chief Global Economist David Seif projects: ‘Compared with baseline expiration, this stimulus package adds 1.2–1.8% to GDP through 2026 by preventing austerity. Production facilities already breaking ground in Texas and Arizona prove investment incentives work.’ Key arguments include:

– Consumer spending firewall: Locking in personal tax rates saves households $170 billion annually post-2025

– Business confidence effect: Bank of America industrial surveys show 38% of manufacturers accelerating hiring plans based on bill prospects

– Tariff funding offset: Up to 40% of new spending covered by proposed levy increases on select imports

Defending criticism about deficits, Citi’s Global Macro Strategy team observed: ‘Structural deficits remain problematic long-term, but immediate debt bomb risks are overstated. Growth-driven revenues plus tariffs could cover two-thirds of costs until 2030.’

The Debt Bomb Defcon

Opposition research paints an apocalyptic fiscal picture. Morgan Stanley’s Washington Policy Team projects ‘material deterioration of debt sustainability’ in a June 24 memo, citing:

– Interest cost spiral: Every 0.5% rate hike adds $1.2 trillion to decade servicing costs

– Stimulus leakage: JPMorgan computes only 37 cents per dollar delivers GDP impact due to corporate share buybacks

– Zombification risk: Over 15% of SMB tax credits allocated to firms with negative cash flow

The Tax Foundation’s Erica York, a leading fiscal policy expert, offers this stinging critique: ‘This isn’t stimulus—it’s debt cladding wrapped in a stimulus costume. Deficits approach 7% of GDP by 2033 under this bill when aging population costs accelerate. That’s post-war Greece territory.’ Her modeling shows for every 0.1% debt-to-GDP increase beyond 140%, recession probability jumps 18%.

The Economic Tightrope: Growth vs. Sustainability

Like its 2017 predecessor, this legislation tests how long stimulus sugar highs can precede debt hangovers. As the Tax Cuts and Jobs Act demonstrated, fiscal expansion delivers diminishing returns.

Short-Term Stimulus Potential

Critical near-term benefits appear credible:

– $220 billion in accelerated corporate investments predicted over 18 months

– Unemployment buffer through expanded worker retraining tax credits

– Supply chain stabilization through domestic manufacturing incentives

Goldman Sachs forecasts represent the bullish view: ‘Despite deficit concerns, the stimulus impact on business capex could lift 2025 GDP by 0.8–1.3% due to reshored factory openings. These are brick-and-mortar multipliers.’ Also notable: the bill allows immediate deduction for US R&D expenses—a demand groups like the American Bankers Association called ‘make-or-break stimulus for innovation.’

The Long Debt Shadow

Nonpartisan fiscal hawks identify permanent structural wounds:

– CBO projects net interest surpassing military spending by 2029

– Healthcare providers face $31 billion in postponed Medicare funding cliffs

– No automatic deficit triggers; rather, 2027 entitlement changes shifting costs to states

Moody’s Analytics warns that absent policy corrections, the bill would spike inflation and rates by 2028: ‘The stimulus gains are front-loaded, while the debt bomb comes with a delayed fuse. When market confidence erodes, the adjustment will be brutal.’ Particularly alarming is the absence of IRS enforcement funding to curb evasion. Research confirms revenue gaps from audit capacity shortages now top $700 billion annually.

The Ghost of Tax Legislation Past

Understanding the ‘Big and Beautiful’ bill’s impact requires examining what followed its ideological predecessor. The 2017 Tax Cuts and Jobs Act offers instructive lessons.

Parallels with the Tax Cuts and Jobs Act

The similarities between the two fiscal experiments are structural: both landed during periods of economic expansion; both relied on deficit financing; both used corporate rate cuts as stimulus anchors. Results were questionably positive:

– Investment pop then fade: Capex rose 9.1% in 2018 before collapsing to -1.5% by 2020

– Wages lagged: Worker pay growth underperformed inflation over three years

– Debt growth doubled expectations

Federal Reserve studies subsequently revealed consumers banked just 32% of tax savings while corporations sent 53% to buybacks—negating stimulus multipliers.

Cautionary Fiscal Tales

In retrospect, several critical flaws emerged:

– Legislation expiration cliffs create business uncertainty, slowing hiring

– Permanent corporate cuts without productivity links invite rent-seeking

– Revenue-positive loophole closures excluded to win votes

Weaknesses the ‘Big and Beautiful’ bill compounds by making corporate cuts permanent while imposing 2025 expiration on individual relief. Citizens for Tax Justice concludes: ‘We’ve seen this stimulus movie. It ends with exploding deficits and widening inequality without sustainable growth.’

The Ripple Effects Beyond America

Passage would reshape global markets and policy:

– Sovereign bond impact: Rising Treasury yields pressure ECB and BOJ rate paths

– Currency volatility: Combined stimulus/debt concerns could trigger dollar instability

– Trade countermeasures: EU carbon border adjustments target bill’s industry subsidies

Emerging markets face acute pressure as higher US interest rates and tariffs drain capital. Former World Bank director Ken Rogoff cautions: ‘American stimulus juiced by debt purchases becomes contagion when investors flee risky assets globally.’ Sovereign wealth funds like Norway’s already hedge US political risk.

Where We Go From Here

Whether the bill passes tonight or requires reconciliation fixes, the fundamental economic conflict remains. Debt aggregators at Congressional Budget Office show that implementing 2025 stopgap extensions alone would peak deficits at 7.1% of GDP. Adding this legislation’s stimulus layers crosses the Rubicon of fiscal sustainability.

The business community must prepare for either outcome. Passage means reevaluating:

– Capital allocation schedules (accelerate US investments)

– Debt structure (lock fixed rates pre-inflation spike)

– Tax functions (maximize new credits)

Rejection demands contingency plans against policy paralysis. What’s certain? Legislative outcomes won’t end this dispute. Structural tensions between stimulus demands and debt constraints will define American policy indefinitely.

Track Senate voting live, then monitor Treasury auction demand to understand if the market buys the ‘stimulus miracle’ narrative or bombs the debt. The real verdict emerges when bonds start trading.