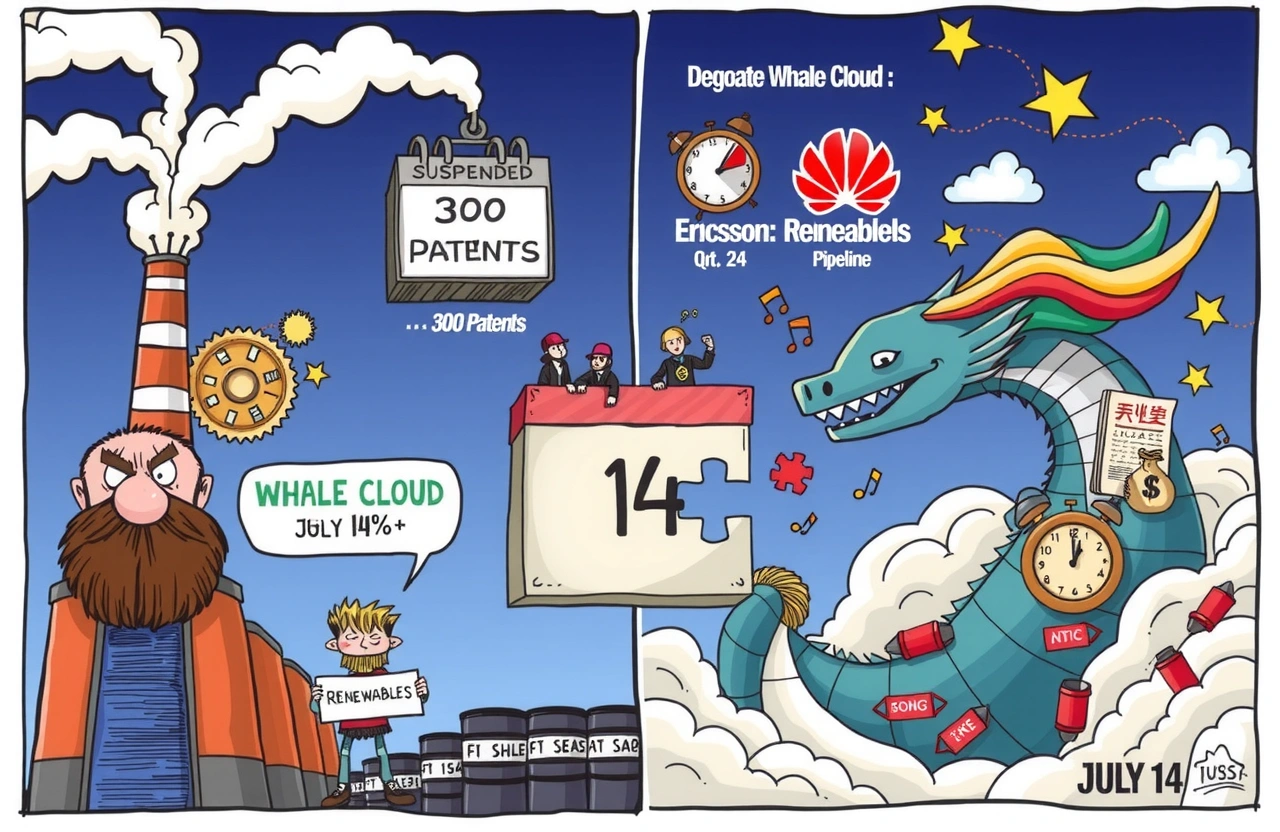

Trading Suspension and Acquisition Framework

Degoate (300950) initiated a trading halt effective June 30 following its announced major asset restructuring plan. The ambitious move involves acquiring controlling stake in Whale Cloud Computing Technology Co., Ltd. through share issuance and cash payments. This major asset restructuring represents a strategic pivot requiring careful stakeholder navigation.

Transaction Timeline and Market Implications

The suspension spans 10 trading days maximum, with disclosure deadline set for July 14. Failure to meet this deadline triggers automatic reinstatement per Shenzhen Stock Exchange regulations:

– Notification deadline: July 14

– Post-deadline protocol: Trading resumes with restructuring abandonment

– Cooling-off clause: Minimum 30-day prohibition on future restructuring talks

The transaction targets shareholders including Nanjing Xi Ruan Enterprise Management Partnership and other private funds collectively holding Whale Cloud’s control rights.

Strategic Rationale Behind Target Acquisition

Whale Cloud stands as a globally recognized digital solution provider serving telecom operators and government entities. Their business architecture complements Degaoate’s manufacturing strengths through three core pillars:

Synergetic Business Integration

Telecom software development, cloud infrastructure management solutions, and enterprise digital transformation capabilities directly align Degoate’s industrial expertise with frontier technologies.

– Cross-selling potential across Degaoate’s energy/chemical client base

– Combined R&D leveraging Whale Cloud’s 300+ granted patents

– Geographic market expansion acceleration

This major asset restructuring deliberately avoids altering Degoate’s controlling interests while fundamentally transforming technological capacities.

Transaction Mechanics and Financing Structure

The preliminary agreement outlines a hybrid payment model:

Capitalization Framework

– Primary payment method: Share swap with supplementary cash

– Concurrent fundraising: Matching capital injection operation

– Valuation basis: Whale Cloud’s unlisted status requiring third-party appraisal

As this major asset restructuring involves multiple private equity entities, final documentation must reconcile conflicting terms between June’s memorandum and forthcoming binding contracts.

Corporate Profiles: Acquirer and Target Analysis

Understanding both entities reveals strategic alignment beyond immediate financial metrics.

Degoate Fundamentals

The industrial equipment specialist reported robust 2024 performance:

– Revenue growth: 64.21% YoY to CNY509 million

– Net profit surge: 150.15% to CNY96.7 million

– Overseas dominance: 59.28% revenue share at 48.77% gross margin

Despite Q1 2025 contraction (31.19% revenue decline), renewable energy equipment backlog supports stable pipeline.

Whale Cloud Value Proposition

The acquisition target delivers digital transformation solutions across heterogeneous industries:

– Carrier-grade software systems optimization

– Hybrid cloud management platforms

– AI-powered enterprise decision support tools

This major asset restructuring positions Degoate competitively against international players like Ericsson and Huawei in industrial IoT integration.

Risk Assessment Framework

Material uncertainties necessitate investor vigilance:

Execution Roadblocks

– Valuation gap resolution among multiple stakeholders

– Limited due diligence window (>10 trading days)

– Support funds financing uncertainty

Regulatory compliance requires disclosure alignment with CSRC’s

Investor Action Guidance

Positioning amidst suspended trading requires strategic perspective:

Decision Framework

1. Review Whale Cloud’s unlisted performance metrics

2. Assess Degoate’s integration capacity

3. Evaluate sector-specific disruption vectors

Investors should monitor July 14 disclosure documentation leveraging Wind terminal data.

This major asset restructuring exemplifies domestic upgrading through strategic M&A diversification. Stakeholders must weigh transaction benefits against integration and market risks.

Immediately access Degaoate’s investor relations portal for forthcoming disclosures and petition regulator filings during suspension.