From Campus Controversy to Stock Exchange Scrutiny

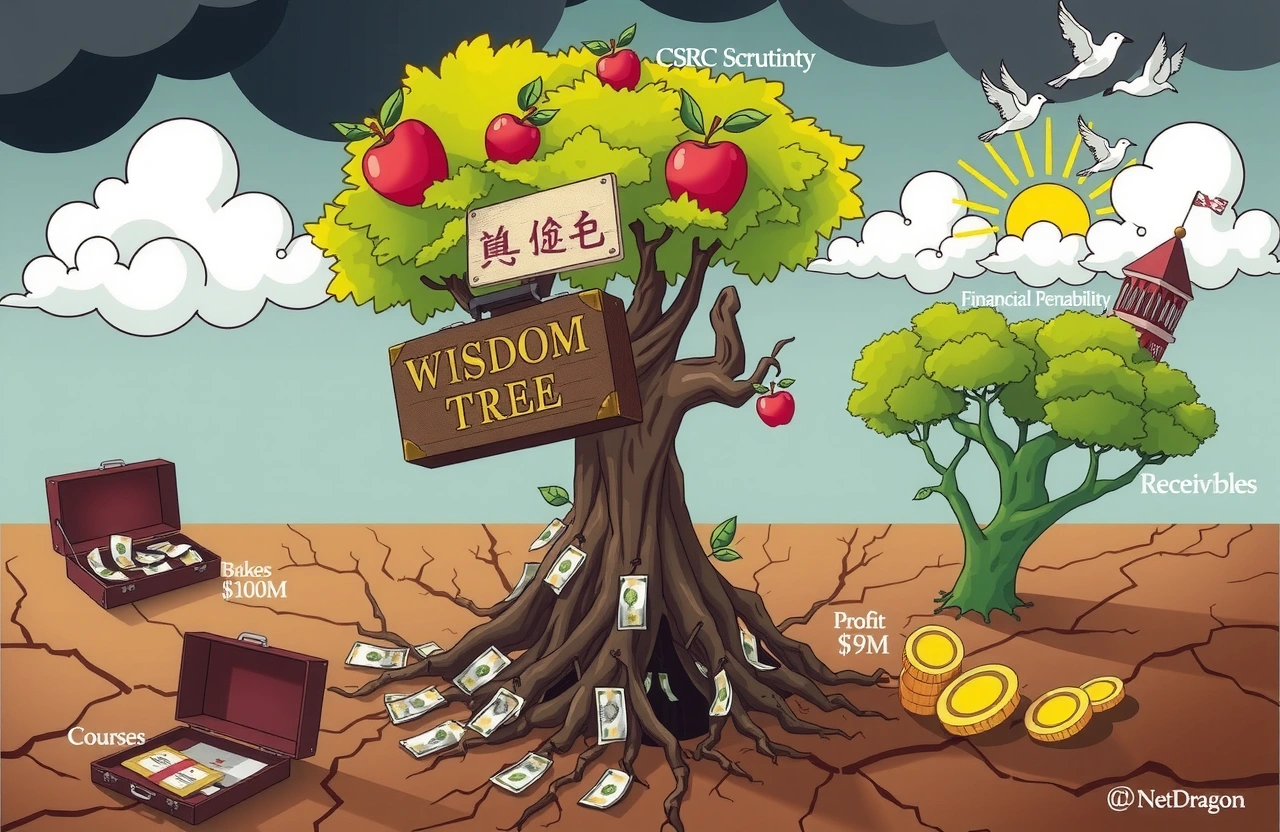

A digital education provider that became a pandemic-era darling among university students now faces intense regulatory examination. Wisdom Tree, whose online learning platforms gained popularity during campus lockdowns, has filed for its third Hong Kong IPO attempt within 12 months. This urgency reveals deeper troubles beneath the surface: a history of bribery scandals and financial instability that could derail its listing ambitions. The company’s rollercoaster profits and questionable accounting practices have drawn sharp scrutiny from regulators already investigating its involvement in university corruption cases. As Wisdom Tree races toward public markets, investors must question whether this edtech firm has truly addressed the compliance landmines in its path.

Financial Turbulence Undermines Stability

Wisdom Tree’s financial statements reveal alarming volatility that contradicts its revenue growth narrative. Between 2022 and 2024, total income climbed steadily from 400 million to 850 million yuan, but profits swung wildly from a 59.11 million yuan loss to an 81.42 million yuan gain, then to a 100 million yuan profit. This erratic performance suggests fundamental operational weaknesses masked by aggressive revenue recognition practices.

Profit Whiplash and Margin Swings

The company’s 2024 financials present particularly concerning contradictions. Public filings show an 88.855 million yuan loss in the first half miraculously transforming into a 100 million yuan full-year profit – a 188 million yuan swing within six months. Gross margins followed this unstable pattern, lurching from 51.1% to 44.1%, then soaring to 60.7% before dropping again. Such extreme fluctuations in core financial metrics raise legitimate questions about earnings quality and accounting consistency.

Accounts Receivable Time Bomb

Trade receivables exploded by 154% over two years, reaching 340 million yuan by 2024 – equivalent to 40% of annual revenue. This ballooning debt burden now represents 67.6% of current assets, meaning most liquid resources are tied up in uncollected payments. The deteriorating quality of these receivables forced Wisdom Tree to increase impairment provisions by 177% to 34.1 million yuan. Financial asset impairment losses followed suit, climbing 126% to 14 million yuan by 2024. This combination of soaring receivables and mounting bad debt provisions signals potential revenue inflation through lenient credit terms.

Cash Flow Crisis Deepens

Operating cash flow patterns reveal a company burning through resources despite reported profits. Cumulative negative operating cash flow reached 46 million yuan over the 2022-2024 period, with a particularly alarming 206 million yuan outflow in the first half of 2024. By April 2025, cash reserves had plummeted 70% from year-end 2024 levels to just 6.89 million yuan – the lowest point in three years. This liquidity crunch forced unexpected borrowing, with 56.2 million yuan in new loans appearing in 2024. The financial instability grows increasingly difficult to ignore as cash evaporates while receivables mount.

Working Capital Constraints

– Receivables collection period extended to 153 days in 2024 versus industry average of 90 days

– Inventory turnover slowed by 22% year-over-year

– Current ratio deteriorated to 1.3x, barely above minimum operational thresholds

Compliance Violations Surface

Public records reveal a pattern of misconduct that threatens IPO approval. In 2021, Wisdom Tree sales staff bribed Liu XX (刘某某), then bidding director at Gansu Industrial Vocational College, securing a 30,000 yuan payment through intermediary Huang XX (黄某某) to manipulate tender outcomes. This bribery scandal directly enabled their winning the “Teaching Quality and Management Improvement Project” contract. The financial instability narrative becomes intertwined with ethical failures when companies resort to illegal tactics for growth.

Systemic Tender Manipulation

Shanxi Provincial Finance Department penalized Wisdom Tree for collusive bidding in the 2021-2022 Shanxi Medical University project, imposing a 2,250 yuan fine. Shanghai regulators separately fined the company 50,000 yuan for false advertising of educational services. These violations form a clear pattern: the company’s bribery scandals and compliance failures demonstrate institutional disregard for fair competition standards. China Securities Regulatory Commission (CSRC) explicitly cited these incidents in its June 2024 inquiry, demanding explanations about their impact on the IPO.

Regulatory Hurdles Intensify

The CSRC’s supplemental request highlights seven specific concerns regarding Wisdom Tree’s listing application, with bribery scandals taking center stage. Regulators demanded full disclosure of:

– Internal investigation findings on corruption incidents

– Disciplinary actions against involved employees

– Overhauled compliance protocols and training programs

– Third-party audits of tender processes

– Impact assessments on existing university contracts

This regulatory scrutiny creates substantial delays in the IPO timeline. Each revision of the prospectus must now address how the company’s history of financial instability connects to its ethical breaches. Without convincing evidence of reform, Hong Kong exchange approval remains unlikely.

Governance Overhaul Challenges

Founders Wang Hui (王晖) and Ge Xin (葛新), who tout 21+ years in education technology, face their toughest leadership test. Their dual roles as both executives and controlling shareholders create inherent conflicts in self-investigation. True remediation requires:

– Independent board oversight committees with investigation authority

– Whistleblower protections for internal reporting

– External forensic accounting review

– Contract reassessments with implicated universities

Market Position Versus Ethical Risks

Despite its troubles, Wisdom Tree maintains significant market share in China’s higher education digitalization sector. Their cloud learning management systems and digital courseware became essential during pandemic campus closures, creating entrenched relationships with over 800 institutions. This operational footprint represents both an asset and a liability – existing contracts provide revenue stability but also expose the company to cancellation risks if bribery scandals trigger contract reviews.

Competitive Landscape Shifts

– Traditional rivals like NetDragon and New Oriental leverage cleaner compliance records

– International platforms like Coursera gain traction through transparent university partnerships

– Government-led Open University of China platform reduces reliance on private vendors

– Student preference shifts toward mobile-first learning apps bypassing institutional systems

Investor Considerations in High-Risk IPO

Prospective shareholders must weigh several red flags before considering this offering. The company’s financial instability manifests in three critical dimensions:

1. Receivables quality: 23% of trade debts are 180+ days overdue

2. Profit sustainability: Non-recurring government subsidies contributed 38% of 2023 net income

3. Cash conversion cycle: Stretched to 217 days versus industry median of 145 days

When combined with ongoing bribery scandals investigation, these factors create exceptional risk. The CSRC’s intervention suggests regulatory skepticism about listing readiness. Investors should demand forensic-level due diligence rather than relying on company-provided audits.

ESG Liability Assessment

Environmental, Social, and Governance screens reveal critical weaknesses:

– Governance: Lack of independent board control over compliance functions

– Social: Multiple confirmed violations of fair competition principles

– Reputational: Ongoing association with education corruption scandals

Navigating the Final Hurdles

For Wisdom Tree to successfully list, it must immediately address both financial and ethical shortcomings. The path forward requires transparent disclosure of all bribery investigations and demonstrable reforms. Financial restatements may be necessary to clarify contradictory profit reports. Until cash flow stabilizes and compliance overhauls are independently verified, this IPO remains highly speculative. Investors should scrutinize the next prospectus for concrete evidence that the company has moved beyond its history of financial instability and bribery scandals. The Hong Kong exchange maintains rigorous listing standards, and Wisdom Tree’s multiple compliance failures directly challenge those requirements. Only through genuine institutional reform can this education technology firm hope to graduate to public markets.